- Buyers struggle to replace sunoil quickly

- Huge demand lifts palm oil prices to a record high

- Soyoil supply limited as drought hits South America

- Palm’s premium could fade as buyers shift to soyoil

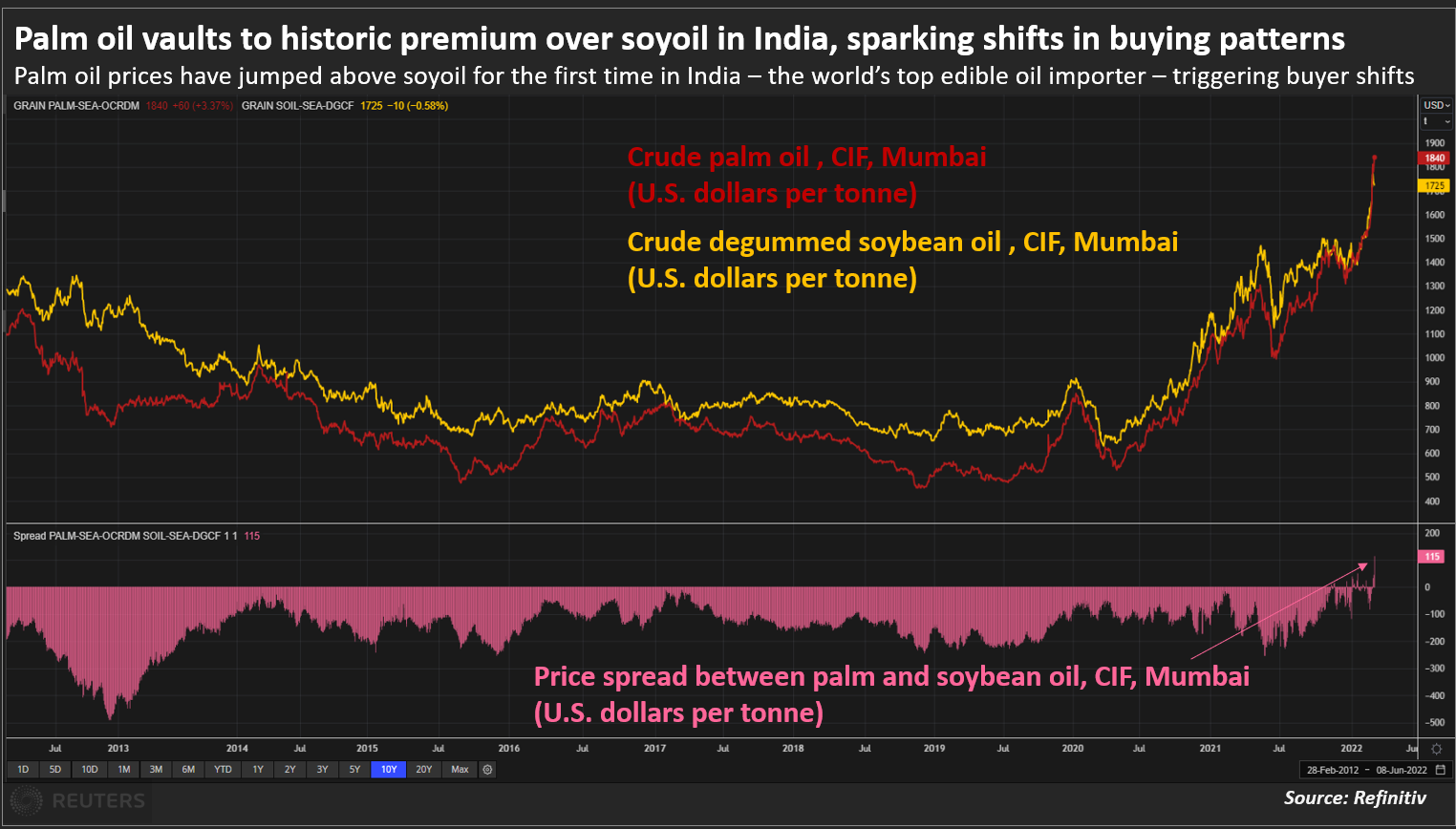

MUMBAI, March 1 (Reuters) – Palm oil has become the costliest among the four major edible oils for the first time as buyers rush to secure replacements for sunflower oil shipments from the top exporting Black Sea region that were disrupted by Russia’s invasion of Ukraine.Palm oil’s record premium over rival oils could squeeze price-sensitive Asian and African consumers already reeling from spiralling fuel and food costs, and force them to curtail consumption and shift to rival soyoil , dealers said.Crude palm oil (CPO) is being offered at about $1,925 a tonne, including cost, insurance and freight (CIF), in India for March shipments, compared with $1,865 for crude soybean oil.Register now for FREE unlimited access to Reuters.comRegisterCrude rapeseed oil was offered at around $1,900, while traders were not offering crude sunflower oil as ports are closed due to the Ukraine crisis. Palm oil vaults to historic premium over soyoil in India, sparking shifts in buying patternsThe Black Sea accounts for 60% of world sunflower oil output and 76% of exports. Ports in Ukraine will remain closed until the invasion ends. read more “Asian and European refiners have raised palm oil purchases for near-month shipments to replace sunoil. This buying has lifted palm oil to irrational price level,” said a Mumbai-based dealer with a global trading firm.”They have the option of buying soyoil as well. But prompt soyoil shipments are limited and they take much longer to land in Asia compared to palm oil,” he said.Soybean production in Argentina, Brazil and Paraguay is expected to fall because of dry weather. Price-sensitive Asian buyers traditionally relied on palm oil because of low costs and quick shipping times, but now they are paying more than $50 per tonne premium over soyoil and sunoil, said a Kuala Lumpur-based edible oil dealer.Palm oil’s price premium is temporary, however, and could fade in the next few weeks as buyers shift to soyoil for April shipments, the dealer said.Most of the incremental demand for palm oil is fulfilled by Malaysia, as Indonesia has put restriction on the exports, said an Indian refiner. “Malaysian stocks are depleting fast because of the surge in demand. It is the biggest beneficiary of the current geopolitical situation,” he said.Register now for FREE unlimited access to Reuters.comRegisterReporting by Rajendra Jadhav

Palm oil vaults to historic premium over soyoil in India, sparking shifts in buying patternsThe Black Sea accounts for 60% of world sunflower oil output and 76% of exports. Ports in Ukraine will remain closed until the invasion ends. read more “Asian and European refiners have raised palm oil purchases for near-month shipments to replace sunoil. This buying has lifted palm oil to irrational price level,” said a Mumbai-based dealer with a global trading firm.”They have the option of buying soyoil as well. But prompt soyoil shipments are limited and they take much longer to land in Asia compared to palm oil,” he said.Soybean production in Argentina, Brazil and Paraguay is expected to fall because of dry weather. Price-sensitive Asian buyers traditionally relied on palm oil because of low costs and quick shipping times, but now they are paying more than $50 per tonne premium over soyoil and sunoil, said a Kuala Lumpur-based edible oil dealer.Palm oil’s price premium is temporary, however, and could fade in the next few weeks as buyers shift to soyoil for April shipments, the dealer said.Most of the incremental demand for palm oil is fulfilled by Malaysia, as Indonesia has put restriction on the exports, said an Indian refiner. “Malaysian stocks are depleting fast because of the surge in demand. It is the biggest beneficiary of the current geopolitical situation,” he said.Register now for FREE unlimited access to Reuters.comRegisterReporting by Rajendra Jadhav

Editing by Shri NavaratnamOur Standards: The Thomson Reuters Trust Principles. .