At the interbank foreign exchange, the rupee opened at 80 against the American dollar, then lost ground to quote at 80.05, registering a fall of 7 paise from the last close.

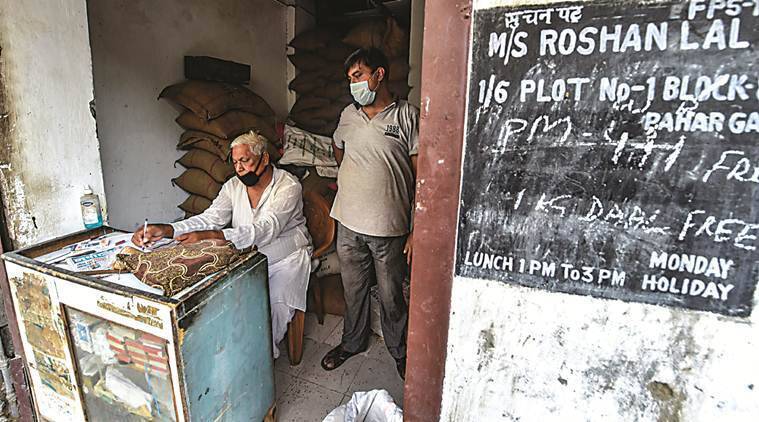

A man counts Indian currency notes inside a shop in Mumbai, India, August 13, 2018. (REUTERS/File Photo)The rupee depreciated 7 paise to an all-time low of 80.05 against the US dollar in early trade on Tuesday tracking the strength of the American currency and firm crude oil prices.

A man counts Indian currency notes inside a shop in Mumbai, India, August 13, 2018. (REUTERS/File Photo)The rupee depreciated 7 paise to an all-time low of 80.05 against the US dollar in early trade on Tuesday tracking the strength of the American currency and firm crude oil prices.

You have exhausted your

monthly limit.

To continue reading,

simply register or sign in

You need a subscription to read on.

Now available at Rs 2/day.

This premium article is free for now.

Register to continue reading this story.

This content is exclusive for our subscribers.

Subscribe to get unlimited access to The Indian Express exclusive and premium stories.

This content is exclusive for our subscribers.

Subscribe now to get unlimited access to The Indian Express exclusive and premium stories.

At the interbank foreign exchange, the rupee opened at 80 against the American dollar, then lost ground to quote at 80.05, registering a fall of 7 paise from the last close.

In initial trade, the local unit also touched 79.90 against the American currency.

On Monday, the rupee for the first time declined to the low level of 80 against the US dollar in intra-day spot trading before ending the session 16 paise lower at 79.98 amid a surge in crude oil prices and unrelenting foreign fund outflows.

The rupee opened on a weaker note on Tuesday morning weighed down by outflows and high oil prices, Sriram Iyer, Senior Research Analyst at Reliance Securities said, adding that lack of intervention from the Reserve Bank of India (RBI) could also weigh on sentiments.

According to Iyer, the range for the USD/INR pair for Tuesday’s session is 79.75-80.12.

Meanwhile, the dollar index, which gauges the greenback’s strength against a basket of six currencies, was trading 0.12 per cent higher at 107.49.

Global oil benchmark Brent crude futures fell 0.35 per cent to USD 105.90 per barrel.

On the domestic equity market front, the 30-share Sensex was trading 86.4 points or 0.16 per cent lower at 54,434.75, while the broader NSE Nifty fell 26.75 points or 0.16 per cent to 16,251.75.

Foreign institutional investors were net buyers in the capital market on Monday as they purchased shares worth Rs 156.08 crore, as per stock exchange data.

Special offer

For your UPSC prep, a special sale on our ePaper. Do not miss out!

- The Indian Express website has been rated GREEN for its credibility and trustworthiness by Newsguard, a global service that rates news sources for their journalistic standards.

.