Swedish Match generates most of its profit from Swedish-style smoke-free tobacco snuffs, also known as ‘snus.’Olivier Morin | Afp | Getty ImagesMarlboro-maker Philip Morris International confirmed Wednesday a $16 billion bid to buy rival Swedish Match as part of its accelerated push into smoke-free tobacco alternatives.Shares of Stockholm-based manufacturer hit a record high in early trade after its board agreed to the 161.2 billion krona cash offer from the U.S.-Swiss tobacco giant.Swedish Match is now trading at a 32% premium since talks between the two companies were first announced Friday. Following a bumpy ride since Friday, Philip Morris International stock is trading marginally higher.The deal, which is now subject to shareholder approval, marks the latest phase in Philip Morris International’s ongoing efforts to reduce its reliance on traditional cigarettes amid growing public scrutiny.A market-leader in smoke-free ‘snus’107-year-old Swedish Match is primarily known for producing traditional Swedish-style snuffs, branded “General Snus,” a type of smoke-free tobacco pouch which is placed between the upper lip and gum as an alternative to smoking.While illegal in the EU over health concerns, Swedish Match’s General Snus were granted authorization by the U.S. Food and Drug Administration in 2019 after they found to present lower risks of “mouth cancer, heart disease [and] lung cancer” than cigarettes.Still, the FDA noted at the time that such products were not implied safe in general, nor were they FDA approved. “All tobacco products are potentially harmful and addictive,” it added.Philip Morris International’s bid for Stockholm-based Swedish Match forms part of its wider plans to expand beyond traditional cigarettes.Bloomberg | Bloomberg | Getty ImagesMeantime, the company has seen rapid growth in recent years of its newer, tobacco-free nicotine pouches, “Zyn,” amid increasing consumer demand for cigarette alternatives.In first-quarter earnings released Wednesday, Swedish Match reported a significant uptick in sales and profits from Zyn in the U.S., with deliveries up 35%.The U.S. now accounts for Swedish Match’s largest market after Scandinavia, and its Zyn pouches dominate in a market flooded by rivals including British American Tobacco PLC and Altria Group, from which Philip Morris International spun off in 2008.Philip Morris weans itself off cigarettesPhilip Morris International is based in the U.S., but does not sell its products there. Rather, it distributes its products internationally, including Marlboro cigarettes, L&M, Lark and Philip Morris.With the deal, it aims to regain access to a ready-made distribution network in its ex-owner’s home territory.It is the latest move by Philip Morris International to diversify beyond traditional, tobacco-based revenue streams. In 2021, it agreed to take over asthma drug develop Vectura Group, and is also responsible for creating the IQOS heated-tobacco system.As of last year, the company’s smoke-free portfolio accounted for about 29% of its net revenue, or $31.4 billion.Campaign groups have condemned tobacco giants, which have a long history of denying the health risks of smoking, for advocating themselves as part of the transition to a smoke-free world while also continuing to sell and promote cigarettes globally.Among Swedish Match’s other smokeless tobacco products are America’s Best Chew, a chewing-tobacco product, and Longhorn, a type of moist snuff brand.Philip Morris International said completing the offer was conditional on regulatory approval and on no other company making an offer.However, analysts at Credit Suisse said in a note that potential counterbids look unlikely. Japan Tobacco International has little appetite to enter the U.S. market, it noted, while British American Tobacco and Imperial would be reluctant due to anti-trust concerns in the U.S. and Scandinavia.—CNBC’s Sam Meredith contributed to this article. .

Qantas orders Airbus jets for world’s longest non-stop flight

Qantas Airways Boeing 737-800 planes sit parked on the runway at Sydney International Airport on July 22, 2020.David Gray | Getty Images News | Getty ImagesQantas Airways said on Monday it had ordered 12 A350-1000 planes from Airbus to be used on what will be the world’s longest commercial flight from Sydney to London, as well as 40 narrowbody jets to renew its domestic fleet.The deal comes as market conditions improve and demand for domestic and international travel recover from the pandemic faster than expected, allowing the carrier to reduce debt and forecast a return to profit in the financial year starting July 1.”The board’s decision to approve what is the largest aircraft order in Australian aviation is a clear vote of confidence in the future of the Qantas Group,” Chief Executive Alan Joyce said in a statement.Qantas did not disclose the value of the deal but it is likely to be in the billions of dollars based on aircraft list prices.Non-stop flights from Sydney to London, which will take nearly 20 hours, will begin in late 2025 following the delivery of A350-1000s, the airline said.The A350s will carry 238 passengers across first class, business class, premium economy and economy class, with more than 40% of the cabin dedicated to premium seating, it added.The deliveries of 20 A321XLRs will start in late 2024, while 20 smaller A220s will arrive from late 2023 – renewing the carrier’s ageing domestic fleet. The order also includes options to buy another 94 aircraft that would arrive through to 2034.”The phasing of this order means it can be funded within our debt range and through earnings, while still leaving room for shareholder returns in line with our financial framework,” Joyce said.The new domestic fleet “will reduce emissions by at least 15% if running on fossil fuels, and significantly better when run on sustainable aviation fuel,” Joyce said, further asserting that its “Project Sunrise” would be carbon neutral from day one.Qantas in December selected Airbus as the preferred supplier for a major order to renew its ageing narrowbody fleet, in a blow to incumbent supplier Boeing.Reuters on Sunday reported, citing sources, that the carrier was set to announce the deal that brings it closer to launching record-breaking direct flights of nearly 20 hours on the “Kangaroo route” between Sydney and London.In a separate filing, Qantas said while it expects an underlying operating loss for fiscal 2022, the second-half of the year would benefit from improved domestic and international demand with free cash flow seen rising further in the current quarter. .

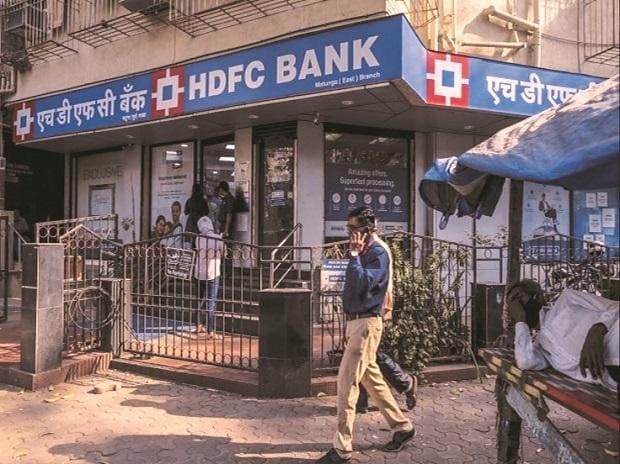

HDFC Life March quarter: Guidance of premium growth offers confidence

HDFC Life declared results that were slightly better than the consensus, but in line with most expectations. It reported 17 per cent YoY growth in Annualised Premium Equivalent (APE) in FY22 to Rs 9,760 crore and 22 per cent YoY growth in Value of New Business (VNB) to Rs 2,680 crore (standalone). Net premium is Rs 45,396 crore for the FY2021-22, versus Rs 38,122 crore (2020-21). Income from investments was Rs 19,215 crore versus Rs 32,677 crore in 2020-21. The VNB margin for FY2021-22 stood at 27.4 per cent (130 bps rise YoY) versus 26.5 per cent for the first three quarters …

Key stories on business-standard.com are available to premium subscribers only.

Already a premium subscriber? LOGIN NOW

MONTHLY STAR

Business Standard Digital

![]()

Business Standard Digital Monthly Subscription

Complete access to the premium product

Convenient – Pay as you go

Pay using Amex/Master/VISA Credit Cards and VISA Debit Cards Only

Auto renewed (subject to your card issuer’s permission)

Cancel any time in the future

Note: Subscription will be auto renewed, you may cancel any time in the future without any questions asked.

Requires personal information

What you get?

ON BUSINESS STANDARD DIGITAL

- Unlimited access to all the content on any device through browser or app.

- Exclusive content, features, opinions and comment – hand-picked by our editors, just for you.

- Pick 5 of your favourite companies. Get a daily email with all the news updates on them.

- Track the industry of your choice with a daily newsletter specific to that industry.

- Stay on top of your investments. Track stock prices in your portfolio.

- 18 years of archival data.

NOTE :

- The product is a monthly auto renewal product.

- Cancellation Policy: You can cancel any time in the future without assigning any reasons, but 48 hours prior to your card being charged for renewal.

We do not offer any refunds. - To cancel, communicate from your registered email id and send the email with the cancellation request to [email protected]. Include your contact number for speedy action.

Requests mailed to any other ID will not be acknowledged or actioned upon.

SMART ANNUAL

Business Standard Digital

Subscribe Now and get 12 months Free

![]()

Business Standard Premium Digital – 12 Months + 12 Months Free

Subscribe for 12 months and get 12 months free.

Single Seamless Sign-up to Business Standard Digital

Convenient – Once a year payment

Pay using an instrument of your choice -all Credit and Debit Cards, Net Banking, Payment Wallets, and UPI

Exclusive Invite to select Business Standard events

Note: Subscription will be auto renewed, you may cancel any time in the future without any questions asked.

What you get

ON BUSINESS STANDARD DIGITAL

- Unlimited access to all content on any device through browser or app.

- Exclusive content, features, opinions and comment – hand-picked by our editors, just for you.

- Pick 5 of your favourite companies. Get a daily email with all the news updates on them.

- Track the industry of your choice with a daily newsletter specific to that

industry. - Stay on top of your investments. Track stock prices in your portfolio.

NOTE :

- The monthly duration product is an auto renewal based product. Once subscribed, subject to your card issuer’s permission we will charge your card/ payment instrument each month automatically and renew your subscription.

- In the Annual duration product we offer both an auto renewal based product and a non auto renewal based product.

- We do not Refund.

- No Questions asked Cancellation Policy.

- You can cancel future renewals anytime including immediately upon subscribing but 48 hours before your next renewal date.

- Subject to the above, self cancel by visiting the “Manage My Account“ section after signing in OR Send an email request to [email protected] from your registered email address and by quoting your mobile number.

Dear Reader,

Dear Reader,

Business Standard has always strived hard to provide up-to-date information and commentary on developments that are of interest to you and have wider political and economic implications for the country and the world. Your encouragement and constant feedback on how to improve our offering have only made our resolve and commitment to these ideals stronger. Even during these difficult times arising out of Covid-19, we continue to remain committed to keeping you informed and updated with credible news, authoritative views and incisive commentary on topical issues of relevance.

We, however, have a request.

As we battle the economic impact of the pandemic, we need your support even more, so that we can continue to offer you more quality content. Our subscription model has seen an encouraging response from many of you, who have subscribed to our online content. More subscription to our online content can only help us achieve the goals of offering you even better and more relevant content. We believe in free, fair and credible journalism. Your support through more subscriptions can help us practise the journalism to which we are committed.

Support quality journalism and subscribe to Business Standard.

Digital Editor

First Published: Wed, April 27 2022. 20:58 IST !function(f,b,e,v,n,t,s){if(f.fbq)return;n=f.fbq=function(){n.callMethod?n.callMethod.apply(n,arguments):n.queue.push(arguments)};if(!f._fbq)f._fbq=n;n.push=n;n.loaded=!0;n.version=’2.0′;n.queue=[];t=b.createElement(e);t.async=!0;t.src=v;s=b.getElementsByTagName(e)[0];s.parentNode.insertBefore(t,s)}(window,document,’script’,’https://connect.facebook.net/en_US/fbevents.js’);fbq(‘init’,’550264998751686′);fbq(‘track’,’PageView’); .

Elon Musk offers to buy Twitter for $54.20 a share, so it can be ‘transformed as private company’

Tesla Inc CEO Elon Musk attends the World Artificial Intelligence Conference (WAIC) in Shanghai, China August 29, 2019.Aly Song | ReutersThis is breaking news. Please check back for updates.Elon Musk offered to buy Twitter for $54.20 a share, saying the social media company needs to be transformed privately, a little over a week after first revealing a 9.2% stake in the company.”I invested in Twitter as I believe in its potential to be the platform for free speech around the globe, and I believe free speech is a societal imperative for a functioning democracy,” Musk wrote in a letter sent to Twitter Chairman Bret Taylor and disclosed in a securities filing.According to Musk, the social media company needs to go private because it can “neither thrive nor serve” free speech in its current state. “As a result, I am offering to buy 100% of Twitter for $54.20 per share in cash, a 54% premium over the day before I began investing in Twitter and a 38% premium over the day before my investment was publicly announced,” he wrote. “My offer is my best and final offer and if it is not accepted, I would need to reconsider my position as a shareholder.”Twitter shares jumped 12% in premarket trading after closing at $45.85 a share on Wednesday. Musk first disclosed his stake in the social media giant on April 4 and later landed a seat on the company’s board of directors, before reversing those plans. The Tesla CEO has previously criticized the social media giant publicly. He polled people on Twitter last month about whether the company abides by free speech principles and said he was considering building a new social media platform.Shares of Twitter have seesawed in recent weeks amid the news from Musk, but are up 6% this year and 18.5% since the start of the month. Musk’s offer values Twitter at about $43 billion.Here is the letter Musk sent as disclosed in a securities filing:I invested in Twitter as I believe in its potential to be the platform for free speech around the globe, and I believe free speech is a societal imperative for a functioning democracy.However, since making my investment I now realize the company will neither thrive nor serve this societal imperative in its current form. Twitter needs to be transformed as a private company.As a result, I am offering to buy 100% of Twitter for $54.20 per share in cash, a 54% premium over the day before I began investing in Twitter and a 38% premium over the day before my investment was publicly announced. My offer is my best and final offer and if it is not accepted, I would need to reconsider my position as a shareholder.Twitter has extraordinary potential. I will unlock it.Elon Musk .

GAIL lines up Rs 1,083 crore share buyback at 24% premium

NEW DELHI: State-run gas utility GAIL Ltd on Thursday announced a Rs 1,083 crore share buyback plan for 5.7 crore scrips at Rs 190 each, marking a premium of roughly 24% on Wednesday closing price on the NSE.

This is the second buyback in as many years and will benefit the government as it holds 51.8% in India’s largest gas company. The government had in 2020-21 gained Rs 747 crore in a Rs 1,046 crore buyback announced by GAIL.

The total number of shares represents 2.5% of the company’s paid-up capital and free reserves as on March 31, 2021, GAIL said in the statement.

A buoyant bottom line is the driving force behind the share buyback, considered a tax-efficient way of rewarding shareholders. Buybacks are attractive in tax terms even after considering the 10% tax on long-term capital gains.

India’s largest gas company has been consistently rewarding its shareholders through regular dividends, issue of bonus shares and also buyback of shares at a premium.

During the current financial year (2021-22), the company paid the highest-ever interim dividend of Rs 3,996 crore at the rate of 90% of the face value.

The company issued bonus shares in 2008-09, 2016-17, 2017-18 and 2019-20. In March 2021, it completed buyback of about 6.9 crore shares at Rs 150 each.

GAIL owns and operates around 13,840 km, or 74% of the total length of the cross-country natural gas pipeline network in the country. It sells around 52% of all natural gas sold in India and 44% of gas imported in ships. It supplies 67% of gas consumed by the fertiliser industry, 53% by power and 60% by the city gas sector.

The company has also forayed into alternate energy such as green hydrogen, renewables and bio-fuels projects.

!function(f,b,e,v,n,t,s) {if(f.fbq)return;n=f.fbq=function(){n.callMethod? n.callMethod.apply(n,arguments):n.queue.push(arguments)}; if(!f._fbq)f._fbq=n;n.push=n;n.loaded=!0;n.version=’2.0′; n.queue=[];t=b.createElement(e);t.async=!0; t.src=v;s=b.getElementsByTagName(e)[0]; s.parentNode.insertBefore(t,s)}(window, document,’script’, ‘https://connect.facebook.net/en_US/fbevents.js’); fbq(‘init’, ‘593671331875494’); fbq(‘track’, ‘PageView’); .