A screen displays trading informations for stocks on the floor of the New York Stock Exchange (NYSE) in New York City, U.S., June 27, 2022. REUTERS/Brendan McDermidRegister now for FREE unlimited access to Reuters.comNEW YORK, July 15 (Reuters) – Fears of a potential economic slowdown are clouding the outlook for value stocks, which have outperformed broader indexes this year in the face of surging inflation and rising interest rates.Value stocks – commonly defined as those trading at a discount on metrics such as book value or price-to-earnings – have typically underperformed their growth counterparts over the past decade, when the S&P 500’s (.SPX) gains were driven by tech-focused giants such as Amazon.com Inc (AMZN.O) and Apple Inc (AAPL.O).That dynamic shifted this year, as the Federal Reserve kicked off its first interest rate-hike cycle since 2018, disproportionately hurting growth stocks, which are more sensitive to higher interest rates. The Russell 1000 value index (.RLV) is down around 13% year-to-date, while the Russell 1000 growth index (.RLG) has fallen about 26%.Register now for FREE unlimited access to Reuters.comThis month, however, fears that the Fed’s monetary policy tightening could bring on a U.S. recession have shifted the momentum away from value stocks, which tend to be more sensitive to the economy. The Russell value index is up 0.7% in July, compared with a 3.4% gain for its growth-stock counterpart.”If you think we are in a recession or are going into a recession, that does not necessarily … work to the advantage of value stocks,” said Chuck Carlson, chief executive at Horizon Investment Services.The nascent shift to growth stocks is one example of how investors are adjusting portfolios in the face of a potential U.S. economic downturn. BofA Global Research on Thursday cut its year-end target price for the S&P 500 to 3,600 from 4,500 previously and became the latest Wall Street bank to forecast a coming recession. read more The index closed at 3,863.16 on Friday and is down 18.95% this year.Corporate earnings arriving in force next week will give investors a better idea of how soaring inflation has affected companies’ bottom lines, with results from Goldman Sachs , Johnson & Johnson (JNJ.N) and Tesla among those on deck.For much of the year, value stocks benefited from broader market trends. Energy shares, which comprise around 7% of the Russell 1000 value index, soared over the first half of 2022, jumping along with oil prices as supply constraints for crude were exacerbated by Russia’s invasion of Ukraine.But energy shares along with crude prices and other commodities have tumbled in recent weeks on concerns that a recession would sap demand.A recession also stands to weigh on bank stocks, with a slowing economy hurting loan growth and increasing credit losses. Financial shares represent nearly 19% of the value index. read more An earnings beat from Citigroup, however, buoyed bank shares on Friday, with the S&P 500 banks index (.SPXBK)gaining 5.76%.At the same time, tech and other growth companies also tend to have businesses that are less cyclical and more likely able to weather a broad economic slowdown.”People pay a premium for growth stocks when growth is scarce,” said Burns McKinney, portfolio manager at NFJ Investment Group.JPMorgan analysts earlier this week wrote they believe growth stocks have a “tactical opportunity” to make up lost ground, citing cheaper valuations after this year’s sharp sell-off as one of the reasons.Value stock proponents cite many reasons for the investing style to continue its run.Growth stocks are still more expensive than value shares on a historical basis, with the Russell 1000 growth index trading at a 65% premium to its value counterpart, compared to a 35% premium over the past 20 years, according to Refinitiv Datastream.Meanwhile, earnings per share for value companies are expected to rise 15.6% this year, more than twice the rate of growth companies, Credit Suisse estimates.Data from UBS Global Wealth Management on Thursday showed value stocks tend to outperform growth stocks when inflation is running above 3% – around a third of the 9.1% annual growth U.S. consumer prices registered in June. read more Josh Kutin, head of asset allocation, North America at Columbia Threadneedle, believes a possible U.S. recession in the next year would be a mild one, leaving economically sensitive value stocks primed to outperform if growth picks up.”If I had to pick one, I’d still pick value over growth,” he said. “But that conviction has come down since the start of the year,” Kutin said.Register now for FREE unlimited access to Reuters.comReporting by Lewis Krauskopf, additional reporting by David Randall and Ira Iosebashvili; Editing by Ira Iosebashvili and Richard ChangOur Standards: The Thomson Reuters Trust Principles. .

Analysis: Private equity’s swoop on listed European firms runs into rising execution risks

- Boards, shareholders start to rail against lowball bids

- Push for higher premiums compound debt funding dilemma

- Buyer vs seller valuation gaps may take a year to close

LONDON, June 28 (Reuters) – European listed companies have not been this cheap for more than a decade, yet for private equity firms looking to put their cash piles to work, costlier financing and stronger resistance from businesses are complicating dealmaking.Sharp falls in the value of the euro and sterling coupled with the deepest trading discounts of European stocks versus global peers seen since March 2009, have fuelled a surge in take-private interest from cash-rich buyout firms.Private equity-led bids for listed companies in Europe hit a record $73 billion in the first six months of this year to date, more than double volumes of $35 billion in the same period last year and representing 37% of overall private equity buyouts in the region, according to Dealogic data.Register now for FREE unlimited access to Reuters.comThat contrasts with a sharp slowdown in overall M&A activity around the world. But as take-private target companies and their shareholders are increasingly bristling against cheap punts which they say fail to reflect fair value of their underlying businesses in 2022, prospects for deals in the second half of the year look less promising.Leading the first half bonanza was a 58 billion euro ($61.38 billion) take-private bid by the Benetton family and U.S. buyout fund Blackstone (BX.N) for Italian infrastructure group Atlantia (ATL.MI).Dealmakers, however, say the vast majority of take-private initiatives are not reflected in official data as many private equity attempts to buy listed companies have gone undetected with boardrooms shooting down takeover approaches before any firm bid has even been launched.”In theory it’s the right time to look at take-privates as valuations are dropping. But the execution risk is high, particularly in cases where the largest shareholder holds less than 10%,” said Chris Mogge, a partner at European buyout fund BC Partners.Other recent private equity swoops include a 1.6 billion pound ($1.97 billion) bid by a consortium of Astorg Asset Management and Epiris for Euromoney (ERM.L) which valued the FTSE 250-listed financial publisher at a 34% premium after four previous offers were rebuffed by its board. read more Also capturing the attention of private equity in recent weeks were power generating firm ContourGlobal (GLO.L), British waste-management specialist Biffa (BIFF.L) and bus and rail operator FirstGroup (FGP.L), with the latter rejecting the takeover approach. read more Trevor Green, head of UK equities at Aviva Investors (AV.L), said his team was stepping up engagement with company executives to thwart lowball bids, with unwelcome approaches from private equity made more likely in view of currency volatility.War in Europe, soaring energy prices and stagflation concerns have hit the euro and the British pound hard, with the former falling around 7% and the latter by 10% against the U.S. dollar this year.”We know this kind of currency movement encourages activity, and where there’s scope for a deal, shareholders will be rightly pushing for higher premiums to reflect that,” Green said.SUBDUED SPENDINGGlobally, private equity activity has eased after a record year in 2021, hit by raging inflation, recession fears and the rising cost of capital. Overall volumes fell 19% to $674 billion in the first half of the year, according to Dealogic data.Dealmaking across the board, including private equity deals, dropped 25.5% in the second quarter of this year from a year earlier to $1 trillion, according to Dealogic data. read more Buyout funds have played a major role in sustaining global M&A activity this year, generating transactions worth $405 billion in the second quarter.But as valuation disputes intensify, concerns sparked by rising costs of debt have prevented firms from pulling off deals for their preferred listed targets in recent months.Private equity firms including KKR, EQT and CVC Capital Partners ditched attempts to take control of German-listed laboratory supplier Stratec (SBSG.DE) in May due to price differences, three sources said. Stratec, which has a market value of 1.1 billion euros, has the Leistner family as its top shareholder with a 40.5% stake.EQT, KKR and CVC declined to comment. Stratec did not immediately return a request for comment.The risks of highly leveraged corporate takeovers have increased with financing becoming more expensive, leaving some buyers struggling to make the numbers on deals stack up, sources said.Meanwhile, piles of cash that private equity firms have raised to invest continue to grow, heaping pressure on partners to consider higher-risk deals structured with more expensive debt.”There is a risk premium for debt, which leads to higher deal costs,” said Marcus Brennecke, global co-head of private equity at EQT (EQT.N).The average yield on euro high yield bonds – typically used to finance leverage buyouts – has surged to 6.77% from 2.815% at the start of the year, according to ICE BofA’s index, and the rising cost of capital has slowed debt issuance sharply. (.MERHE00)As a result, private equity firms have increasingly relied on more expensive private lending funds to finance their deals, four sources said.But as share prices continue to slide, the gap between the premium buyers are willing to offer and sellers’ price expectations remains too wide for many and could take up to a year to narrow, two bankers told Reuters.In the UK, where Dealogic data shows a quarter of all European take-private deals have been struck this year, the average premium paid was 40%, in line with last year, according to data from Peel Hunt.”Getting these deals over the line is harder than it looks. The question really is going to be how much leverage (buyers can secure),” one senior European banker with several top private equity clients told Reuters.($1 = 0.8141 pounds)($1 = 0.9450 euros)Register now for FREE unlimited access to Reuters.comReporting by Joice Alves, Emma-Victoria Farr, Sinead Cruise, additional reporting by Yoruk Bahceli, editing by Pamela Barbaglia and Susan FentonOur Standards: The Thomson Reuters Trust Principles. .

Insurer LIC opens subscriptions for $2.7 bln IPO, India’s largest

MUMBAI, May 4 (Reuters) – State-owned Life Insurance Corp’s (LIC) $2.7 billion IPO, India’s largest, opened to subscriptions from retail and other investors on Wednesday following strong demand from anchor investors led by domestic mutual funds.The Indian government expects to raise the sum, just a third of its original target, from selling a 3.5% stake in the country’s top insurance company, giving it an initial value of $78.52 billion. read more The subscription, set to close on May 9, will offer a discount to employees and retail investors of 45 rupees per share. LIC policyholders will be offered a discount of 60 rupees per share.Register now for FREE unlimited access to Reuters.comThe price range for the issue has been set between 902 rupees and 949 rupees per share.After a reservation for employees and policyholders, the remaining shares will be allocated in a ratio of 50% to qualified institutional buyers, 35% to retail investors and 15% for non-institutional investors.The final IPO price will be determined after the subscription closes.LIC shares were trading in the “grey” market at a premium of 95 rupees, at around 1,044 rupees apiece.To drum up demand from retail investors, in addition to heavy advertising in local newspapers, some 1.2 million field agents were dispatched across India to woo many of LIC’s more than 250 million policyholders to buy the shares.Policyholders were also flooded with text messages earlier this year recommending they open an electronic stock holding account early so they can take part in the IPO. read more The 59.3 million shares set aside for anchor investors were subscribed at 949 rupees apiece. Norwegian wealth fund Norges Bank Investment Management and the government of Singapore joined the anchor book, along with several domestic mutual funds. read more The government had initially wanted to list LIC in the financial year that ended March 31 but chose to delay the sale after Russia’s invasion of Ukraine and the U.S. Federal Reserve’s interest rate tightening triggered a market rout.The 66-year-old company dominates India’s insurance sector, with more than 280 million policies. It was the fifth-biggest global insurer in terms of insurance premium collection in 2020, the latest year for which statistics are available.Register now for FREE unlimited access to Reuters.comReporting by Nupur Anand Editing by Jamie Freed and Mark PotterOur Standards: The Thomson Reuters Trust Principles. .

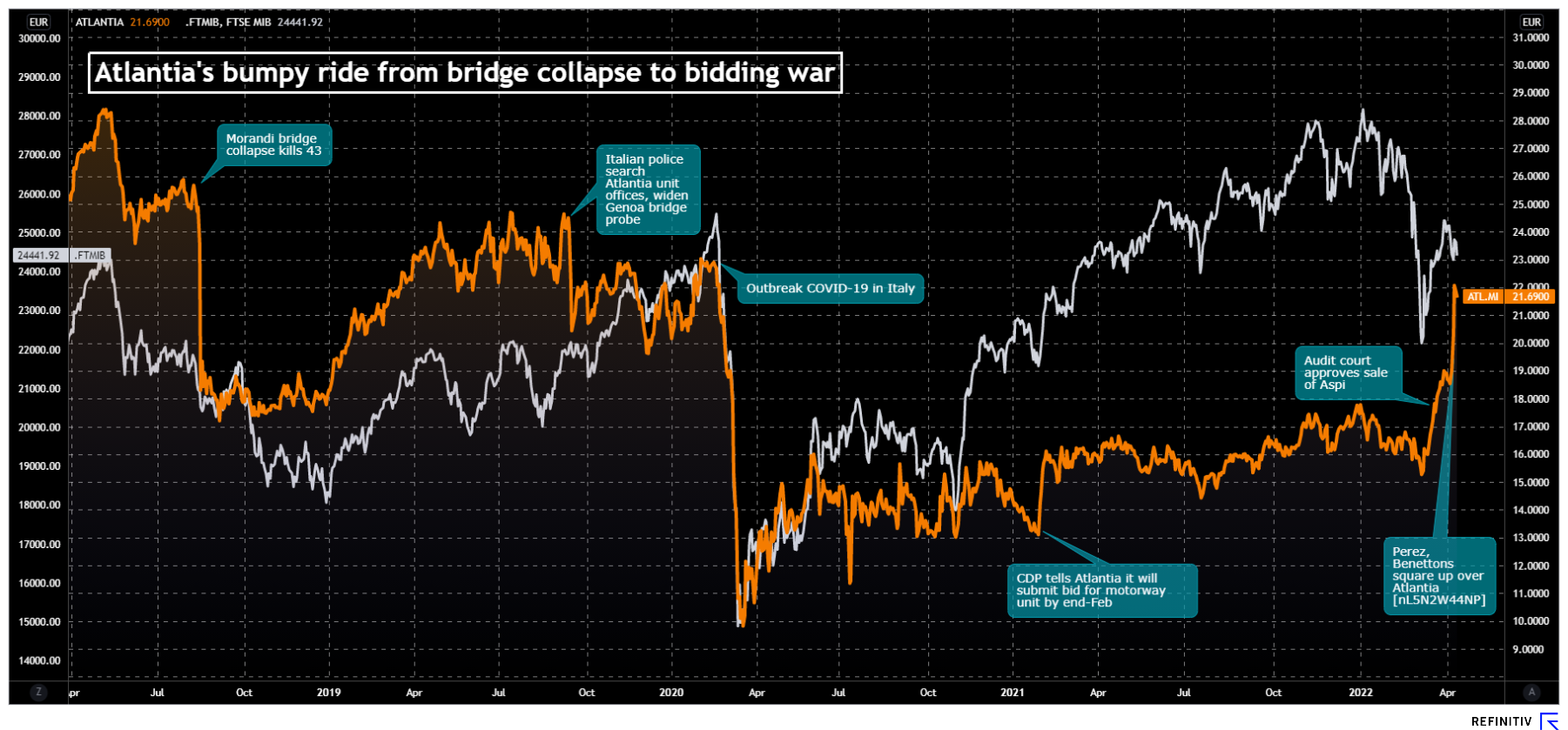

Benetton team working on premium of around 30% to buy out Atlantia – sources

The logo of infrastructure group Atlantia in Rome, Italy October 5, 2020. REUTERS/Guglielmo MangiapaneRegister now for FREE unlimited access to Reuters.comMILAN, April 12 (Reuters) – The Benetton family and U.S. investment fund Blackstone are working on a premium of around 30% over Atlantia’s (ATL.MI) average stock price in the last six months, as they ready a bid that could land as early as Wednesday, three sources said.The two partners are considering an offer between 22 and 23 euros per share, one of the sources said, but cautioned no final decision had been taken.While a significant premium on the six month average share price, that would be a more modest increase over the current price of about 21.7 euros, and would value the whole of Atlantia – in which the Benetton family already owns a 33% stake – at about 18.1-19.0 billion euros ($19.7-$20.7 billion).Register now for FREE unlimited access to Reuters.comShares in the Italian infrastructure group have gained nearly 20% since April 6 when speculation first emerged about an approach involving Global Infrastructure Partners (GIP), Brookfield and Florentino Perez, head of Spain’s ACS (ACS.MC).The stock hit a two-year high of 22.5 euros on Monday as investors waited for a move that could take the group private.”The offer could land very soon, even early Wednesday morning,” one of the sources said.Blackstone and Benetton holding company Edizione declined to comment. Atlantia’s share performanceEdizione and Blackstone want to delist Atlantia to shield it from the appetite of rival suitors, who approached the Benettons last month with a proposal to buy the group and hand over Atlantia’s motorway concessions to Perez.GIP, Brookfield and the Spanish tycoon are in a ‘wait and see’ mode after the Benetton family and Atlantia’s long-time investors CRT and GIC rebuffed their offer, sources have said.The takeover offer comes as Atlantia prepares to pocket 8 billion euros from the sale of the group’s Italian motorway unit, a deal aimed at ending a political dispute triggered by the 2018 collapse of a motorway bridge.It also puts the spotlight on Alessandro Benetton, 58, who was appointed chairman of Edizione earlier this year, tightening the family’s grip on its investments.After parting ways with its Autostrade per l’Italia, Atlantia will continue to run airports in Italy and France, motorways in Europe and Latin America and digital toll payment company Telepass.The Italian government so far has been silent on the latest developments, but it has special vetting ‘golden’ powers over strategic assets, such as the country’s airports and their ownership.($1 = 0.9184 euro)Register now for FREE unlimited access to Reuters.comReporting by Francesca Landini and Stephen Jewkes

Atlantia’s share performanceEdizione and Blackstone want to delist Atlantia to shield it from the appetite of rival suitors, who approached the Benettons last month with a proposal to buy the group and hand over Atlantia’s motorway concessions to Perez.GIP, Brookfield and the Spanish tycoon are in a ‘wait and see’ mode after the Benetton family and Atlantia’s long-time investors CRT and GIC rebuffed their offer, sources have said.The takeover offer comes as Atlantia prepares to pocket 8 billion euros from the sale of the group’s Italian motorway unit, a deal aimed at ending a political dispute triggered by the 2018 collapse of a motorway bridge.It also puts the spotlight on Alessandro Benetton, 58, who was appointed chairman of Edizione earlier this year, tightening the family’s grip on its investments.After parting ways with its Autostrade per l’Italia, Atlantia will continue to run airports in Italy and France, motorways in Europe and Latin America and digital toll payment company Telepass.The Italian government so far has been silent on the latest developments, but it has special vetting ‘golden’ powers over strategic assets, such as the country’s airports and their ownership.($1 = 0.9184 euro)Register now for FREE unlimited access to Reuters.comReporting by Francesca Landini and Stephen Jewkes

Editing by Mark Potter and Chizu NomiyamaOur Standards: The Thomson Reuters Trust Principles. .

Column: Elusive bond risk premium misses its curtain call: Mike Dolan

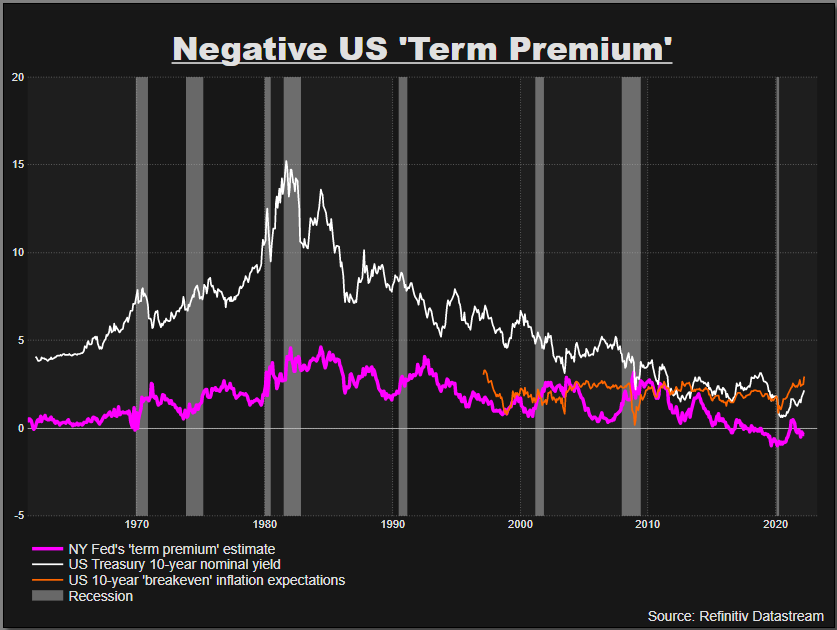

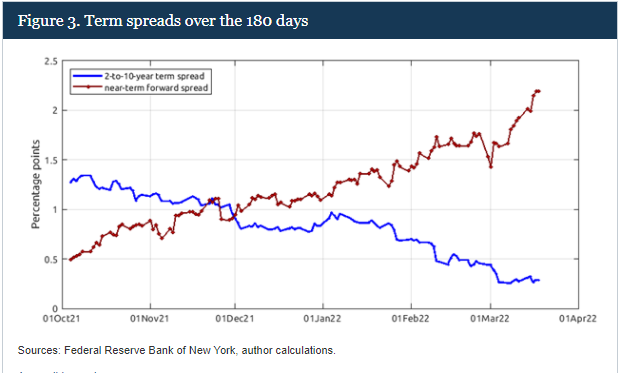

LONDON, March 30 (Reuters) – If not now, when? Investors typically demand some added compensation for holding a security over many years to cover all the unknowables over long horizons – making the absence of such a premium in bond markets right now seem slightly bizarre.Disappearance of the so-called “term premium” in 10-year U.S. Treasury bonds over the past 5 years has puzzled analysts and policymakers and been blamed variously on subdued inflation expectations or distortions related to central bank bond buying.And yet it’s rarely, if ever, been more difficult to fathom the decade ahead – at least in terms of inflation, interest rates or indeed quantitative easing or tightening.Register now for FREE unlimited access to Reuters.comInflation is running at a 40-year high after the pandemic forced wild swings in economic activity and supply bottlenecks and was then compounded by an energy price spike due to war in Ukraine that may redraw the geopolitical map.The U.S. Federal Reserve and other central banks are scrambling to normalise super easy monetary policies to cope – not really knowing whether to focus on reining in runaway prices or tackle what Bank of England chief Andrew Bailey this week described as a “historic shock” to real household incomes.Bond yields have surged, much like they did in the first quarter of last year. But this time bond funds have suffered one of their worst quarters in more than 20 years and some measures of Treasury price volatility are at their highest since banking crash of 2008. (.MOVE3M)But the most-followed estimates of term premia embedded in bond markets remain deeply negative. And this matters a lot to a whole host of critical bond market signals, not least the unfolding inversion of the U.S. Treasury curve between short and long-term yields that has presaged recessions in the past.”The 10-year term premium has barely budged even as inflation spiked to 8%, suggesting that long-dated yields are probably still capped by the Fed’s record-high balance sheet,” said Franklin Templeton’s fixed income chief Sonal Desai. “Or maybe investors think the Fed will blink and ease policy again once asset prices start a meaningful correction.””In either case, I think markets are still underestimating the magnitude of the monetary policy tightening ahead,” said Desai, adding that expectations of another more than 2 percentage points of Fed hikes this year still likely leaves real policy rates deeply negative by December even if inflation eases to 5%. US ‘term premium’ stays negative

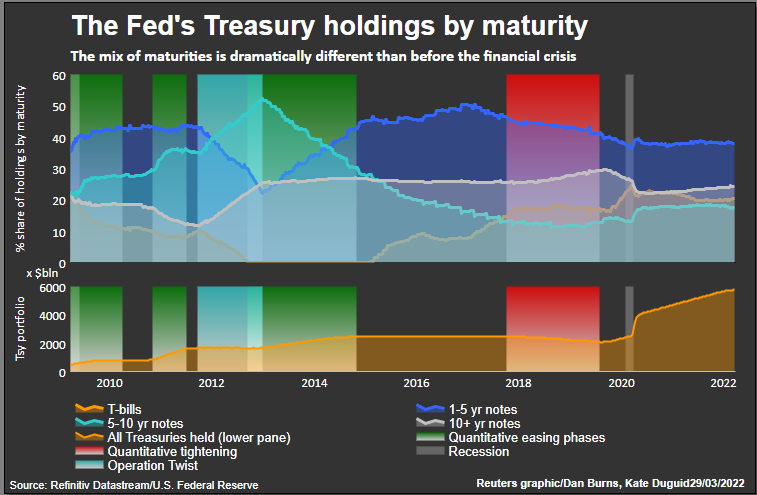

US ‘term premium’ stays negative Fed contrast between Yield Curve and Near Term Forward SpreadBUMP IN THE NIGHTSo what’s the beef with the term premium?In effect, the Treasury term premium is meant to measure the additional yield demanded by investors for buying and holding a 10-year bond to maturity as opposed to buying a one year bond and rolling it over for 10 years with a new coupon.In theory it covers all the things that might go bump in the night over a decade hence – including the outside chance of credit or even political risk – but it mostly reflects uncertainty about future Fed rates and inflation expectations.At zero, you’d assume investors are indifferent to holding the 10-year today as opposed to rolling 10 one-year notes.But the New York Fed’s measure of the 10-year term premium remains deeply negative to the tune of -32 basis points – ostensibly suggesting investors actually prefer holding the longer-duration asset.Although the premium popped back positive in the first half of last year, it’s been stuck around zero or below since 2017 – oddly in the face of the Fed’s last attempt to unwind its balance sheet.And the persistent and puzzling erosion of the term premium to zero and below brings it back to the 1960s, not the much-vaunted inflation-ravaged 1970s that everyone seems to think we’re back in.It matters a lot now as the debate about the inversion of the 2-10 yield curve heats up and many argue that the signal sent by that inversion is less clear about a coming recession as it’s distorted by the disappearance of the term premium.In the absence of a term premium, the long-term yield curve is just a reflection of long-run policy rate expectations that will inevitably see some retreat if the Fed is successful in taming inflation over the next two years.Fed Board economists Eric Engstrom and Steven Sharpe late last week also dismissed the market’s obsession with a 2-10 year yield inversion signalling recession.In a blog called ‘(Don’t Fear) The Yield Curve’ they said near term forward rate spreads out to 18 months were much more informative about the chance of a looming recession, just as accurate over time and – significantly – heading in the opposite direction right now.The main reason they pushed back on the 2-10s was it contained a whole host of information about the world beyond two years that’s simply less reliable as an economic signal and “buffeted by other significant factors such as risk premiums on long-term bonds.”But what could see the term premium return?Presumably the Fed’s planned balance sheet rundown, or quantitative tightening (QT), would be a prime candidate if indeed its long-term bond buying has distorted term premia.But the last Fed attempt at QT in 2017-19 didn’t do that and Morgan Stanley thinks it will be some time yet before just allowing short-term bonds on its balance sheet to roll off and mature gets replaced by outright sales of longer-term bonds.”QT is not the opposite of QE; asset sales are.”Of course, maybe the world just hasn’t changed that much – in terms of ageing demographics, excess savings and pension fund demand, falling potential growth and negative real interest rates. Once this current storm has passed, investors seem to think that will dominate once more. read more

Fed contrast between Yield Curve and Near Term Forward SpreadBUMP IN THE NIGHTSo what’s the beef with the term premium?In effect, the Treasury term premium is meant to measure the additional yield demanded by investors for buying and holding a 10-year bond to maturity as opposed to buying a one year bond and rolling it over for 10 years with a new coupon.In theory it covers all the things that might go bump in the night over a decade hence – including the outside chance of credit or even political risk – but it mostly reflects uncertainty about future Fed rates and inflation expectations.At zero, you’d assume investors are indifferent to holding the 10-year today as opposed to rolling 10 one-year notes.But the New York Fed’s measure of the 10-year term premium remains deeply negative to the tune of -32 basis points – ostensibly suggesting investors actually prefer holding the longer-duration asset.Although the premium popped back positive in the first half of last year, it’s been stuck around zero or below since 2017 – oddly in the face of the Fed’s last attempt to unwind its balance sheet.And the persistent and puzzling erosion of the term premium to zero and below brings it back to the 1960s, not the much-vaunted inflation-ravaged 1970s that everyone seems to think we’re back in.It matters a lot now as the debate about the inversion of the 2-10 yield curve heats up and many argue that the signal sent by that inversion is less clear about a coming recession as it’s distorted by the disappearance of the term premium.In the absence of a term premium, the long-term yield curve is just a reflection of long-run policy rate expectations that will inevitably see some retreat if the Fed is successful in taming inflation over the next two years.Fed Board economists Eric Engstrom and Steven Sharpe late last week also dismissed the market’s obsession with a 2-10 year yield inversion signalling recession.In a blog called ‘(Don’t Fear) The Yield Curve’ they said near term forward rate spreads out to 18 months were much more informative about the chance of a looming recession, just as accurate over time and – significantly – heading in the opposite direction right now.The main reason they pushed back on the 2-10s was it contained a whole host of information about the world beyond two years that’s simply less reliable as an economic signal and “buffeted by other significant factors such as risk premiums on long-term bonds.”But what could see the term premium return?Presumably the Fed’s planned balance sheet rundown, or quantitative tightening (QT), would be a prime candidate if indeed its long-term bond buying has distorted term premia.But the last Fed attempt at QT in 2017-19 didn’t do that and Morgan Stanley thinks it will be some time yet before just allowing short-term bonds on its balance sheet to roll off and mature gets replaced by outright sales of longer-term bonds.”QT is not the opposite of QE; asset sales are.”Of course, maybe the world just hasn’t changed that much – in terms of ageing demographics, excess savings and pension fund demand, falling potential growth and negative real interest rates. Once this current storm has passed, investors seem to think that will dominate once more. read more  Fed balance sheet and maturitiesThe author is editor-at-large for finance and markets at Reuters News. Any views expressed here are his ownRegister now for FREE unlimited access to Reuters.comby Mike Dolan, Twitter: @reutersMikeD. Editing by Jane MerrimanOur Standards: The Thomson Reuters Trust Principles.Opinions expressed are those of the author. They do not reflect the views of Reuters News, which, under the Trust Principles, is committed to integrity, independence, and freedom from bias. .

Fed balance sheet and maturitiesThe author is editor-at-large for finance and markets at Reuters News. Any views expressed here are his ownRegister now for FREE unlimited access to Reuters.comby Mike Dolan, Twitter: @reutersMikeD. Editing by Jane MerrimanOur Standards: The Thomson Reuters Trust Principles.Opinions expressed are those of the author. They do not reflect the views of Reuters News, which, under the Trust Principles, is committed to integrity, independence, and freedom from bias. .