Stellantis logo and stock graph are seen displayed in this illustration taken, May 3, 2022. REUTERS/Dado Ruvic/IllustrationRegister now for FREE unlimited access to Reuters.comVERONA, Italy, May 18 (Reuters) – Stellantis (STLA.MI) will start a reshuffle of its European dealers’ network next year from Austria, Belgium and the Netherlands, and its van and premium brands in all markets, its regional sales chief said on Wednesday.As part of its efforts to cut costs and finance its electrification strategy, the carmaker, formed through the merger of Fiat Chrysler and France’s PSA, has said it would end all current sales and services contracts with European dealers for its 14 brands, effective form June 2023. read more The plan is to move its distribution structure in Europe towards an “agency model”, where carmakers take more control of sales transactions and prices while dealers focus on handovers and servicing, no longer acting as the customer’s contractual partner.Register now for FREE unlimited access to Reuters.com“We will start in June next year with all our van brands and with our premium brands – Alfa Romeo, DS and Lancia – in all markets, and on three pilot markets, Austria, Belgium and the Netherlands with all our brands,” Stellantis’ sales chief for ‘Enlarged Europe’ region Maria Grazia Davino said.She added the new distribution structure would be operational in all of Europe’s 10 largest markets by 2026.”We will anticipate all that we can, but this is our schedule at the moment,” she said during an “Automotive dealer day” event in Verona, northern Italy.Davino said core elements of the new contract Stellantis will propose to retailers are expected to be ready by this summer, while a final set up would be prepared by year-end.”Our direction is to envisage a 5% fee for our retailers on new cars sold, we’re working on this hypothesis,” she said. “We’re into a transition of course, then we’ll see”.She added that in the first stage of this process retailers would earn different fees for different brands, with some higher ones for premium brands. Retailers will also get a variable performance bonus based on sales targets, she said.Register now for FREE unlimited access to Reuters.comReporting by Giulio Piovaccari

Editing by Keith WeirOur Standards: The Thomson Reuters Trust Principles. .

In it for the long haul: Qantas bets on non-stop Sydney-London flights with Airbus order

- Orders 12 Airbus ultra-long haul A350-1000 planes

- Commercial direct Sydney-London flight to start late in 2025

- 20-hour trip to be world’s longest non-stop flight

- Orders 20 A321XLRs and 20 A220s to renew domestic fleet

- Overall Airbus deal could be worth more than $4 bln – Barrenjoey

SYDNEY, May 2 (Reuters) – Qantas Airways (QAN.AX) will fly non-stop from Sydney to London after ordering a dozen special Airbus (AIR.PA) jets, charging higher fares in a multi-billion dollar bet that fliers will pay a premium to save four hours on the popular route.To be launched late in 2025, the flights will use A350-1000 planes, specially configured with extra premium seating and reduced overall capacity, to ferry up to 238 passengers in a 20-hour trip – the world’s longest direct commercial flight.Announcing plans for the service on Monday, the loss-making carrier said a strong recovery in the domestic market and signs of an improvement in international flying after the worst of the COVID-19 pandemic had given it the confidence to make a major investment on its future. Qantas forecasts a return to profit in the financial year starting this July.Register now for FREE unlimited access to Reuters.comThe order from the European aircraft maker also includes 40 narrowbody A321XLR and A220 jets to start the replacement of Qantas’ ageing domestic fleet, with deliveries spread over a decade. The airline did not disclose the value of the Airbus deal, but analysts at Barrenjoey estimated in a client note it would cost at least A$6 billion ($4.23 billion).”Since the start of the calendar year, we have seen huge increases in demand,” Qantas Chief Executive Alan Joyce told reporters at Sydney Airport, where an Airbus A350-1000 test plane flown from France emblazoned with the Qantas logo and “Our Spirit flies further” was parked in a hangar as a backdrop for the announcement.Qantas shares surged as much as 5.5% on Monday to the highest level since November after it also said debt levels had fallen to pre-COVID levels faster than the market’s expectations.The A350-1000 order was the culmination of a challenge called “Project Sunrise” set for Airbus and its rival Boeing Co (BA.N) in 2017 to create aircraft capable of the record-breaking flights.Airbus was selected as the preferred supplier in late 2019, but Qantas delayed placing an order for two years due to financial challenges during the COVID pandemic.Airbus Chief Commercial Officer Christian Scherer said the aircraft to be used on the Sydney-London flights would offer more fuel storage than A350-1000s currently in operation with other airlines.The Qantas planes will carry passengers across four classes and will have around 100 fewer seats than rivals British Airways (ICAG.L) and Cathay Pacific Airways Ltd (0293.HK) use on their A350-1000s. The Australian carrier will dedicate more than 40% of the jets’ cabins to premium seating.CEO Joyce said demand for non-stop flights had grown since the pandemic, when complex travel rules were put in place. Rising fuel costs could be recovered through higher fares, he said, as the airline had done previously on its non-stop Perth-London flights.In a market update, Qantas said while it expects an underlying operating loss for the financial year ending June 30, 2022, the second half would benefit from improved domestic and international demand, with free cash flow seen rising further in the current quarter.Barrenjoey analysts forecast Qantas could achieve a 20% revenue premium on the ultra-long haul flights, which Joyce said will also go to New York from late 2025 and possible future destinations like Paris, Chicago and Rio de Janeiro.Qantas estimated Project Sunrise would have an internal rate of return of around 15%.($1 = 1.4180 Australian dollars)Register now for FREE unlimited access to Reuters.comReporting by Jamie Freed; Additional reporting by Sameer Manekar in Bengaluru; Editing by Diane Craft, Sam Holmes and Kenneth MaxwellOur Standards: The Thomson Reuters Trust Principles. .

Column: European smelter squeeze keeps zinc close to record highs

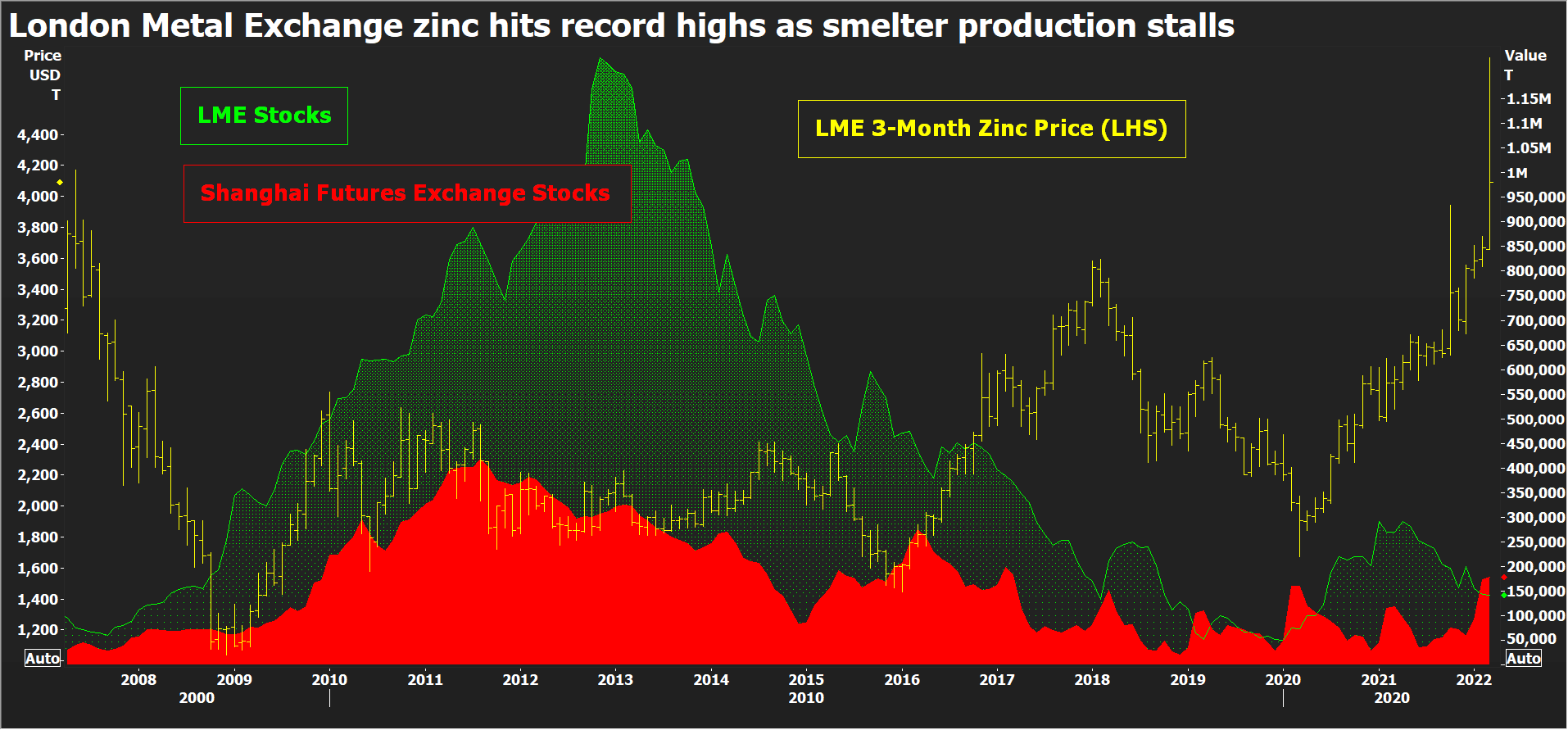

LONDON, March 29 (Reuters) – London Metal Exchange (LME) zinc recorded a new all-time high of $4,896 per tonne earlier this month, eclipsing the previous 2006 peak of $4,580 per tonne.True, the March 8 spike was over in a matter of hours and looked very much like the forced close-out of positions to cover margin calls in the LME nickel contract, which was imploding at the time before being suspended.But zinc has since re-established itself above the $4,000 level, last trading at $4,100 per tonne, amid escalating supply chain tensions.Register now for FREE unlimited access to Reuters.comRussia’s invasion of Ukraine, which Moscow calls a special military operation, doesn’t have any direct impact on zinc supply as Russian exports are negligible.But the resulting increase in energy prices is piling more pressure on already struggling European smelters.European buyers are paying record physical premiums over and above record high LME prices, a tangible sign of scarcity which is now starting to spread to the North American market.The world is not yet running out of the galvanising metal but a market that even a few months ago was expected to be in comfortable supply surplus is turning out to be anything but. LME zinc price and stocks, Shanghai stocksEUROPEAN POWER-DOWNOne European smelter – Nyrstar’s Auby plant in France – has returned to partial production after being shuttered in January due to soaring power costs. But run-rates across the company’s three European smelters with combined annual capacity of 720,000 tonnes will continue to be flexed “with anticipated total production cuts of up to 50%”, Nyrstar said.High electricity prices across Europe mean “it is not economically feasible to operate any of our sites at full capacity”, it said.Still on full care and maintenance is Glencore’s (GLEN.L) 100,000-tonne-per-year Portovesme site in Italy, another power-crisis casualty.Zinc smelting is an energy-intensive business and these smelters were already in trouble before Russia’s invasion sent European electricity prices spiralling yet higher.Record-high physical premiums, paid on top of the LME cash price, attest to the regional shortage of metal. The premium for special-high-grade zinc at the Belgian port of Antwerp has risen to $450 per tonne from $170 last October before the winter heating crisis kicked in.The Italian premium has exploded from $215.00 to $462.50 per tonne over the same time frame, according to Fastmarkets.LME warehouses in Europe hold just 500 tonnes of zinc – all of it at the Spanish port of Bilbao and just about all of it bar 25 tonnes cancelled in preparation for physical load-out.Tightness in Europe is rippling over the Atlantic. Fastmarkets has just hiked its assessment of the U.S. Midwest physical premium by 24% to 26-30 cents per lb ($573-$661 per tonne).LME-registered stocks in the United States total a low 25,925 tonnes and available tonnage is lower still at 19,825 tonnes. This time last year New Orleans alone held almost 100,000 tonnes of zinc.

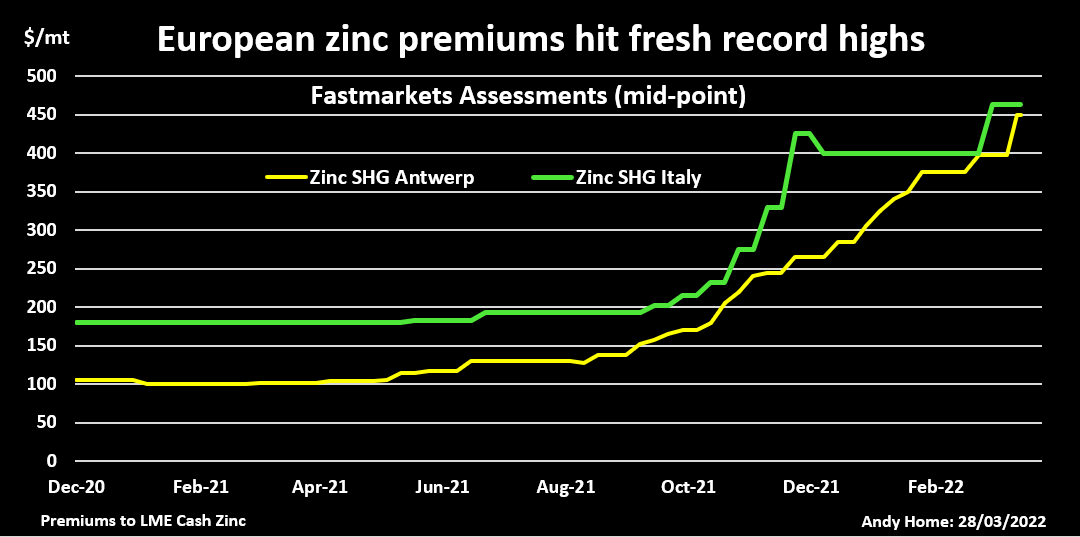

LME zinc price and stocks, Shanghai stocksEUROPEAN POWER-DOWNOne European smelter – Nyrstar’s Auby plant in France – has returned to partial production after being shuttered in January due to soaring power costs. But run-rates across the company’s three European smelters with combined annual capacity of 720,000 tonnes will continue to be flexed “with anticipated total production cuts of up to 50%”, Nyrstar said.High electricity prices across Europe mean “it is not economically feasible to operate any of our sites at full capacity”, it said.Still on full care and maintenance is Glencore’s (GLEN.L) 100,000-tonne-per-year Portovesme site in Italy, another power-crisis casualty.Zinc smelting is an energy-intensive business and these smelters were already in trouble before Russia’s invasion sent European electricity prices spiralling yet higher.Record-high physical premiums, paid on top of the LME cash price, attest to the regional shortage of metal. The premium for special-high-grade zinc at the Belgian port of Antwerp has risen to $450 per tonne from $170 last October before the winter heating crisis kicked in.The Italian premium has exploded from $215.00 to $462.50 per tonne over the same time frame, according to Fastmarkets.LME warehouses in Europe hold just 500 tonnes of zinc – all of it at the Spanish port of Bilbao and just about all of it bar 25 tonnes cancelled in preparation for physical load-out.Tightness in Europe is rippling over the Atlantic. Fastmarkets has just hiked its assessment of the U.S. Midwest physical premium by 24% to 26-30 cents per lb ($573-$661 per tonne).LME-registered stocks in the United States total a low 25,925 tonnes and available tonnage is lower still at 19,825 tonnes. This time last year New Orleans alone held almost 100,000 tonnes of zinc. Fastmarkets Assessments of Antwerp and Italian physical zinc premiumsREBALANCING ACTAbout 80% of the LME’s registered zinc inventory is currently located at Asian locations, first and foremost Singapore, which holds 81,950 tonnes.There is also plenty of metal sitting in Shanghai Futures Exchange warehouses. Registered stocks have seen their usual seasonal Lunar New Year holiday surge, rising from 58,000 tonnes at the start of January to a current 177,826 tonnes.Quite evidently Asian buyers haven’t yet been affected by the unfolding supply crunch in Europe and there is plenty of potential for a wholesale redistribution of stocks from east to west.This is what happened last year in the lead market, China exporting its surplus to help plug gaps in the Western supply chain. Lead, however, should also serve as a warning that global rebalancing can be a slow, protracted affair due to continuing log-jams in the shipping sector.MOVING THE GLOBAL DIALWhile there is undoubted slack in the global zinc market, Europe is still big enough a refined metal producer to move the market dial.The continent accounts for around 16% of global refined output and the loss of production due to the regional energy crisis has upended the zinc market narrative.When the International Lead and Zinc Study Group (ILZSG) last met in October, it forecast a global supply surplus of 217,000 tonnes for 2021.That was already a sharp reduction from its earlier April assessment of a 353,000-tonne production overhang. The Group’s most recent calculation is that the expected surplus turned into a 194,000-tonne shortfall last year. The difference was almost wholly down to lower-than-forecast refined production growth, which came in at just 0.5% compared with an October forecast of 2.5%.With Chinese smelters recovering from their own power problems earlier in the year, the fourth-quarter deceleration was largely due to lower run-rates at Europe’s smelters.The ILZSG’s monthly statistical updates are inevitably a rear-view mirror but Europe’s production losses have continued unabated over the first quarter of 2022.Moreover, the scale of the shift higher in power pricing, not just spot but along the length of the forward curve, poses a longer-term question mark over the viability of European zinc production.A redistribution of global stocks westwards can provide some medium-term relief but zinc supply is facing a new structural challenge which is not going away any time soon.The opinions expressed here are those of the author, a columnist for Reuters.Register now for FREE unlimited access to Reuters.comEditing by David ClarkeOur Standards: The Thomson Reuters Trust Principles.Opinions expressed are those of the author. They do not reflect the views of Reuters News, which, under the Trust Principles, is committed to integrity, independence, and freedom from bias. .

Fastmarkets Assessments of Antwerp and Italian physical zinc premiumsREBALANCING ACTAbout 80% of the LME’s registered zinc inventory is currently located at Asian locations, first and foremost Singapore, which holds 81,950 tonnes.There is also plenty of metal sitting in Shanghai Futures Exchange warehouses. Registered stocks have seen their usual seasonal Lunar New Year holiday surge, rising from 58,000 tonnes at the start of January to a current 177,826 tonnes.Quite evidently Asian buyers haven’t yet been affected by the unfolding supply crunch in Europe and there is plenty of potential for a wholesale redistribution of stocks from east to west.This is what happened last year in the lead market, China exporting its surplus to help plug gaps in the Western supply chain. Lead, however, should also serve as a warning that global rebalancing can be a slow, protracted affair due to continuing log-jams in the shipping sector.MOVING THE GLOBAL DIALWhile there is undoubted slack in the global zinc market, Europe is still big enough a refined metal producer to move the market dial.The continent accounts for around 16% of global refined output and the loss of production due to the regional energy crisis has upended the zinc market narrative.When the International Lead and Zinc Study Group (ILZSG) last met in October, it forecast a global supply surplus of 217,000 tonnes for 2021.That was already a sharp reduction from its earlier April assessment of a 353,000-tonne production overhang. The Group’s most recent calculation is that the expected surplus turned into a 194,000-tonne shortfall last year. The difference was almost wholly down to lower-than-forecast refined production growth, which came in at just 0.5% compared with an October forecast of 2.5%.With Chinese smelters recovering from their own power problems earlier in the year, the fourth-quarter deceleration was largely due to lower run-rates at Europe’s smelters.The ILZSG’s monthly statistical updates are inevitably a rear-view mirror but Europe’s production losses have continued unabated over the first quarter of 2022.Moreover, the scale of the shift higher in power pricing, not just spot but along the length of the forward curve, poses a longer-term question mark over the viability of European zinc production.A redistribution of global stocks westwards can provide some medium-term relief but zinc supply is facing a new structural challenge which is not going away any time soon.The opinions expressed here are those of the author, a columnist for Reuters.Register now for FREE unlimited access to Reuters.comEditing by David ClarkeOur Standards: The Thomson Reuters Trust Principles.Opinions expressed are those of the author. They do not reflect the views of Reuters News, which, under the Trust Principles, is committed to integrity, independence, and freedom from bias. .

Asia Fuel Oil VLSFO cash premiums gain, HSFO cash premiums hit multi-month highs

SINGAPORE, March 8 (Reuters) – Asia’s cash premiums for 0.5% very low-sulphur fuel oil (VLSFO) rose for a second consecutive session on Tuesday, while the prompt-month spread for the marine fuel grade remained in steep backwardation.Cash differentials for Asia’s 0.5% VLSFO , which have surged about 44% in the last month, were at a premium of $19.80 a tonne to Singapore quotes, compared with $19.67 per tonne a day earlier.The March/April VLSFO time spread traded at $32 a tonne on Tuesday, compared with $33.75 a tonne on Monday.Register now for FREE unlimited access to Reuters.comThe front-month VLSFO crack rose to $29.83 per barrel against Dubai crude during Asian trading hours, up from $29.61 per barrel in the previous session.Meanwhile, the 380-cst HSFO barge crack for April traded at a discount of $16.79 barrel to Brent on Tuesday, while cash premiums for 380-cst high sulphur fuel oil (HSFO) rose to a more than four-month high of $5.55 per tonne to Singapore quotes.Backed by firmer deals in the physical market, the cash differentials for 180-cst HSFO surged to a premium of $8.59 a tonne to Singapore quotes, a level not seen since October last year. They were at a premium of $6.39 per tonne a day earlier.ASIA REFINERS TO CRANK UP RUNS- Some Asian refineries plan to increase output in May to cash in on high prices for gasoil exports to Europe, even as the steepest crude prices in 14 years threaten profit margins, numerous trade sources said. read more – European diesel supplies have shrunk following the disruption of western sanctions imposed on Russia in response to its invasion of Ukraine, which it describes as a “special operation”.- Strong European demand has boosted Asian refiners’ profits for producing gasoil for exports to the West. However, the refiners are also paying record premiums for Middle East crude supplies after the disruption of sanctions left buyers with limited options.WINDOW TRADES- One 380-cst high-sulphur fuel oil (HSFO) deal, two 180-cst HSFO trades- One VLSFO trade was reportedOTHER NEWS- The United States is willing to move ahead with a ban on Russian oil imports without the participation of allies in Europe, two people familiar with the matter told Reuters, in light of Russia’s invasion of Ukraine. read more – Oil prices rose on Tuesday, with Brent surging past $126 a barrel, as fears of formal sanctions against Russian oil and fuel exports spurred concerns about supply availability.ASSESSMENTSRegister now for FREE unlimited access to Reuters.comReporting by Koustav Samanta; Editing by Shinjini GanguliOur Standards: The Thomson Reuters Trust Principles. .

Finnair to stay independent and stick to Asia strategy, says CEO

A Finnair Airbus A320-200 aircraft prepares to take off from Manchester Airport in Manchester, Britain September 4, 2018. REUTERS/Phil NobleRegister now for FREE unlimited access to Reuters.comRegisterHELSINKI, Feb 11 (Reuters) – Finnair will remain a stand-alone airline and stick to its Asia-focused strategy while adding new routes to the United States, Chief Executive Topi Manner said on Friday.Finland’s national carrier, which has bet heavily on providing connections to Asia, expects the business environment to return close to normal in the second half of this year following pandemic disruptions, he told Reuters.”We are optimistic about summer,” Manner said, adding the airline expected countries like Japan and South Korea to lift travel restrictions towards summer in the northern hemisphere.Register now for FREE unlimited access to Reuters.comRegisterThe recovery of Asian traffic from the slump caused by widespread border restrictions is particularly important for the Finnair, which seeks to benefit from providing connections to Asia from Europe thanks to the location of its Helsinki hub.”We believe Asia will open up eventually. In the meantime, we are partially pivoting to North America,” Manner said in an interview.He was speaking after the airline announced a 200-million-euro ($228 million) investment in renewing the cabins of its long-haul fleet, including a new premium economy service and redesigned business cabin.Manner said the new cabin class was being added to address increasing demand in premium leisure travel, while also introducing a new business class seat called “the air lounge,” a nest-like shell that does not recline but modifies to allow for vertical sleeping.”We as a carrier of course need to differentiate and we have chosen to differentiate with quality,” he said.Finnair operates Airbus A330 and A350 planes on long-haul routes.Unlike many airlines, Finnair has not yet joined a wave of orders for the latest generation of narrowbody jets like the A320neo, which burn 15% less fuel.Finnair’s fleet of 35 Airbus A320-family jets includes some planes as old as 21 years but others produced as recently as 2018, according to its website.Asked whether Finnair planned to renew its medium-haul fleet, Manner said it could do so in three or four years but stressed the importance of sustainable aviation fuel as the airline targets net zero emissions by 2045.($1 = 0.8770 euros)Register now for FREE unlimited access to Reuters.comRegisterReporting by Anne Kauranen Editing by Tim Hepher and Mark PotterOur Standards: The Thomson Reuters Trust Principles. .