People play “Pokemon GO” on the Pokequan GoBoat Adventure Cruise in the Occoquan River in the small town of Occoquan, Virginia, U.S. August 14, 2016. REUTERS/Sait Serkan GurbuzRegister now for FREE unlimited access to Reuters.comAug 9 (Reuters) – Gaming software company AppLovin Corp (APP.O) made an offer on Tuesday to buy its peer Unity Software Inc (U.N) in a $17.54 billion all-stock deal, threatening to derail Unity’s announced plan to acquire AppLovin’s smaller competitor ironSource .AppLovin has offered $58.85 for each Unity share, which represents a premium of 18% to Unity’s Monday closing price. Unity will own 55% of the combined company’s outstanding shares, representing about 49% of the voting rights.AppLovin hired advisors to work out an offer after Unity last month said it would buy ironSource in a $4.4 billion all-stock transaction, sources familiar with the matter told Reuters. Unity’s board will have to terminate the ironSource deal if it wants to pursue a combination with AppLovin, according to the proposal.Register now for FREE unlimited access to Reuters.comUnder the proposed deal, Unity’s Chief Executive John Riccitiello will become CEO of the combined business, while AppLovin Chief Executive Adam Foroughi will take the role of chief operating officer.Unity said its board would evaluate the offer. The company is slated to report its earnings after the bell on Tuesday.Both companies make software used to design video games. Game-making software has also been expanding to new technologies such as the so-called metaverse, or immersive virtual worlds.Unity’s software has been used to build some of the most-played games such as “Call of Duty: Mobile,” and “Pokemon Go”, while AppLovin provides helps developers to grow and monetize their apps.AppLovin’s offer comes as game developers and console makers warn of a slowdown in the sector as decades-high inflation and easing of COVID-19 restrictions lead gamers to pick outdoor activities. The company lowered its sales guidance on Tuesday.”The deal comes as surprise to everybody in the business,” said Serkan Toto, founder of game industry consultancy Kantan Games. “It’s a $15 billion company going after a $15 billion company. It’s a desperate attempt to consolidate and the chances of this deal happening are very slim.”Shares of Palo Alto, California-based AppLovin, which went public last year, fell 9.9% while those of Unity rose 1% in the morning trading session. Shares of ironSource were down 9.7%.Foroughi said the combined company will have the potential to generate an adjusted operating profit of over $3 billion by the end of 2024.Register now for FREE unlimited access to Reuters.comReporting by Eva Mathews and Nivedita Balu in Bengaluru, Krystal Hu in New York; Editing by Saumyadeb Chakrabarty and Mike HarrisonOur Standards: The Thomson Reuters Trust Principles. .

Wall St Week Ahead Recession fears loom over U.S. value stocks

A screen displays trading informations for stocks on the floor of the New York Stock Exchange (NYSE) in New York City, U.S., June 27, 2022. REUTERS/Brendan McDermidRegister now for FREE unlimited access to Reuters.comNEW YORK, July 15 (Reuters) – Fears of a potential economic slowdown are clouding the outlook for value stocks, which have outperformed broader indexes this year in the face of surging inflation and rising interest rates.Value stocks – commonly defined as those trading at a discount on metrics such as book value or price-to-earnings – have typically underperformed their growth counterparts over the past decade, when the S&P 500’s (.SPX) gains were driven by tech-focused giants such as Amazon.com Inc (AMZN.O) and Apple Inc (AAPL.O).That dynamic shifted this year, as the Federal Reserve kicked off its first interest rate-hike cycle since 2018, disproportionately hurting growth stocks, which are more sensitive to higher interest rates. The Russell 1000 value index (.RLV) is down around 13% year-to-date, while the Russell 1000 growth index (.RLG) has fallen about 26%.Register now for FREE unlimited access to Reuters.comThis month, however, fears that the Fed’s monetary policy tightening could bring on a U.S. recession have shifted the momentum away from value stocks, which tend to be more sensitive to the economy. The Russell value index is up 0.7% in July, compared with a 3.4% gain for its growth-stock counterpart.”If you think we are in a recession or are going into a recession, that does not necessarily … work to the advantage of value stocks,” said Chuck Carlson, chief executive at Horizon Investment Services.The nascent shift to growth stocks is one example of how investors are adjusting portfolios in the face of a potential U.S. economic downturn. BofA Global Research on Thursday cut its year-end target price for the S&P 500 to 3,600 from 4,500 previously and became the latest Wall Street bank to forecast a coming recession. read more The index closed at 3,863.16 on Friday and is down 18.95% this year.Corporate earnings arriving in force next week will give investors a better idea of how soaring inflation has affected companies’ bottom lines, with results from Goldman Sachs , Johnson & Johnson (JNJ.N) and Tesla among those on deck.For much of the year, value stocks benefited from broader market trends. Energy shares, which comprise around 7% of the Russell 1000 value index, soared over the first half of 2022, jumping along with oil prices as supply constraints for crude were exacerbated by Russia’s invasion of Ukraine.But energy shares along with crude prices and other commodities have tumbled in recent weeks on concerns that a recession would sap demand.A recession also stands to weigh on bank stocks, with a slowing economy hurting loan growth and increasing credit losses. Financial shares represent nearly 19% of the value index. read more An earnings beat from Citigroup, however, buoyed bank shares on Friday, with the S&P 500 banks index (.SPXBK)gaining 5.76%.At the same time, tech and other growth companies also tend to have businesses that are less cyclical and more likely able to weather a broad economic slowdown.”People pay a premium for growth stocks when growth is scarce,” said Burns McKinney, portfolio manager at NFJ Investment Group.JPMorgan analysts earlier this week wrote they believe growth stocks have a “tactical opportunity” to make up lost ground, citing cheaper valuations after this year’s sharp sell-off as one of the reasons.Value stock proponents cite many reasons for the investing style to continue its run.Growth stocks are still more expensive than value shares on a historical basis, with the Russell 1000 growth index trading at a 65% premium to its value counterpart, compared to a 35% premium over the past 20 years, according to Refinitiv Datastream.Meanwhile, earnings per share for value companies are expected to rise 15.6% this year, more than twice the rate of growth companies, Credit Suisse estimates.Data from UBS Global Wealth Management on Thursday showed value stocks tend to outperform growth stocks when inflation is running above 3% – around a third of the 9.1% annual growth U.S. consumer prices registered in June. read more Josh Kutin, head of asset allocation, North America at Columbia Threadneedle, believes a possible U.S. recession in the next year would be a mild one, leaving economically sensitive value stocks primed to outperform if growth picks up.”If I had to pick one, I’d still pick value over growth,” he said. “But that conviction has come down since the start of the year,” Kutin said.Register now for FREE unlimited access to Reuters.comReporting by Lewis Krauskopf, additional reporting by David Randall and Ira Iosebashvili; Editing by Ira Iosebashvili and Richard ChangOur Standards: The Thomson Reuters Trust Principles. .

Column: Collapsing metal inventories clash with plunging prices

LONDON, July 13 (Reuters) – London Metal Exchange (LME) stocks are rapidly dwindling.LME warehouses held just 696,109 tonnes of registered metal at the end of June, the lowest amount this century.Inventory halved over the first six months of the year and June’s tally was down by 1.67 million tonnes year-on-year.Register now for FREE unlimited access to Reuters.comThe downtrend has further to run.Nearly 306,000 tonnes of metal were awaiting physical load-out at the end of last month. Available tonnage of all metals was just 390,280.LME shadow stocks, metal stored off-market with the option of exchange delivery, rebuilt modestly in April and May but the year-to-date increase has been a negligible 4,600 tonnes.Shrinking exchange stocks should be a bullish price signal. Right now, however, macro is trumping micro as Western recession fears pummel the industrial metals complex. The LME Index (.LMEX), which tracks the performance of the exchange’s six main base metals, has slumped by 31% from its April peak.The scale of the disconnect between price and stocks is striking. The resulting mismatch of current scarcity and expected future surplus is likely to be resolved by sporadic flare-ups in LME time-spreads.LME registered and “shadow” stocksSTOCKED OUTThis is currently happening in the LME zinc market. The cash premium over three-month metalAvailable live stocks shrunk to a depleted 14,975 tonnes at one stage in June and are still a meagre 22,475 tonnes.The rest of the headline zinc inventory of 82,200 tonnes is scheduled to depart.It also happened to sister metal lead last year, when the cash premium spiked to over $200 per tonne in August as LME on-warrant stocks fell to less than 40,000 tonnes.Time-spread tightness has been a recurring feature of the LME lead contract ever since and the cash premium is once again edging wider, ending Tuesday valued at $33 per tonne.That’s because lead stocks haven’t rebuilt in any meaningful way, currently totalling 39,250 tonnes with available tonnage at 34,850.The LME tin market has been living with depleted stocks since the start of 2021 and backwardation appears to be now hard-wired into short-dated spreads.PHYSICAL TIGHTNESSLow LME stocks of all three metals reflect extreme physical supply-chain tightness.All three have seen significant supply disruption over the last year with tin smelters hit by coronarivus lockdowns, zinc smelters in Europe powering down due to high energy prices and the Stolberg lead plant in Germany out of action since July 2021 due to flooding. read more Physical premiums for all three metals have hit record highs in Europe and the United States and remain close to those levels even as outright prices have dropped like a stone.The LME has acted as market of last resort for physical buyers and stocks will only rebuild once the supply-chain pressures pass.Chinese exports are helping rebalance both lead and zinc markets but the process is a slow one as freight and logistics bottlenecks brake arbitrage flows.

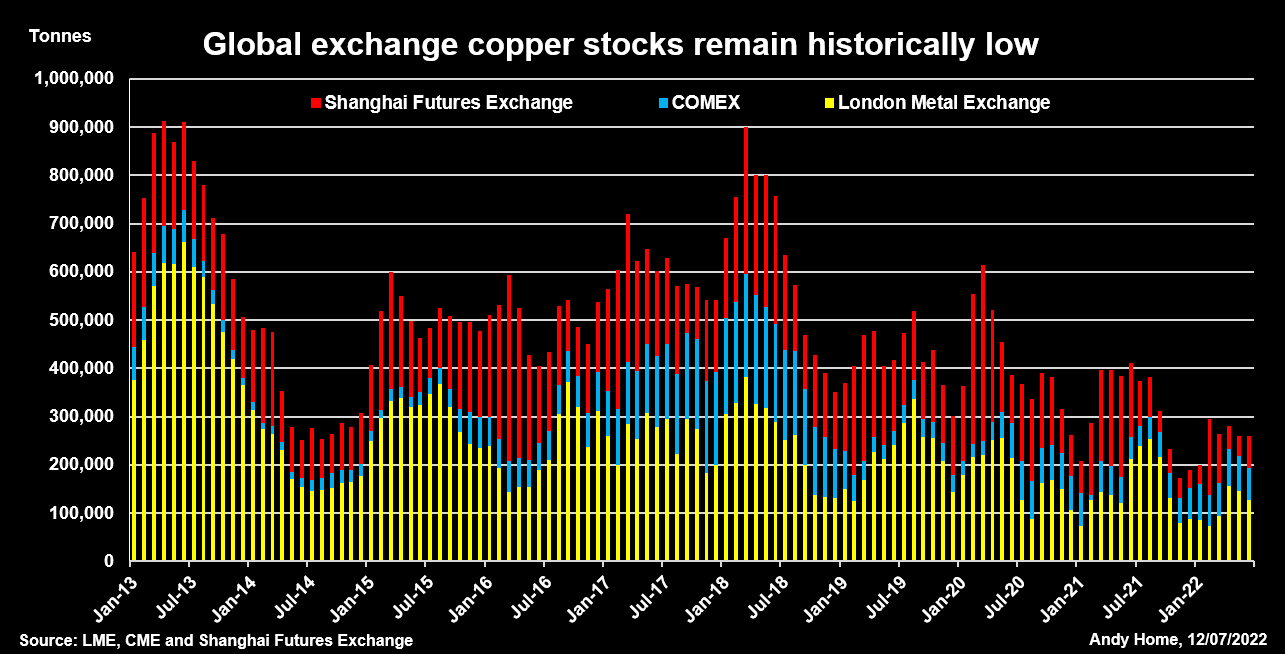

LME, CME and Shanghai Futures Exchange copper stocksCOPPER’S MUTED REBUILDCopper was stocked out last October, when live LME tonnage fell to 14,150 tonnes and the cash premium exploded to an eye-watering $1,000 per tonne.The LME intervened with lending caps and deferred delivery options, a tool-kit now extended to all its physically-deliverable contracts after the March nickel debacle.LME registered copper inventory recovered to a May peak of 180,925 tonnes but the trend has since reversed. Headline stocks have fallen back to 130,975 tonnes with fresh deliveries being offset by a string of cancellations as metal is turned around for the exit door.Indeed, combined inventory across all three major copper trading venues – LME, CME and the Shanghai Futures Exchange (ShFE)- totalled 261,000 tonnes at the end of June, up 71,000 tonnes on the start of January but down by 150,000 tonnes on June 2021.It’s a muted rebuild considering the world’s largest buyer – China – spent much of the first half of the year constrained by rolling lockdowns.

LME, CME and Shanghai Futures Exchange copper stocksCOPPER’S MUTED REBUILDCopper was stocked out last October, when live LME tonnage fell to 14,150 tonnes and the cash premium exploded to an eye-watering $1,000 per tonne.The LME intervened with lending caps and deferred delivery options, a tool-kit now extended to all its physically-deliverable contracts after the March nickel debacle.LME registered copper inventory recovered to a May peak of 180,925 tonnes but the trend has since reversed. Headline stocks have fallen back to 130,975 tonnes with fresh deliveries being offset by a string of cancellations as metal is turned around for the exit door.Indeed, combined inventory across all three major copper trading venues – LME, CME and the Shanghai Futures Exchange (ShFE)- totalled 261,000 tonnes at the end of June, up 71,000 tonnes on the start of January but down by 150,000 tonnes on June 2021.It’s a muted rebuild considering the world’s largest buyer – China – spent much of the first half of the year constrained by rolling lockdowns.LME registered and shadow aluminium stocksOFF-MARKET BUILD?Weaker Chinese demand doesn’t appear to have made any impact on ShFE copper inventory, which remains low at 69,000 tonnes, down from 129,500 tonnes a year ago.However, the headline stocks may be deceiving.The Chinese market has been rocked by another multi-pledging stocks scandal reminiscent of the Qingdao fraud of 2014.That seems to have triggered movement of both aluminium and zinc into safe-haven storage and may be deterring copper exchange deliveries.It’s quite possible that such rotation between visible and non-visible storage is accentuating the LME stocks downtrend as well.Registered aluminium stocks, for example, collapsed by 64% over the first half of the year. Live tonnage stands at just 156,300 tonnes.Yet there is no sign of tension in aluminium time-spreads, the cash-to-three-months period trading in mild contango.The market seems to be assuming that there is no shortage of aluminium despite the headline stocks figure ticking lower every day.But if metal is available, it is evidently sitting in the statistical darkness.One small clue as to its existence was a 92,000-tonne build in LME shadow aluminium stocks over the course of April and May.Such metal is primed for LME warranting if price and spreads move into the right alignment and the recent rise suggests that some metal at least is being enticed back to the paper market from the physical market.REGIONAL IMBALANCEJust about all of the shadow aluminium stocks build has occurred in Asia, which accounted for 87% of the 289,978 tonnes in this category at the end of May.LME warehouse locations in Europe held just 21,642 tonnes and U.S. ones 14,608 tonnes.The same regional skew is clear to see across all the LME base metals and is as equally true of registered stocks as it is of shadow inventory.It is a symptom of the supply and freight issues that have roiled the metals markets since the onset of COVID-19 two years ago.It is also a warning that metals supply chains are still far from functioning efficiently, even as prices bow to the weight of macro selling.The opinions expressed here are those of the author, a columnist for Reuters.Register now for FREE unlimited access to Reuters.comEditing by Kirsten DonovanOur Standards: The Thomson Reuters Trust Principles.Opinions expressed are those of the author. They do not reflect the views of Reuters News, which, under the Trust Principles, is committed to integrity, independence, and freedom from bias. .

Analysis: Private equity’s swoop on listed European firms runs into rising execution risks

- Boards, shareholders start to rail against lowball bids

- Push for higher premiums compound debt funding dilemma

- Buyer vs seller valuation gaps may take a year to close

LONDON, June 28 (Reuters) – European listed companies have not been this cheap for more than a decade, yet for private equity firms looking to put their cash piles to work, costlier financing and stronger resistance from businesses are complicating dealmaking.Sharp falls in the value of the euro and sterling coupled with the deepest trading discounts of European stocks versus global peers seen since March 2009, have fuelled a surge in take-private interest from cash-rich buyout firms.Private equity-led bids for listed companies in Europe hit a record $73 billion in the first six months of this year to date, more than double volumes of $35 billion in the same period last year and representing 37% of overall private equity buyouts in the region, according to Dealogic data.Register now for FREE unlimited access to Reuters.comThat contrasts with a sharp slowdown in overall M&A activity around the world. But as take-private target companies and their shareholders are increasingly bristling against cheap punts which they say fail to reflect fair value of their underlying businesses in 2022, prospects for deals in the second half of the year look less promising.Leading the first half bonanza was a 58 billion euro ($61.38 billion) take-private bid by the Benetton family and U.S. buyout fund Blackstone (BX.N) for Italian infrastructure group Atlantia (ATL.MI).Dealmakers, however, say the vast majority of take-private initiatives are not reflected in official data as many private equity attempts to buy listed companies have gone undetected with boardrooms shooting down takeover approaches before any firm bid has even been launched.”In theory it’s the right time to look at take-privates as valuations are dropping. But the execution risk is high, particularly in cases where the largest shareholder holds less than 10%,” said Chris Mogge, a partner at European buyout fund BC Partners.Other recent private equity swoops include a 1.6 billion pound ($1.97 billion) bid by a consortium of Astorg Asset Management and Epiris for Euromoney (ERM.L) which valued the FTSE 250-listed financial publisher at a 34% premium after four previous offers were rebuffed by its board. read more Also capturing the attention of private equity in recent weeks were power generating firm ContourGlobal (GLO.L), British waste-management specialist Biffa (BIFF.L) and bus and rail operator FirstGroup (FGP.L), with the latter rejecting the takeover approach. read more Trevor Green, head of UK equities at Aviva Investors (AV.L), said his team was stepping up engagement with company executives to thwart lowball bids, with unwelcome approaches from private equity made more likely in view of currency volatility.War in Europe, soaring energy prices and stagflation concerns have hit the euro and the British pound hard, with the former falling around 7% and the latter by 10% against the U.S. dollar this year.”We know this kind of currency movement encourages activity, and where there’s scope for a deal, shareholders will be rightly pushing for higher premiums to reflect that,” Green said.SUBDUED SPENDINGGlobally, private equity activity has eased after a record year in 2021, hit by raging inflation, recession fears and the rising cost of capital. Overall volumes fell 19% to $674 billion in the first half of the year, according to Dealogic data.Dealmaking across the board, including private equity deals, dropped 25.5% in the second quarter of this year from a year earlier to $1 trillion, according to Dealogic data. read more Buyout funds have played a major role in sustaining global M&A activity this year, generating transactions worth $405 billion in the second quarter.But as valuation disputes intensify, concerns sparked by rising costs of debt have prevented firms from pulling off deals for their preferred listed targets in recent months.Private equity firms including KKR, EQT and CVC Capital Partners ditched attempts to take control of German-listed laboratory supplier Stratec (SBSG.DE) in May due to price differences, three sources said. Stratec, which has a market value of 1.1 billion euros, has the Leistner family as its top shareholder with a 40.5% stake.EQT, KKR and CVC declined to comment. Stratec did not immediately return a request for comment.The risks of highly leveraged corporate takeovers have increased with financing becoming more expensive, leaving some buyers struggling to make the numbers on deals stack up, sources said.Meanwhile, piles of cash that private equity firms have raised to invest continue to grow, heaping pressure on partners to consider higher-risk deals structured with more expensive debt.”There is a risk premium for debt, which leads to higher deal costs,” said Marcus Brennecke, global co-head of private equity at EQT (EQT.N).The average yield on euro high yield bonds – typically used to finance leverage buyouts – has surged to 6.77% from 2.815% at the start of the year, according to ICE BofA’s index, and the rising cost of capital has slowed debt issuance sharply. (.MERHE00)As a result, private equity firms have increasingly relied on more expensive private lending funds to finance their deals, four sources said.But as share prices continue to slide, the gap between the premium buyers are willing to offer and sellers’ price expectations remains too wide for many and could take up to a year to narrow, two bankers told Reuters.In the UK, where Dealogic data shows a quarter of all European take-private deals have been struck this year, the average premium paid was 40%, in line with last year, according to data from Peel Hunt.”Getting these deals over the line is harder than it looks. The question really is going to be how much leverage (buyers can secure),” one senior European banker with several top private equity clients told Reuters.($1 = 0.8141 pounds)($1 = 0.9450 euros)Register now for FREE unlimited access to Reuters.comReporting by Joice Alves, Emma-Victoria Farr, Sinead Cruise, additional reporting by Yoruk Bahceli, editing by Pamela Barbaglia and Susan FentonOur Standards: The Thomson Reuters Trust Principles. .

Column: Market turbulence won’t slow aluminium’s green drive

LONDON, May 26 (Reuters) – These are turbulent times for the global aluminium market.Aluminium has for years been characterised by chronic oversupply thanks to China’s relentless build-out of primary smelting capacity.Now, however, buyers in Europe and the United States are paying up record high premiums to get hold of physical metal.Register now for FREE unlimited access to Reuters.comThe Chinese aluminium juggernaut has run out of momentum and smelters in Europe are powering down as a rolling energy crunch takes a rising toll on the region’s producers. read more London Metal Exchange (LME) stocks are disappearing to fill gaps in the supply chain. Even after its recent tumble LME three-month metal at a current $2,860 per tonne is trading at levels last seen in the great bull market of 2008.None of which, it seems, is going to slow down the drive towards green low-carbon aluminium with some of the world’s largest buyers this week committing to purchase a minimum 10% of near-zero carbon metal by 2030.GREEN ALLIANCEThe newly-formed aluminium branch of the First Movers Coalition comprises automotive companies Ford (F.N) and Volvo Group (VOLVb.ST), packaging company Ball Corp , aluminium products manufacturer Novelis (NVLXC.UL) and trade house Trafigura.The Coalition, led by the World Economic Forum and the U.S. government, is aimed at tackling carbon emissions in heavily emitting sectors such as steel, shipping and aviation. And now aluminium.The light metal is a key enabler of the green energy transition. It is a material of choice for electric vehicle (EV) battery casings and solar panels as well as offering light-weighting across multiple transport applications.However, producing aluminium is an energy-intensive process, the global sector accounting for around 2% of greenhouse gas emissions, including over one billion tonnes per year of carbon dioxide.The paradox is encapsulated in an EV battery. Aluminium accounts for only 1-2% of the cost but 17% of the carbon impact, according to Torbjörn Sternsjö, senior advisor at Swedish products group Granges, speaking at CRU’s London aluminium conference.This is a problem given ever more automakers are themselves committing to carbon-neutrality – as early as 2035 in the case of Porsche.Global aluminium production by power source 2020FROM LOW CARBON…Coal is still the globally dominant source of power for smelting aluminium, reflecting the market dominance of China, which last year accounted for around 58% of world primary output.Within China there has been a rush to swap coal-fired capacity for new plants in hydro-rich Yunnan province but spaces are fast running out and most of the country’s smelters continue to run on captive coal plants or draw energy from coal-based grids.Changing the source of power from fossil fuel to renewables is the fastest way of lowering primary aluminium’s carbon footprint.Outside of China, the rush to go green has been led by those producers with large captive hydro generation capacity.The LMEpassport for ESG accreditation now lists several aluminium producers, including Russia’s Rusal, U.S. operator Century Aluminum (CENX.O), Indonesian producer Asahan Aluminium and smelters in France (Dunkerque) and the United Kingdom (Lochaber).All have disclosed carbon equivalent footprints of 0-4 tonnes per tonne of aluminium, referencing research house CRU’s Emissions Analysis Tool.No-one yet can make it to zero on a commercial basis.The new green aluminium coalition accepts that its 10% purchase commitments for near-zero metal will be dependent on “advanced technologies not yet commercially available”….TO NO CARBONThe collective race to get to zero or near-zero aluminium is already underway, led by ELYSIS, a joint venture between Alcoa and Rio Tinto.It requires the replacement of the carbon anode in the electrolytic smelting process. The anode accounts for 1.9 tonnes of carbon per tonne of aluminium, the largest remaining carbon problem for a renewables-powered smelter, according to Tim Murray, chief executive of Cardinal Virtues Consulting, also presenting at the CRU conference.The anode being trialled in the ELYSIS process results in zero direct emissions, a much longer anode life and 15% lower costs, Alcoa chief operations officer John Slaven told delegates.If the smelter is fed with “green” alumina, the carbon impact falls below 1 tonne per tonne of metal, freight accounting for most of the residue.A processing path to near-zero primary aluminium is starting to take tangible shape.NO GREEN SANCTIONSThere has been concern that aluminium’s race to go green would be abruptly halted by Russia’s invasion of Ukraine and the possible sanctioning of Rusal metal.Rusal is already a major supplier of low-carbon aluminium from its hydro-powered smelters in Siberia and is itself working on inert anode technology.Fortunately for carbon-conscious buyers, the company was already put through the U.S. sanctions process in 2018, resulting in owner Oleg Deripaska (still sanctioned) giving up control of the company.That shields Rusal this time around. So too do memories of the sanctions supply-chain disruption which stretched from Guinean bauxite mines to European automakers.Rusal’s significance as a supplier, particularly to Europe, will only increase as buyers look for low-carbon metal.NO GREEN PREMIUM…YETThe First Movers Coalition is intended to create a decarbonisation tipping-point for individual sectors centred on future purchase commitments.The incentive for suppliers will be a premium for their low-carbon aluminium, according to Trafigura chief executive Jeremy Weir.Such a green premium remains conspicuous by its absence at the primary metal stage of aluminium’s process chain.And it might not appear for long at all, Colin Hamilton, commodities analyst at BMO Capital Markets, told the CRU conference.Rather, a green premium would simply be a “stepping-stone to low-carbon becoming the prime market and anything else sub-prime.”We may not have to wait much longer to find out because the drive to zero-carbon aluminium has just accelerated.The opinions expressed here are those of the author, a columnist for Reuters.Register now for FREE unlimited access to Reuters.comEditing by Kirsten DonovanOur Standards: The Thomson Reuters Trust Principles.Opinions expressed are those of the author. They do not reflect the views of Reuters News, which, under the Trust Principles, is committed to integrity, independence, and freedom from bias. .