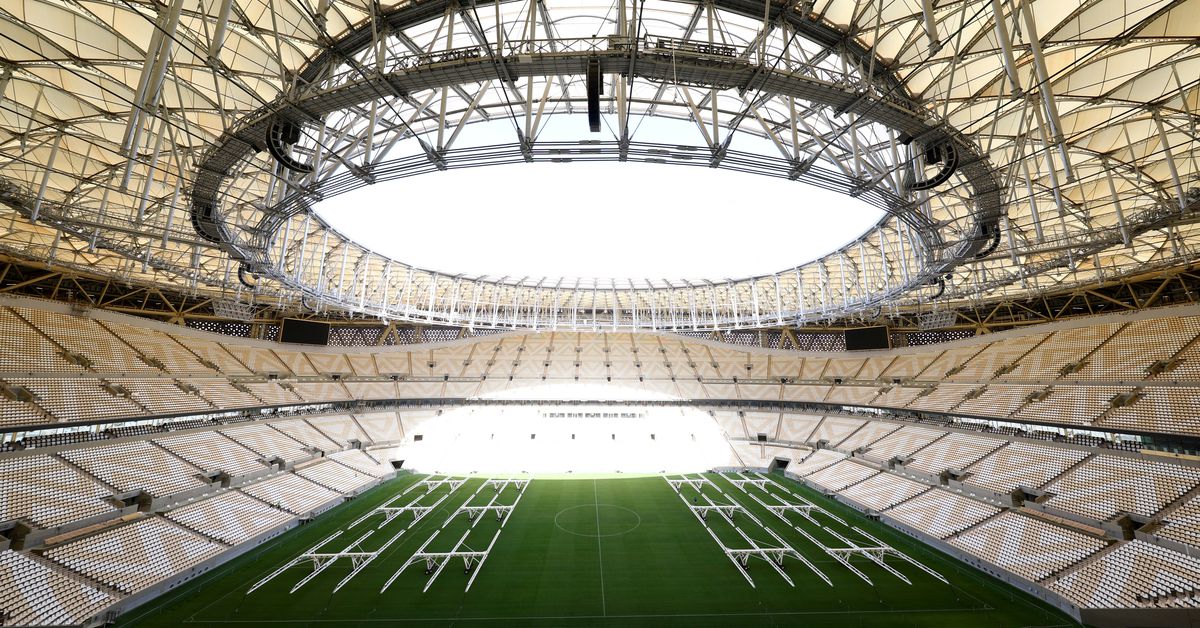

DOHA, July 7 (Reuters) – Qatar’s World Cup stadium stands are set to be alcohol-free, with beer sales outside arenas only allowed before and after some matches, a source with knowledge of plans for the soccer tournament said.This year’s World Cup is the first to be held in a Muslim country with strict controls on alcohol, presenting unique challenges for organisers of an event often associated with beer drinking fans and sponsored by global brewing brands.”At stadiums, the plans are still being finalised, but the current discussion is to allow fans to have beer upon arrival and when leaving stadium, but beer won’t be served during the match or inside the stadium bowl,” the source told Reuters.Register now for FREE unlimited access to Reuters.comA document dated June 2 and seen by Reuters gives the first insight into how organisers plan to handle the demands of an estimated 1.2 million soccer fans, many of whom are used to drinking beer without limits on match days.Soccer’s relationship with booze has long been a tricky one and in the lead up to the 2014 World Cup, Brazil lifted a ban on alcohol at stadiums, after pressure from governing body FIFA.There has been a question mark over alcohol at this year’s tournament since the Gulf Arab state won hosting rights in 2010. While not a “dry” state like neighbouring Saudi Arabia, consuming alcohol in public places is illegal in Qatar.However, fans at November’s World Cup will also be able to buy beer during restricted times in certain parts of the main FIFA fan zone in the Al Bidda park in Doha, the Qatari capital.”Unlike previous World Cup fan zones, beer won’t be served all day long, but at restricted times,” the source added.Alcohol will also be available for 15,000 to 20,000 fans on a disused corner of the Doha Golf Club, some kilometres away from stadiums and the main fan zone, the document shows.In addition, a sandy plot surrounded by a 3 metre wall and located between the delivery entrance of a hotel and a district cooling plant will be transformed into a 10,000 capacity venue promising Techno music and alcohol, the document shows.A spokesperson for the organisers, Qatar’s Supreme Committee for Delivery and Legacy, said that together with FIFA they will announce plans on the availability of alcohol at the 28-day tournament “in due course”.”Alcohol is already available in designated areas in Qatar, such as hotels and bars, and this will not change in 2022. With the aim of catering to visiting fans in 2022, alcohol will be available in additional designated areas during the tournament,” the spokesperson said.’FAMILY FRIENDLY’Although FIFA’s website advertises free flowing “beers, Champagne, sommelier-selected wines, and premium spirits” in stadium VIP hospitality suites, alcohol was not sold in stadiums in December during a test event for the World Cup.Visitors are prohibited from carrying alcohol into Qatar, even from airport duty free, and they cannot shop at the country’s only liquor store, on the outskirts of Doha, where foreign residents with permits can buy for home consumption.Alcohol can be bought by visitors to Qatar at a handful of licensed hotels and clubs, where a pint of beer can cost $18.The price of beer inside the fan zones and close to the stadium has not yet been agreed, the source said.Earlier this year, another source close to the discussions told Reuters that alcohol prices will be capped in the fan zones, pointing out that at the FIFA Club World Cup in 2019 a pint of beer cost around five pounds ($6.55). read more Although the document anticipates “strong demand for international beverages”, it says the main party zone adjacent to FIFA’s fan festival will be alcohol-free, offering up to 70,000 fans a six kilometre “family friendly” street carnival.Rules about alcohol sales in soccer stadiums vary around the world. In England, alcohol is sold at stadium concourses, but fans cannot drink it in sight of the pitch while in France none is permitted on stadium grounds.Register now for FREE unlimited access to Reuters.comReporting by Andrew Mills; Editing by Alexander SmithOur Standards: The Thomson Reuters Trust Principles. .

Shift to premium spirits helps Remy weather China lockdowns

- 2021/22 current operating profit up 39.9% vs forecast 38.6%

- Expects another year of strong growth in 2022/23

- Still eyes double-digit organic sales growth in Q1 – CEO

PARIS, June 2 (Reuters) – France’s Remy Cointreau (RCOP.PA) on Thursday predicted a strong start to its new financial year, as broad demand for its premium spirits helps to offset inflationary pressures and the impact of COVID lockdowns in China.The maker of Remy Martin cognac and Cointreau liquor made the upbeat comments after reporting higher-than-expected operating profit growth for its financial year ended March 31.”On the strength of our progress against our strategic goals, new consumption trends and our robust pricing power, we are starting the year 2022-23 with confidence,” Chief Executive Officer Eric Vallat said in a statement.Register now for FREE unlimited access to Reuters.comThe pandemic has helped Remy’s long-term drive towards higher-priced spirits to boost profit margins, accelerating a shift towards premium drinks, at-home consumption, cocktails and e-commerce.Vallat told journalists that for the new fiscal year, Remy expected “solid profitable growth” as price increases and cost control would help mitigate inflationary pressures.In the short term, Vallat said: “I can confirm we are expecting double-digit organic sales growth in the first quarter despite the lockdown in China and high comparables.”With China accounting for 15-20% of group sales, growth would be led by demand from other regions, notably the United States.Strong demand for its premium cognac in China and the United States, along with tight cost management, lifted the company’s 2021/22 organic operating profit by 39.9% to 334.4 million euros ($356.3 million), beating the 38.6% forecast by analysts.Reflecting its confidence, Remy said it would pay shareholders an ordinary dividend of 1.85 euros per share in cash and an exceptional dividend of 1 euro.”Remy guides to another year of strong growth and margin improvement, led by its strong pricing power, which suggests upside to consensus organic EBIT of +10%,” Credit Suisse analysts said in a note.Remy Cointreau shares jumped more than 3% in early trade, before handing back some gains.The company reiterated its 2030 goals for a gross margin of 72% and an operating margin of 33%. That compares with the 68.6% and 25.5% achieved respectively in 2021/22.($1 = 0.9385 euros)Register now for FREE unlimited access to Reuters.comReporting by Dominique Vidalon Editing by Sherry Jacob-Phillips and Mark PotterOur Standards: The Thomson Reuters Trust Principles. .

Treasury Wine shares surge as ex-China growth begins to pay off

Bottles of Penfolds Grange wine and other varieties, made by Australian wine maker Penfolds and owned by Australia’s Treasury Wine Estates, sit on shelves for sale at a winery located in the Hunter Valley, north of Sydney, Australia, February 14, 2018. REUTERS/David GrayRegister now for FREE unlimited access to Reuters.comRegisterFeb 16 (Reuters) – Treasury Wine Estates (TWE.AX) said on Wednesday its operating earnings outside mainland China jumped 28%, underpinned by growth in its luxury and premium brands, sending shares of the world’s largest standalone winemaker nearly 12% higher.Treasury has had to re-direct supply to the United States, Europe and domestically after a diplomatic row between Canberra and Beijing effectively closed the lucrative Chinese market to Australian wine.The company said it recorded strong growth in its Americas and premium brands businesses, both of which reported a 19% rise in their earnings before interest, tax, SGARA and material items (EBITS).Register now for FREE unlimited access to Reuters.comRegister“Penfolds growth was particularly strong in Asian markets outside of Mainland China … increasing distribution in Asia, domestic markets, Europe and the United States was a key execution highlight,” the company said in a statement.Reported EBITS, excluding Australian COO wine sold in mainland China, rose to A$262.4 million ($187.7 million), narrowly missing market expectations of A$265 million while its total net profit slid 7.5% to A$109.1 million.The company said trading conditions for the remainder of fiscal 2022 were expected to remain broadly in line with the first half across its key markets and channels.”Despite FY22 potentially shaping up to be slightly softer than expectations, we see Treasury doing a commendable job building demand for its products in new markets,” Citi analysts said in a note.Treasury shares jumped as much as 11.8% to A$11.78 in early trading, while the broader market (.AXJO) rose 0.4%.The company said it plans to increase prices across select portfolio brands to partly mitigate the impact of elevated supply chain costs and logistics. The Melbourne-based firm retained its interim dividend of 15 Australian cents per share.($1 = 1.3986 Australian dollars)Register now for FREE unlimited access to Reuters.comRegisterReporting by Tejaswi Marthi and Savyata Mishra in Bengaluru; Editing by Aditya Soni and Sherry Jacob-PhillipsOur Standards: The Thomson Reuters Trust Principles. .