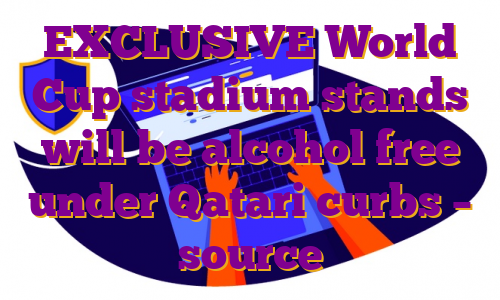

DOHA, July 7 (Reuters) – Qatar’s World Cup stadium stands are set to be alcohol-free, with beer sales outside arenas only allowed before and after some matches, a source with knowledge of plans for the soccer tournament said.This year’s World Cup is the first to be held in a Muslim country with strict controls on alcohol, presenting unique challenges for organisers of an event often associated with beer drinking fans and sponsored by global brewing brands.”At stadiums, the plans are still being finalised, but the current discussion is to allow fans to have beer upon arrival and when leaving stadium, but beer won’t be served during the match or inside the stadium bowl,” the source told Reuters.Register now for FREE unlimited access to Reuters.comA document dated June 2 and seen by Reuters gives the first insight into how organisers plan to handle the demands of an estimated 1.2 million soccer fans, many of whom are used to drinking beer without limits on match days.Soccer’s relationship with booze has long been a tricky one and in the lead up to the 2014 World Cup, Brazil lifted a ban on alcohol at stadiums, after pressure from governing body FIFA.There has been a question mark over alcohol at this year’s tournament since the Gulf Arab state won hosting rights in 2010. While not a “dry” state like neighbouring Saudi Arabia, consuming alcohol in public places is illegal in Qatar.However, fans at November’s World Cup will also be able to buy beer during restricted times in certain parts of the main FIFA fan zone in the Al Bidda park in Doha, the Qatari capital.”Unlike previous World Cup fan zones, beer won’t be served all day long, but at restricted times,” the source added.Alcohol will also be available for 15,000 to 20,000 fans on a disused corner of the Doha Golf Club, some kilometres away from stadiums and the main fan zone, the document shows.In addition, a sandy plot surrounded by a 3 metre wall and located between the delivery entrance of a hotel and a district cooling plant will be transformed into a 10,000 capacity venue promising Techno music and alcohol, the document shows.A spokesperson for the organisers, Qatar’s Supreme Committee for Delivery and Legacy, said that together with FIFA they will announce plans on the availability of alcohol at the 28-day tournament “in due course”.”Alcohol is already available in designated areas in Qatar, such as hotels and bars, and this will not change in 2022. With the aim of catering to visiting fans in 2022, alcohol will be available in additional designated areas during the tournament,” the spokesperson said.’FAMILY FRIENDLY’Although FIFA’s website advertises free flowing “beers, Champagne, sommelier-selected wines, and premium spirits” in stadium VIP hospitality suites, alcohol was not sold in stadiums in December during a test event for the World Cup.Visitors are prohibited from carrying alcohol into Qatar, even from airport duty free, and they cannot shop at the country’s only liquor store, on the outskirts of Doha, where foreign residents with permits can buy for home consumption.Alcohol can be bought by visitors to Qatar at a handful of licensed hotels and clubs, where a pint of beer can cost $18.The price of beer inside the fan zones and close to the stadium has not yet been agreed, the source said.Earlier this year, another source close to the discussions told Reuters that alcohol prices will be capped in the fan zones, pointing out that at the FIFA Club World Cup in 2019 a pint of beer cost around five pounds ($6.55). read more Although the document anticipates “strong demand for international beverages”, it says the main party zone adjacent to FIFA’s fan festival will be alcohol-free, offering up to 70,000 fans a six kilometre “family friendly” street carnival.Rules about alcohol sales in soccer stadiums vary around the world. In England, alcohol is sold at stadium concourses, but fans cannot drink it in sight of the pitch while in France none is permitted on stadium grounds.Register now for FREE unlimited access to Reuters.comReporting by Andrew Mills; Editing by Alexander SmithOur Standards: The Thomson Reuters Trust Principles. .

Shift to premium spirits helps Remy weather China lockdowns

- 2021/22 current operating profit up 39.9% vs forecast 38.6%

- Expects another year of strong growth in 2022/23

- Still eyes double-digit organic sales growth in Q1 – CEO

PARIS, June 2 (Reuters) – France’s Remy Cointreau (RCOP.PA) on Thursday predicted a strong start to its new financial year, as broad demand for its premium spirits helps to offset inflationary pressures and the impact of COVID lockdowns in China.The maker of Remy Martin cognac and Cointreau liquor made the upbeat comments after reporting higher-than-expected operating profit growth for its financial year ended March 31.”On the strength of our progress against our strategic goals, new consumption trends and our robust pricing power, we are starting the year 2022-23 with confidence,” Chief Executive Officer Eric Vallat said in a statement.Register now for FREE unlimited access to Reuters.comThe pandemic has helped Remy’s long-term drive towards higher-priced spirits to boost profit margins, accelerating a shift towards premium drinks, at-home consumption, cocktails and e-commerce.Vallat told journalists that for the new fiscal year, Remy expected “solid profitable growth” as price increases and cost control would help mitigate inflationary pressures.In the short term, Vallat said: “I can confirm we are expecting double-digit organic sales growth in the first quarter despite the lockdown in China and high comparables.”With China accounting for 15-20% of group sales, growth would be led by demand from other regions, notably the United States.Strong demand for its premium cognac in China and the United States, along with tight cost management, lifted the company’s 2021/22 organic operating profit by 39.9% to 334.4 million euros ($356.3 million), beating the 38.6% forecast by analysts.Reflecting its confidence, Remy said it would pay shareholders an ordinary dividend of 1.85 euros per share in cash and an exceptional dividend of 1 euro.”Remy guides to another year of strong growth and margin improvement, led by its strong pricing power, which suggests upside to consensus organic EBIT of +10%,” Credit Suisse analysts said in a note.Remy Cointreau shares jumped more than 3% in early trade, before handing back some gains.The company reiterated its 2030 goals for a gross margin of 72% and an operating margin of 33%. That compares with the 68.6% and 25.5% achieved respectively in 2021/22.($1 = 0.9385 euros)Register now for FREE unlimited access to Reuters.comReporting by Dominique Vidalon Editing by Sherry Jacob-Phillips and Mark PotterOur Standards: The Thomson Reuters Trust Principles. .

Swedish Match top 10 investor says Philip Morris bid a ‘healthy premium’

Moist powder tobacco “snus” cans are seen on shelves at a Swedish Match store in Stockholm, Sweden October 24, 2018. Picture taken October 24, 2018. REUTERS/Anna Ringstrom/File PhotoRegister now for FREE unlimited access to Reuters.comLONDON, May 12 (Reuters) – Philip Morris’ $16 billion offer for Stockholm-based Swedish Match (SWMA.ST) represents a “healthy premium” and the Marlboro maker could yet go higher, Swedish Match’s No. 10 shareholder GACMO Investors (GBL.N) said on Thursday.Marlboro maker Philip Morris agreed on Wednesday to buy Swedish Match, one of the world’s biggest makers of oral nicotine products. These include Snus – a sucked tobacco product the firm says is less harmful than smoking – as well as Zyn nicotine pouches, which are used the same way and tobacco-free.Kevin Dreyer, co-chief investment officer, value, at GAMCO identified Japan Tobacco Inc (2914.T) (JTI) as a possible rival bidder but said it would be hard-pressed to hijack the deal. GAMCO, formerly known as Gabelli Asset Management Company, owns just over 2% of Swedish Match, according to Refinitiv.Register now for FREE unlimited access to Reuters.com“PMI has very deep pockets and will be a tough company to out-bid,” he said. “This deal is really the culmination of the last five-to-seven years of work Swedish Match has done in developing Zyn into the leading brand, and having that advantageous market share – it’s an attractive stock.”Philip Morris declined to comment. Swedish Match and JTI did not immediately respond to a request for comment.Philip Morris needs at least 90% of shareholders to approve the deal for it to succeed. Some other shareholders have questioned whether the Philip Morris offer represents good value. Swedish Match shareholder Bronte Capital said on Wednesday the price Philip Morris agreed to pay was “unacceptable”.Register now for FREE unlimited access to Reuters.comReporting by Richa Naidu; editing by David Evans and Emelia Sithole-MatariseOur Standards: The Thomson Reuters Trust Principles. .

Column: European smelter squeeze keeps zinc close to record highs

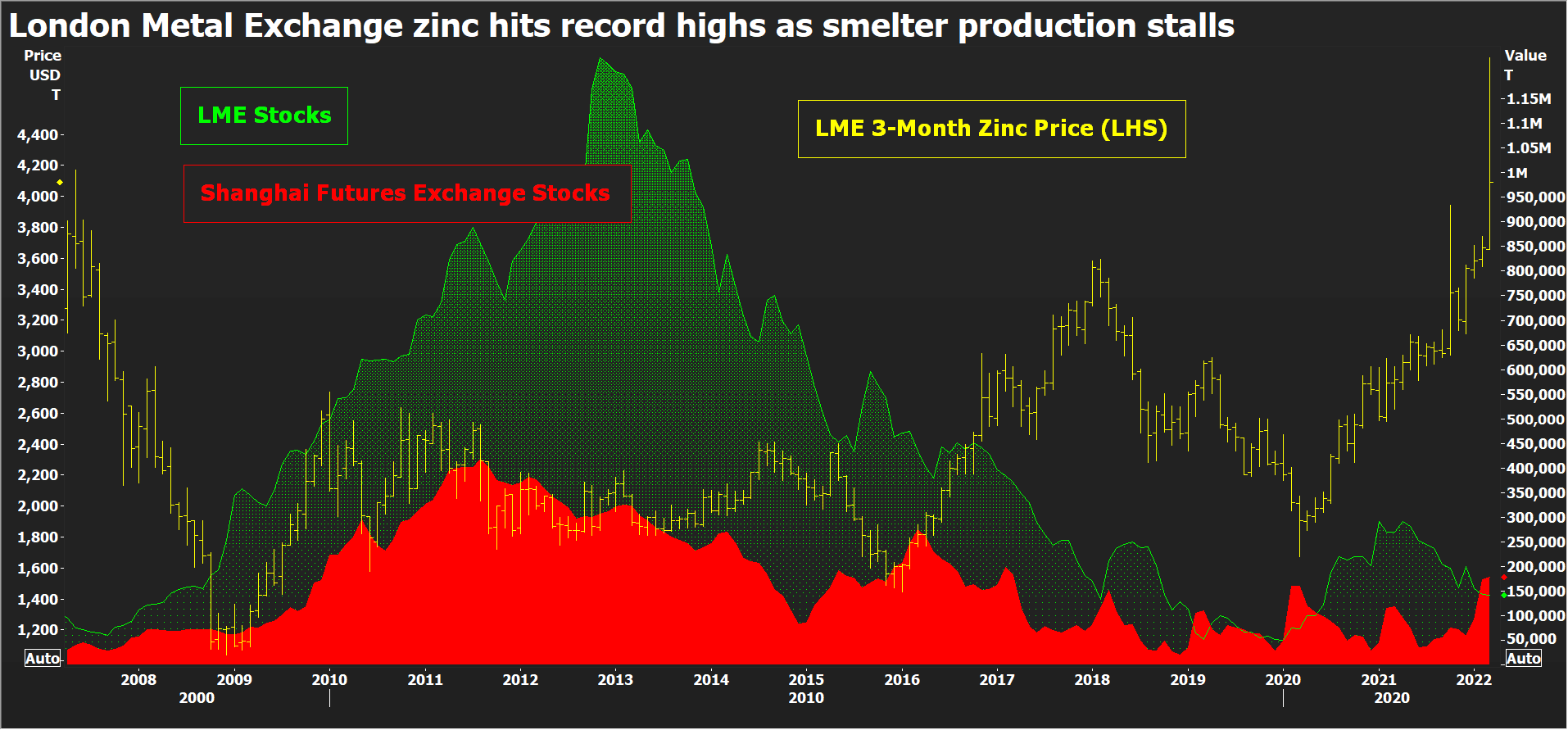

LONDON, March 29 (Reuters) – London Metal Exchange (LME) zinc recorded a new all-time high of $4,896 per tonne earlier this month, eclipsing the previous 2006 peak of $4,580 per tonne.True, the March 8 spike was over in a matter of hours and looked very much like the forced close-out of positions to cover margin calls in the LME nickel contract, which was imploding at the time before being suspended.But zinc has since re-established itself above the $4,000 level, last trading at $4,100 per tonne, amid escalating supply chain tensions.Register now for FREE unlimited access to Reuters.comRussia’s invasion of Ukraine, which Moscow calls a special military operation, doesn’t have any direct impact on zinc supply as Russian exports are negligible.But the resulting increase in energy prices is piling more pressure on already struggling European smelters.European buyers are paying record physical premiums over and above record high LME prices, a tangible sign of scarcity which is now starting to spread to the North American market.The world is not yet running out of the galvanising metal but a market that even a few months ago was expected to be in comfortable supply surplus is turning out to be anything but. LME zinc price and stocks, Shanghai stocksEUROPEAN POWER-DOWNOne European smelter – Nyrstar’s Auby plant in France – has returned to partial production after being shuttered in January due to soaring power costs. But run-rates across the company’s three European smelters with combined annual capacity of 720,000 tonnes will continue to be flexed “with anticipated total production cuts of up to 50%”, Nyrstar said.High electricity prices across Europe mean “it is not economically feasible to operate any of our sites at full capacity”, it said.Still on full care and maintenance is Glencore’s (GLEN.L) 100,000-tonne-per-year Portovesme site in Italy, another power-crisis casualty.Zinc smelting is an energy-intensive business and these smelters were already in trouble before Russia’s invasion sent European electricity prices spiralling yet higher.Record-high physical premiums, paid on top of the LME cash price, attest to the regional shortage of metal. The premium for special-high-grade zinc at the Belgian port of Antwerp has risen to $450 per tonne from $170 last October before the winter heating crisis kicked in.The Italian premium has exploded from $215.00 to $462.50 per tonne over the same time frame, according to Fastmarkets.LME warehouses in Europe hold just 500 tonnes of zinc – all of it at the Spanish port of Bilbao and just about all of it bar 25 tonnes cancelled in preparation for physical load-out.Tightness in Europe is rippling over the Atlantic. Fastmarkets has just hiked its assessment of the U.S. Midwest physical premium by 24% to 26-30 cents per lb ($573-$661 per tonne).LME-registered stocks in the United States total a low 25,925 tonnes and available tonnage is lower still at 19,825 tonnes. This time last year New Orleans alone held almost 100,000 tonnes of zinc.

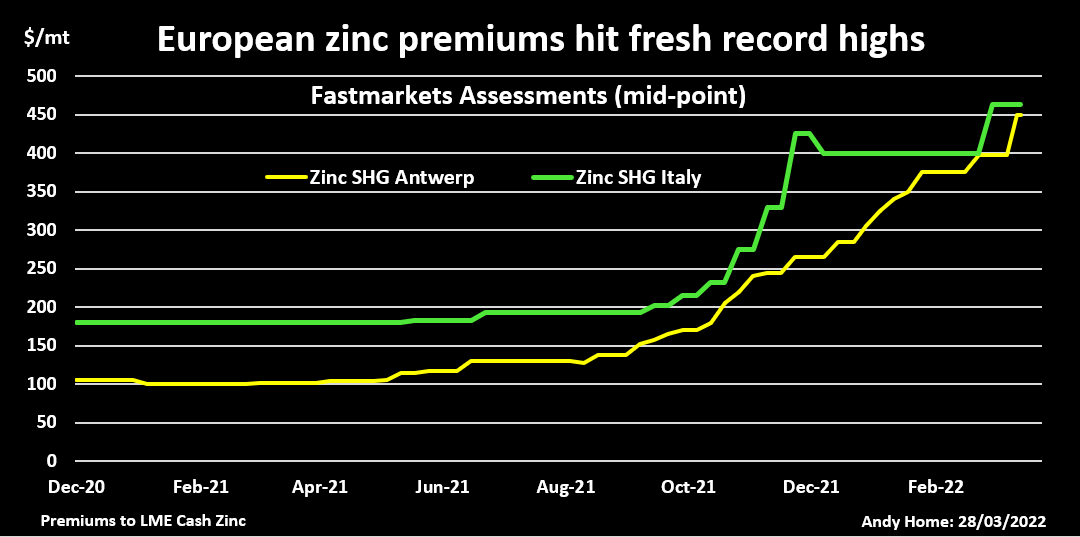

LME zinc price and stocks, Shanghai stocksEUROPEAN POWER-DOWNOne European smelter – Nyrstar’s Auby plant in France – has returned to partial production after being shuttered in January due to soaring power costs. But run-rates across the company’s three European smelters with combined annual capacity of 720,000 tonnes will continue to be flexed “with anticipated total production cuts of up to 50%”, Nyrstar said.High electricity prices across Europe mean “it is not economically feasible to operate any of our sites at full capacity”, it said.Still on full care and maintenance is Glencore’s (GLEN.L) 100,000-tonne-per-year Portovesme site in Italy, another power-crisis casualty.Zinc smelting is an energy-intensive business and these smelters were already in trouble before Russia’s invasion sent European electricity prices spiralling yet higher.Record-high physical premiums, paid on top of the LME cash price, attest to the regional shortage of metal. The premium for special-high-grade zinc at the Belgian port of Antwerp has risen to $450 per tonne from $170 last October before the winter heating crisis kicked in.The Italian premium has exploded from $215.00 to $462.50 per tonne over the same time frame, according to Fastmarkets.LME warehouses in Europe hold just 500 tonnes of zinc – all of it at the Spanish port of Bilbao and just about all of it bar 25 tonnes cancelled in preparation for physical load-out.Tightness in Europe is rippling over the Atlantic. Fastmarkets has just hiked its assessment of the U.S. Midwest physical premium by 24% to 26-30 cents per lb ($573-$661 per tonne).LME-registered stocks in the United States total a low 25,925 tonnes and available tonnage is lower still at 19,825 tonnes. This time last year New Orleans alone held almost 100,000 tonnes of zinc. Fastmarkets Assessments of Antwerp and Italian physical zinc premiumsREBALANCING ACTAbout 80% of the LME’s registered zinc inventory is currently located at Asian locations, first and foremost Singapore, which holds 81,950 tonnes.There is also plenty of metal sitting in Shanghai Futures Exchange warehouses. Registered stocks have seen their usual seasonal Lunar New Year holiday surge, rising from 58,000 tonnes at the start of January to a current 177,826 tonnes.Quite evidently Asian buyers haven’t yet been affected by the unfolding supply crunch in Europe and there is plenty of potential for a wholesale redistribution of stocks from east to west.This is what happened last year in the lead market, China exporting its surplus to help plug gaps in the Western supply chain. Lead, however, should also serve as a warning that global rebalancing can be a slow, protracted affair due to continuing log-jams in the shipping sector.MOVING THE GLOBAL DIALWhile there is undoubted slack in the global zinc market, Europe is still big enough a refined metal producer to move the market dial.The continent accounts for around 16% of global refined output and the loss of production due to the regional energy crisis has upended the zinc market narrative.When the International Lead and Zinc Study Group (ILZSG) last met in October, it forecast a global supply surplus of 217,000 tonnes for 2021.That was already a sharp reduction from its earlier April assessment of a 353,000-tonne production overhang. The Group’s most recent calculation is that the expected surplus turned into a 194,000-tonne shortfall last year. The difference was almost wholly down to lower-than-forecast refined production growth, which came in at just 0.5% compared with an October forecast of 2.5%.With Chinese smelters recovering from their own power problems earlier in the year, the fourth-quarter deceleration was largely due to lower run-rates at Europe’s smelters.The ILZSG’s monthly statistical updates are inevitably a rear-view mirror but Europe’s production losses have continued unabated over the first quarter of 2022.Moreover, the scale of the shift higher in power pricing, not just spot but along the length of the forward curve, poses a longer-term question mark over the viability of European zinc production.A redistribution of global stocks westwards can provide some medium-term relief but zinc supply is facing a new structural challenge which is not going away any time soon.The opinions expressed here are those of the author, a columnist for Reuters.Register now for FREE unlimited access to Reuters.comEditing by David ClarkeOur Standards: The Thomson Reuters Trust Principles.Opinions expressed are those of the author. They do not reflect the views of Reuters News, which, under the Trust Principles, is committed to integrity, independence, and freedom from bias. .

Fastmarkets Assessments of Antwerp and Italian physical zinc premiumsREBALANCING ACTAbout 80% of the LME’s registered zinc inventory is currently located at Asian locations, first and foremost Singapore, which holds 81,950 tonnes.There is also plenty of metal sitting in Shanghai Futures Exchange warehouses. Registered stocks have seen their usual seasonal Lunar New Year holiday surge, rising from 58,000 tonnes at the start of January to a current 177,826 tonnes.Quite evidently Asian buyers haven’t yet been affected by the unfolding supply crunch in Europe and there is plenty of potential for a wholesale redistribution of stocks from east to west.This is what happened last year in the lead market, China exporting its surplus to help plug gaps in the Western supply chain. Lead, however, should also serve as a warning that global rebalancing can be a slow, protracted affair due to continuing log-jams in the shipping sector.MOVING THE GLOBAL DIALWhile there is undoubted slack in the global zinc market, Europe is still big enough a refined metal producer to move the market dial.The continent accounts for around 16% of global refined output and the loss of production due to the regional energy crisis has upended the zinc market narrative.When the International Lead and Zinc Study Group (ILZSG) last met in October, it forecast a global supply surplus of 217,000 tonnes for 2021.That was already a sharp reduction from its earlier April assessment of a 353,000-tonne production overhang. The Group’s most recent calculation is that the expected surplus turned into a 194,000-tonne shortfall last year. The difference was almost wholly down to lower-than-forecast refined production growth, which came in at just 0.5% compared with an October forecast of 2.5%.With Chinese smelters recovering from their own power problems earlier in the year, the fourth-quarter deceleration was largely due to lower run-rates at Europe’s smelters.The ILZSG’s monthly statistical updates are inevitably a rear-view mirror but Europe’s production losses have continued unabated over the first quarter of 2022.Moreover, the scale of the shift higher in power pricing, not just spot but along the length of the forward curve, poses a longer-term question mark over the viability of European zinc production.A redistribution of global stocks westwards can provide some medium-term relief but zinc supply is facing a new structural challenge which is not going away any time soon.The opinions expressed here are those of the author, a columnist for Reuters.Register now for FREE unlimited access to Reuters.comEditing by David ClarkeOur Standards: The Thomson Reuters Trust Principles.Opinions expressed are those of the author. They do not reflect the views of Reuters News, which, under the Trust Principles, is committed to integrity, independence, and freedom from bias. .

Palm oil becomes costliest vegoil as Ukraine war halts sunoil supply

- Buyers struggle to replace sunoil quickly

- Huge demand lifts palm oil prices to a record high

- Soyoil supply limited as drought hits South America

- Palm’s premium could fade as buyers shift to soyoil

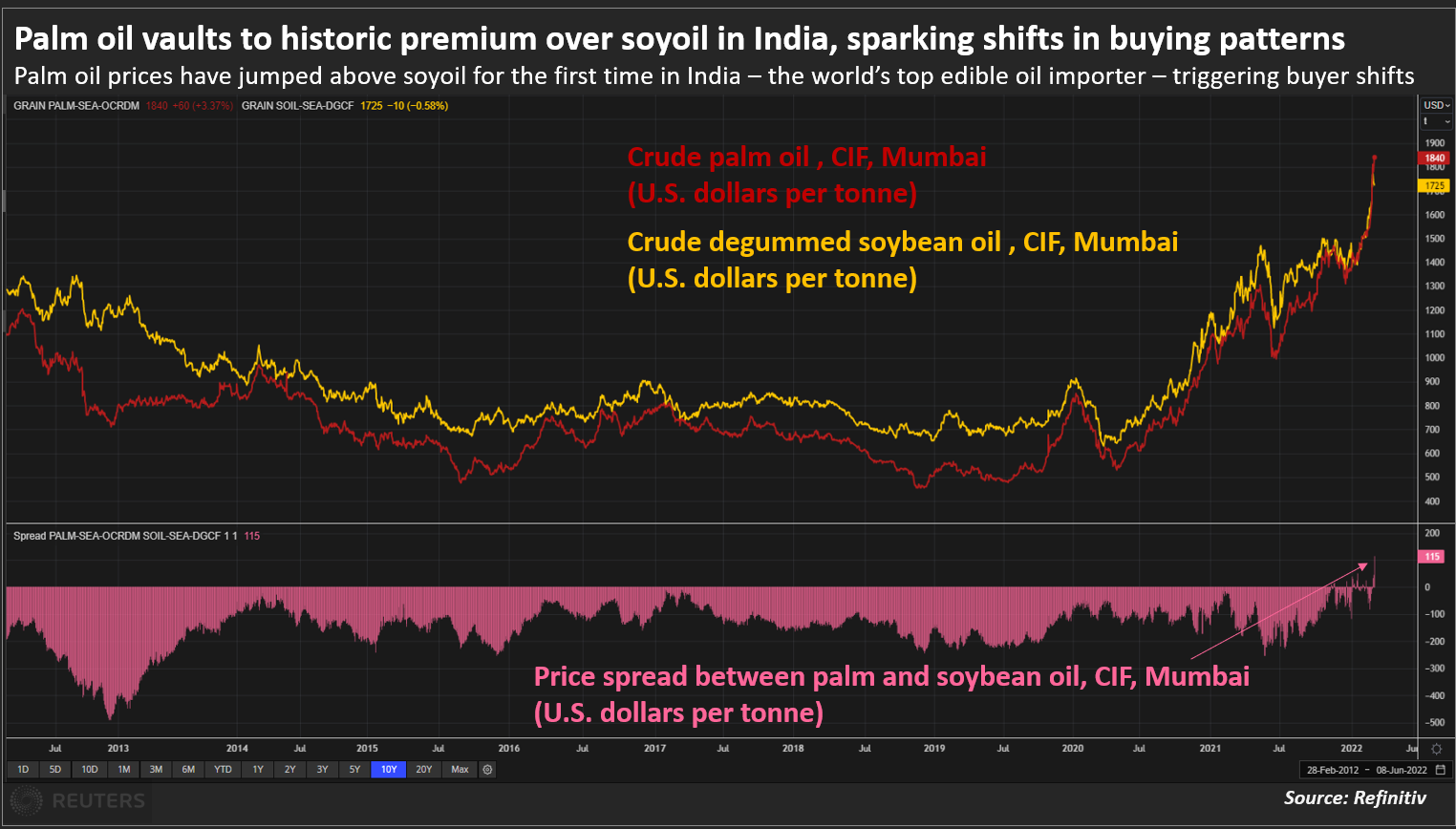

MUMBAI, March 1 (Reuters) – Palm oil has become the costliest among the four major edible oils for the first time as buyers rush to secure replacements for sunflower oil shipments from the top exporting Black Sea region that were disrupted by Russia’s invasion of Ukraine.Palm oil’s record premium over rival oils could squeeze price-sensitive Asian and African consumers already reeling from spiralling fuel and food costs, and force them to curtail consumption and shift to rival soyoil , dealers said.Crude palm oil (CPO) is being offered at about $1,925 a tonne, including cost, insurance and freight (CIF), in India for March shipments, compared with $1,865 for crude soybean oil.Register now for FREE unlimited access to Reuters.comRegisterCrude rapeseed oil was offered at around $1,900, while traders were not offering crude sunflower oil as ports are closed due to the Ukraine crisis. Palm oil vaults to historic premium over soyoil in India, sparking shifts in buying patternsThe Black Sea accounts for 60% of world sunflower oil output and 76% of exports. Ports in Ukraine will remain closed until the invasion ends. read more “Asian and European refiners have raised palm oil purchases for near-month shipments to replace sunoil. This buying has lifted palm oil to irrational price level,” said a Mumbai-based dealer with a global trading firm.”They have the option of buying soyoil as well. But prompt soyoil shipments are limited and they take much longer to land in Asia compared to palm oil,” he said.Soybean production in Argentina, Brazil and Paraguay is expected to fall because of dry weather. Price-sensitive Asian buyers traditionally relied on palm oil because of low costs and quick shipping times, but now they are paying more than $50 per tonne premium over soyoil and sunoil, said a Kuala Lumpur-based edible oil dealer.Palm oil’s price premium is temporary, however, and could fade in the next few weeks as buyers shift to soyoil for April shipments, the dealer said.Most of the incremental demand for palm oil is fulfilled by Malaysia, as Indonesia has put restriction on the exports, said an Indian refiner. “Malaysian stocks are depleting fast because of the surge in demand. It is the biggest beneficiary of the current geopolitical situation,” he said.Register now for FREE unlimited access to Reuters.comRegisterReporting by Rajendra Jadhav

Palm oil vaults to historic premium over soyoil in India, sparking shifts in buying patternsThe Black Sea accounts for 60% of world sunflower oil output and 76% of exports. Ports in Ukraine will remain closed until the invasion ends. read more “Asian and European refiners have raised palm oil purchases for near-month shipments to replace sunoil. This buying has lifted palm oil to irrational price level,” said a Mumbai-based dealer with a global trading firm.”They have the option of buying soyoil as well. But prompt soyoil shipments are limited and they take much longer to land in Asia compared to palm oil,” he said.Soybean production in Argentina, Brazil and Paraguay is expected to fall because of dry weather. Price-sensitive Asian buyers traditionally relied on palm oil because of low costs and quick shipping times, but now they are paying more than $50 per tonne premium over soyoil and sunoil, said a Kuala Lumpur-based edible oil dealer.Palm oil’s price premium is temporary, however, and could fade in the next few weeks as buyers shift to soyoil for April shipments, the dealer said.Most of the incremental demand for palm oil is fulfilled by Malaysia, as Indonesia has put restriction on the exports, said an Indian refiner. “Malaysian stocks are depleting fast because of the surge in demand. It is the biggest beneficiary of the current geopolitical situation,” he said.Register now for FREE unlimited access to Reuters.comRegisterReporting by Rajendra Jadhav

Editing by Shri NavaratnamOur Standards: The Thomson Reuters Trust Principles. .