A logo of Petronas is seen at their office in Kuala Lumpur, Malaysia, April 27, 2022. REUTERS/Hasnoor HussainRegister now for FREE unlimited access to Reuters.comSINGAPORE, July 21 (Reuters) – Malaysia’s state oil company Petronas has sold a cargo of Labuan crude at a record premium amid tight supplies for sweet crude in the region, several traders said on Thursday.The cargo, loading in September, was sold at a premium of more than $20 a barrel to dated Brent to Vitol, they said.Register now for FREE unlimited access to Reuters.comReporting by Florence Tan; Editing by Clarence FernandezOur Standards: The Thomson Reuters Trust Principles. .

‘Sell premium’ – Thailand discourages discounts, wants high value tourists

Tourists visit Maya bay after Thailand reopened its world-famous beach after closing it for more than three years to allow its ecosystem to recover from the impact of overtourism, at Krabi province, Thailand, January 3, 2022. Picture taken January 3, 2022. REUTERS/Athit Perawongmetha/File PhotoRegister now for FREE unlimited access to Reuters.comBANGKOK, July 4 (Reuters) – Thailand’s hotels, businesses and private hospitals should refrain from offering big discounts to lure tourists and focus instead on raising the country’s value as a premium travel destination, government ministers said on Monday.Thailand has received about 2 million foreign visitors in the first six months of this year, a steady revival after its tourism industry almost collapsed due to the pandemic and more than 18 months of complex and costly entry requirements.”We cannot let people come to Thailand and say because it’s cheap,” Deputy Prime Minister Anutin Charnvirakul said at an event at Bangkok’s main international airport to promote tourism.Register now for FREE unlimited access to Reuters.com“Instead they should say ‘because it works, it’s reasonable’, that’s where we can increase value,” he said, echoing remarks by the country’s tourism minister.Anutin likened the approach to that of luxury fashion brand Louis Vuitton.”Hold your ground. Sell premium. The more expensive, the more customers,” he said. “Otherwise Louis Vuitton wouldn’t have any sales.”One of Asia’s most popular travel destinations, Thailand welcomed a record of nearly 40 million visitors in pre-pandemic 2019, who spent 1.91 trillion baht ($53.53 billion), equivalent to 11% of gross domestic product.Arrivals slumped to 6.7 million the following year, and down to 428,000 in 2021, despite calibrated moves to end quarantine requirements.It is forecasting 10 million foreign arrivals in 2022.Earlier this year, Thailand launched a long-term visa programme for wealthy foreigners and skilled workers, sticking to its plan to lure high-spending visitors, despite major jobs and business losses in tourism during the pandemic.($1 = 35.6500 baht)Register now for FREE unlimited access to Reuters.comReporting by Chayut Setboonsarng and Panarat Thepgumpanat; Editing by Martin PettyOur Standards: The Thomson Reuters Trust Principles. .

Asia Fuel Oil VLSFO cash premiums gain, HSFO cash premiums hit multi-month highs

SINGAPORE, March 8 (Reuters) – Asia’s cash premiums for 0.5% very low-sulphur fuel oil (VLSFO) rose for a second consecutive session on Tuesday, while the prompt-month spread for the marine fuel grade remained in steep backwardation.Cash differentials for Asia’s 0.5% VLSFO , which have surged about 44% in the last month, were at a premium of $19.80 a tonne to Singapore quotes, compared with $19.67 per tonne a day earlier.The March/April VLSFO time spread traded at $32 a tonne on Tuesday, compared with $33.75 a tonne on Monday.Register now for FREE unlimited access to Reuters.comThe front-month VLSFO crack rose to $29.83 per barrel against Dubai crude during Asian trading hours, up from $29.61 per barrel in the previous session.Meanwhile, the 380-cst HSFO barge crack for April traded at a discount of $16.79 barrel to Brent on Tuesday, while cash premiums for 380-cst high sulphur fuel oil (HSFO) rose to a more than four-month high of $5.55 per tonne to Singapore quotes.Backed by firmer deals in the physical market, the cash differentials for 180-cst HSFO surged to a premium of $8.59 a tonne to Singapore quotes, a level not seen since October last year. They were at a premium of $6.39 per tonne a day earlier.ASIA REFINERS TO CRANK UP RUNS- Some Asian refineries plan to increase output in May to cash in on high prices for gasoil exports to Europe, even as the steepest crude prices in 14 years threaten profit margins, numerous trade sources said. read more – European diesel supplies have shrunk following the disruption of western sanctions imposed on Russia in response to its invasion of Ukraine, which it describes as a “special operation”.- Strong European demand has boosted Asian refiners’ profits for producing gasoil for exports to the West. However, the refiners are also paying record premiums for Middle East crude supplies after the disruption of sanctions left buyers with limited options.WINDOW TRADES- One 380-cst high-sulphur fuel oil (HSFO) deal, two 180-cst HSFO trades- One VLSFO trade was reportedOTHER NEWS- The United States is willing to move ahead with a ban on Russian oil imports without the participation of allies in Europe, two people familiar with the matter told Reuters, in light of Russia’s invasion of Ukraine. read more – Oil prices rose on Tuesday, with Brent surging past $126 a barrel, as fears of formal sanctions against Russian oil and fuel exports spurred concerns about supply availability.ASSESSMENTSRegister now for FREE unlimited access to Reuters.comReporting by Koustav Samanta; Editing by Shinjini GanguliOur Standards: The Thomson Reuters Trust Principles. .

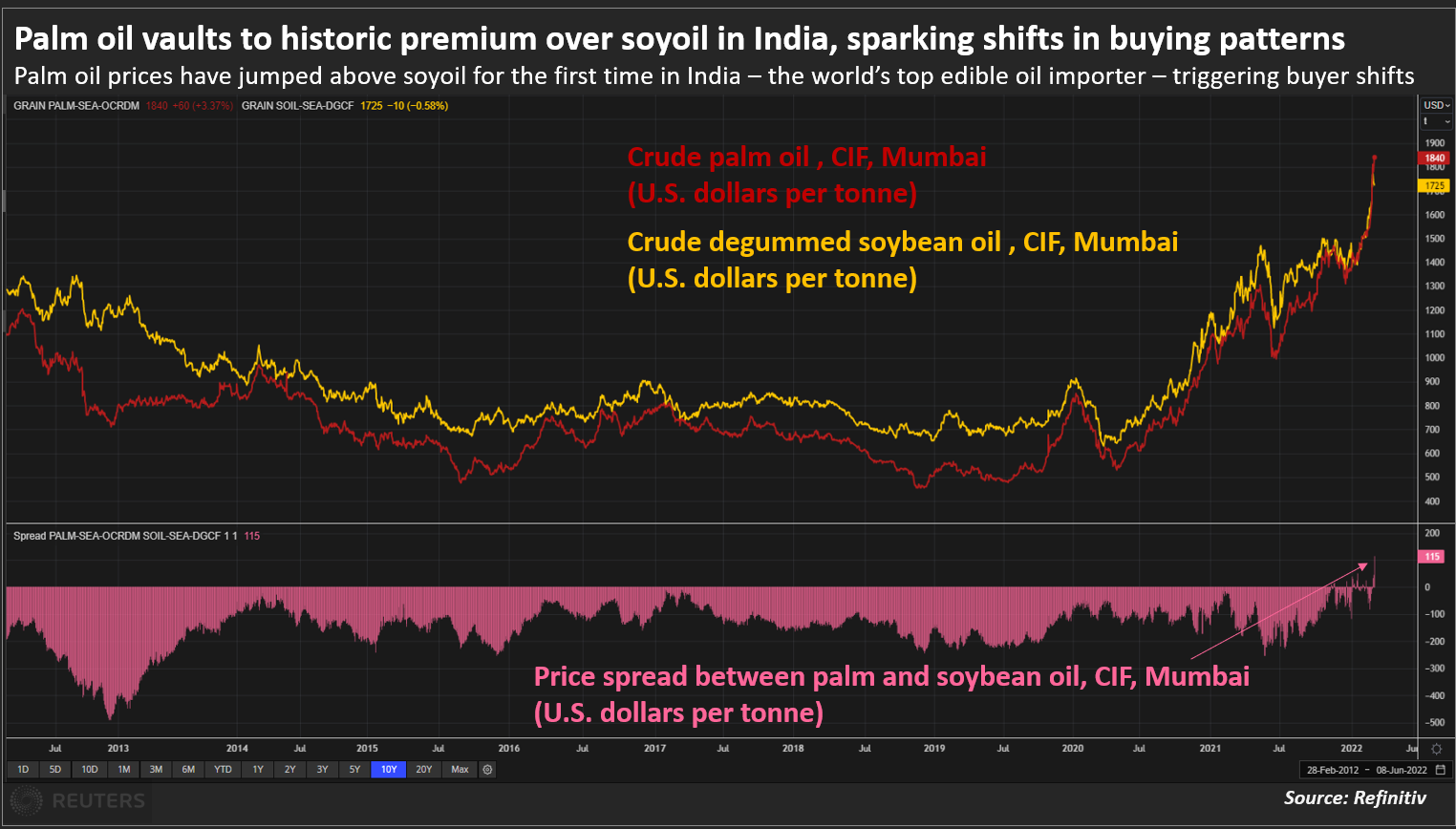

Palm oil becomes costliest vegoil as Ukraine war halts sunoil supply

- Buyers struggle to replace sunoil quickly

- Huge demand lifts palm oil prices to a record high

- Soyoil supply limited as drought hits South America

- Palm’s premium could fade as buyers shift to soyoil

MUMBAI, March 1 (Reuters) – Palm oil has become the costliest among the four major edible oils for the first time as buyers rush to secure replacements for sunflower oil shipments from the top exporting Black Sea region that were disrupted by Russia’s invasion of Ukraine.Palm oil’s record premium over rival oils could squeeze price-sensitive Asian and African consumers already reeling from spiralling fuel and food costs, and force them to curtail consumption and shift to rival soyoil , dealers said.Crude palm oil (CPO) is being offered at about $1,925 a tonne, including cost, insurance and freight (CIF), in India for March shipments, compared with $1,865 for crude soybean oil.Register now for FREE unlimited access to Reuters.comRegisterCrude rapeseed oil was offered at around $1,900, while traders were not offering crude sunflower oil as ports are closed due to the Ukraine crisis. Palm oil vaults to historic premium over soyoil in India, sparking shifts in buying patternsThe Black Sea accounts for 60% of world sunflower oil output and 76% of exports. Ports in Ukraine will remain closed until the invasion ends. read more “Asian and European refiners have raised palm oil purchases for near-month shipments to replace sunoil. This buying has lifted palm oil to irrational price level,” said a Mumbai-based dealer with a global trading firm.”They have the option of buying soyoil as well. But prompt soyoil shipments are limited and they take much longer to land in Asia compared to palm oil,” he said.Soybean production in Argentina, Brazil and Paraguay is expected to fall because of dry weather. Price-sensitive Asian buyers traditionally relied on palm oil because of low costs and quick shipping times, but now they are paying more than $50 per tonne premium over soyoil and sunoil, said a Kuala Lumpur-based edible oil dealer.Palm oil’s price premium is temporary, however, and could fade in the next few weeks as buyers shift to soyoil for April shipments, the dealer said.Most of the incremental demand for palm oil is fulfilled by Malaysia, as Indonesia has put restriction on the exports, said an Indian refiner. “Malaysian stocks are depleting fast because of the surge in demand. It is the biggest beneficiary of the current geopolitical situation,” he said.Register now for FREE unlimited access to Reuters.comRegisterReporting by Rajendra Jadhav

Palm oil vaults to historic premium over soyoil in India, sparking shifts in buying patternsThe Black Sea accounts for 60% of world sunflower oil output and 76% of exports. Ports in Ukraine will remain closed until the invasion ends. read more “Asian and European refiners have raised palm oil purchases for near-month shipments to replace sunoil. This buying has lifted palm oil to irrational price level,” said a Mumbai-based dealer with a global trading firm.”They have the option of buying soyoil as well. But prompt soyoil shipments are limited and they take much longer to land in Asia compared to palm oil,” he said.Soybean production in Argentina, Brazil and Paraguay is expected to fall because of dry weather. Price-sensitive Asian buyers traditionally relied on palm oil because of low costs and quick shipping times, but now they are paying more than $50 per tonne premium over soyoil and sunoil, said a Kuala Lumpur-based edible oil dealer.Palm oil’s price premium is temporary, however, and could fade in the next few weeks as buyers shift to soyoil for April shipments, the dealer said.Most of the incremental demand for palm oil is fulfilled by Malaysia, as Indonesia has put restriction on the exports, said an Indian refiner. “Malaysian stocks are depleting fast because of the surge in demand. It is the biggest beneficiary of the current geopolitical situation,” he said.Register now for FREE unlimited access to Reuters.comRegisterReporting by Rajendra Jadhav

Editing by Shri NavaratnamOur Standards: The Thomson Reuters Trust Principles. .