LONDON, May 26 (Reuters) – These are turbulent times for the global aluminium market.Aluminium has for years been characterised by chronic oversupply thanks to China’s relentless build-out of primary smelting capacity.Now, however, buyers in Europe and the United States are paying up record high premiums to get hold of physical metal.Register now for FREE unlimited access to Reuters.comThe Chinese aluminium juggernaut has run out of momentum and smelters in Europe are powering down as a rolling energy crunch takes a rising toll on the region’s producers. read more London Metal Exchange (LME) stocks are disappearing to fill gaps in the supply chain. Even after its recent tumble LME three-month metal at a current $2,860 per tonne is trading at levels last seen in the great bull market of 2008.None of which, it seems, is going to slow down the drive towards green low-carbon aluminium with some of the world’s largest buyers this week committing to purchase a minimum 10% of near-zero carbon metal by 2030.GREEN ALLIANCEThe newly-formed aluminium branch of the First Movers Coalition comprises automotive companies Ford (F.N) and Volvo Group (VOLVb.ST), packaging company Ball Corp , aluminium products manufacturer Novelis (NVLXC.UL) and trade house Trafigura.The Coalition, led by the World Economic Forum and the U.S. government, is aimed at tackling carbon emissions in heavily emitting sectors such as steel, shipping and aviation. And now aluminium.The light metal is a key enabler of the green energy transition. It is a material of choice for electric vehicle (EV) battery casings and solar panels as well as offering light-weighting across multiple transport applications.However, producing aluminium is an energy-intensive process, the global sector accounting for around 2% of greenhouse gas emissions, including over one billion tonnes per year of carbon dioxide.The paradox is encapsulated in an EV battery. Aluminium accounts for only 1-2% of the cost but 17% of the carbon impact, according to Torbjörn Sternsjö, senior advisor at Swedish products group Granges, speaking at CRU’s London aluminium conference.This is a problem given ever more automakers are themselves committing to carbon-neutrality – as early as 2035 in the case of Porsche.Global aluminium production by power source 2020FROM LOW CARBON…Coal is still the globally dominant source of power for smelting aluminium, reflecting the market dominance of China, which last year accounted for around 58% of world primary output.Within China there has been a rush to swap coal-fired capacity for new plants in hydro-rich Yunnan province but spaces are fast running out and most of the country’s smelters continue to run on captive coal plants or draw energy from coal-based grids.Changing the source of power from fossil fuel to renewables is the fastest way of lowering primary aluminium’s carbon footprint.Outside of China, the rush to go green has been led by those producers with large captive hydro generation capacity.The LMEpassport for ESG accreditation now lists several aluminium producers, including Russia’s Rusal, U.S. operator Century Aluminum (CENX.O), Indonesian producer Asahan Aluminium and smelters in France (Dunkerque) and the United Kingdom (Lochaber).All have disclosed carbon equivalent footprints of 0-4 tonnes per tonne of aluminium, referencing research house CRU’s Emissions Analysis Tool.No-one yet can make it to zero on a commercial basis.The new green aluminium coalition accepts that its 10% purchase commitments for near-zero metal will be dependent on “advanced technologies not yet commercially available”….TO NO CARBONThe collective race to get to zero or near-zero aluminium is already underway, led by ELYSIS, a joint venture between Alcoa and Rio Tinto.It requires the replacement of the carbon anode in the electrolytic smelting process. The anode accounts for 1.9 tonnes of carbon per tonne of aluminium, the largest remaining carbon problem for a renewables-powered smelter, according to Tim Murray, chief executive of Cardinal Virtues Consulting, also presenting at the CRU conference.The anode being trialled in the ELYSIS process results in zero direct emissions, a much longer anode life and 15% lower costs, Alcoa chief operations officer John Slaven told delegates.If the smelter is fed with “green” alumina, the carbon impact falls below 1 tonne per tonne of metal, freight accounting for most of the residue.A processing path to near-zero primary aluminium is starting to take tangible shape.NO GREEN SANCTIONSThere has been concern that aluminium’s race to go green would be abruptly halted by Russia’s invasion of Ukraine and the possible sanctioning of Rusal metal.Rusal is already a major supplier of low-carbon aluminium from its hydro-powered smelters in Siberia and is itself working on inert anode technology.Fortunately for carbon-conscious buyers, the company was already put through the U.S. sanctions process in 2018, resulting in owner Oleg Deripaska (still sanctioned) giving up control of the company.That shields Rusal this time around. So too do memories of the sanctions supply-chain disruption which stretched from Guinean bauxite mines to European automakers.Rusal’s significance as a supplier, particularly to Europe, will only increase as buyers look for low-carbon metal.NO GREEN PREMIUM…YETThe First Movers Coalition is intended to create a decarbonisation tipping-point for individual sectors centred on future purchase commitments.The incentive for suppliers will be a premium for their low-carbon aluminium, according to Trafigura chief executive Jeremy Weir.Such a green premium remains conspicuous by its absence at the primary metal stage of aluminium’s process chain.And it might not appear for long at all, Colin Hamilton, commodities analyst at BMO Capital Markets, told the CRU conference.Rather, a green premium would simply be a “stepping-stone to low-carbon becoming the prime market and anything else sub-prime.”We may not have to wait much longer to find out because the drive to zero-carbon aluminium has just accelerated.The opinions expressed here are those of the author, a columnist for Reuters.Register now for FREE unlimited access to Reuters.comEditing by Kirsten DonovanOur Standards: The Thomson Reuters Trust Principles.Opinions expressed are those of the author. They do not reflect the views of Reuters News, which, under the Trust Principles, is committed to integrity, independence, and freedom from bias. .

Twitter set to accept Musk’s $43 billion offer

Elon Musk’s twitter account is seen through the Twitter logo in this illustration taken, April 25, 2022. REUTERS/Dado Ruvic/Illustration Register now for FREE unlimited access to Reuters.comNEW YORK, April 25 (Reuters) – Twitter Inc (TWTR.N) is poised to agree a sale to Elon Musk for around $43 billion in cash, the price the CEO of Tesla has called his “best and final” offer for the social media company, people familiar with the matter said.Twitter may announce the $54.20-per-share deal later on Monday once its board has met to recommend the transaction to Twitter shareholders, the sources said, adding it was still possible the deal could collapse at the last minute.Musk, the world’s richest person according to Forbes, is negotiating to buy Twitter in a personal capacity and Tesla (TSLA.O) is not involved in the deal.Register now for FREE unlimited access to Reuters.comTwitter has not been able to secure so far a ‘go-shop’ provision under its agreement with Musk that would allow it to solicit other bids once the deal is signed, the sources said. Still, Twitter would be allowed to accept an offer from another party by paying Musk a break-up fee, the sources added.The sources requested anonymity because the matter is confidential. Twitter and Musk did not immediately respond to requests for comment.Twitter shares were up 4.5% in pre-market trading in New York at $51.15.Musk, a prolific Twitter user, has said it needs to be taken private to grow and become a genuine platform for free speech.The 50-year-old entrepreneur, who is also CEO of rocket developer SpaceX, has said he wants to combat trolls on Twitter and proposed changes to the Twitter Blue premium subscription service, including slashing its price and banning advertising.The billionaire, a vocal advocate of cryptocurrencies, has also suggested adding dogecoin as a payment option on Twitter.He has said Twitter’s current leadership team is incapable of getting the company’s stock to his offer price on its own, but stopped short of saying it needs to be replaced.”The company will neither thrive nor serve this societal imperative in its current form,” Musk said in his offer letter last week.Up to the point Musk disclosed a stake in Twitter in April, the company’s shares had fallen about 10% since Parag Agrawal took over as CEO from founder Jack Dorsey in late November.The deal, if it happens, would come just four days after Musk unveiled a financing package to back the acquisition.This led Twitter’s board to take his offer more seriously and many shareholders to ask the company not to let the opportunity for a deal slip away, Reuters reported on Sunday. Before Musk revealed the financing package, Twitter’s board was expected to reject the bid, sources had said. read more The sale would represent an admission by Twitter that Agrawal is not making enough traction in making the company more profitable, despite being on track to meet ambitious financial goals the company set for 2023. Twitter’s shares were trading higher than Musk’s offer price as recently as November.Musk unveiled his intention to buy Twitter on April 14 and take it private via a financing package comprised of equity and debt. Wall Street’s biggest lenders, except those advising Twitter, have all committed to provide debt financing.Musk’s negotiating tactics – making one offer and sticking with it – resembles how another billionaire, Warren Buffett, negotiates acquisitions. Musk did not provide any financing details when he first disclosed his offer for Twitter, making the market skeptical about its prospects.Register now for FREE unlimited access to Reuters.comReporting by Greg Roumeliotis in New York, additional reporting by Krystal Hu;

Editing by Mark PotterOur Standards: The Thomson Reuters Trust Principles. .

Analysis: Positive real yields may spell more trouble for U.S. stocks

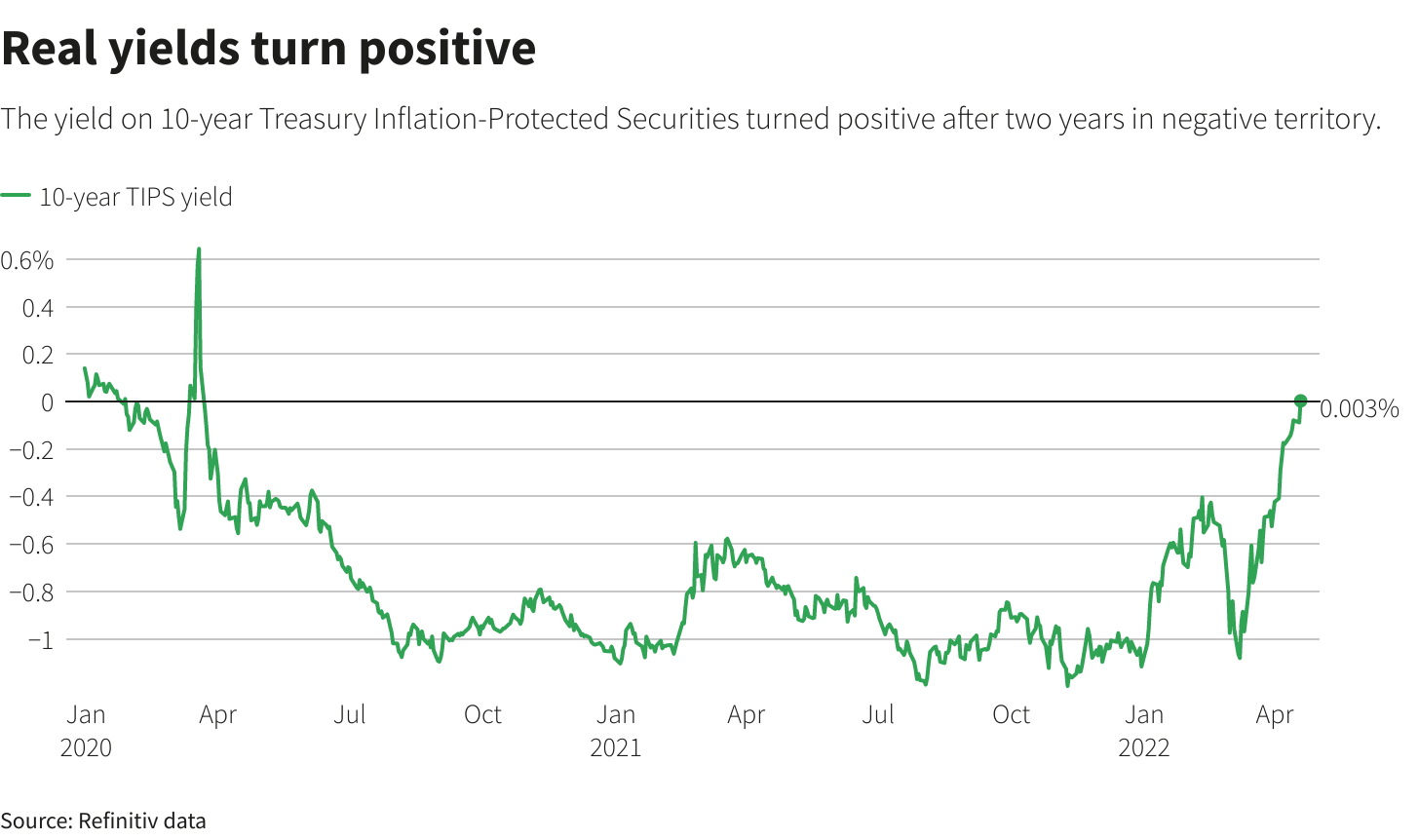

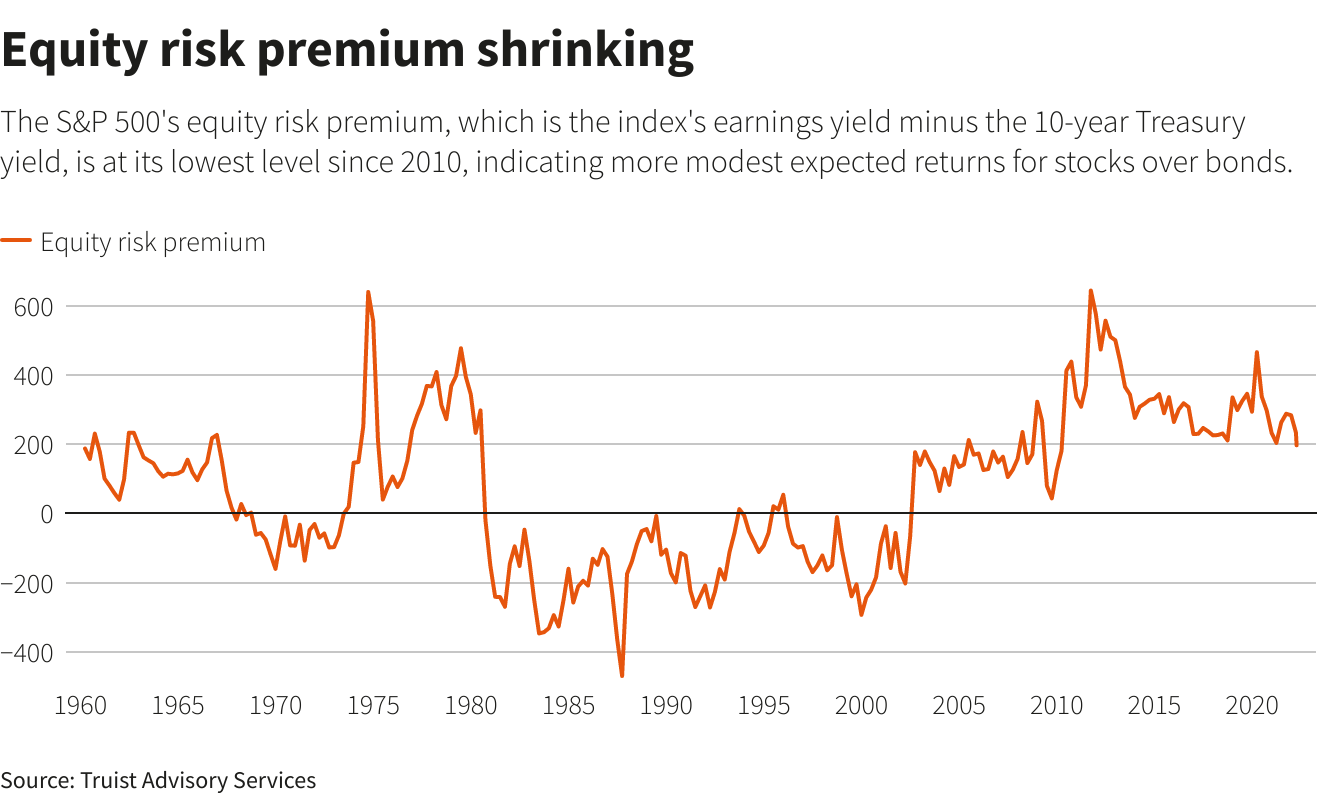

A street sign for Wall Street is seen in the financial district in New York, U.S., November 8, 2021. REUTERS/Brendan McDermid/File Photo/File PhotoRegister now for FREE unlimited access to Reuters.comNEW YORK, April 20 (Reuters) – A hawkish turn by the Federal Reserve is eroding a key support for U.S. stocks, as real yields climb into positive territory for the first time in two years.Yields on the 10-year Treasury Inflation-Protected Securities (TIPS) – also known as real yields because they subtract projected inflation from the nominal yield on Treasury securities – had been in negative territory since March 2020, when the Federal Reserve slashed interest rates to near zero. That changed on Tuesday, when real yields ticked above zero. Negative real yields have meant that an investor would have lost money on an annualized basis when buying a 10-year Treasury note, adjusted for inflation. That dynamic has helped divert money from U.S. government bonds and into a broad spectrum of comparatively riskier assets, including stocks, helping the S&P 500 (.SPX) more than double from its post-pandemic low.Register now for FREE unlimited access to Reuters.comAnticipation of tighter monetary policy, however, is pushing yields higher and may dent the luster of stocks in comparison to Treasuries, which are viewed as much less risky since they are backed by the U.S. government. Reuters GraphicsOn Tuesday, stocks shrugged off the rise in yields, with the S&P 500 ending up 1.6% on the day. Still, the S&P 500 is down 6.4% this year, while the yield on the 10-year TIPS has climbed more than 100 basis points.”Real 10-year yields are the risk-free alternative to owning stocks,” said Barry Bannister, chief equity strategist at Stifel. “As real yield rises, at the margin it makes stocks less attractive.”One key factor influenced by yields is the equity risk premium, which measures how much investors expect to be compensated for owning stocks over government bonds.Rising yields have helped result in the measure standing at its lowest level since 2010, Truist Advisory Services said in a note last week.

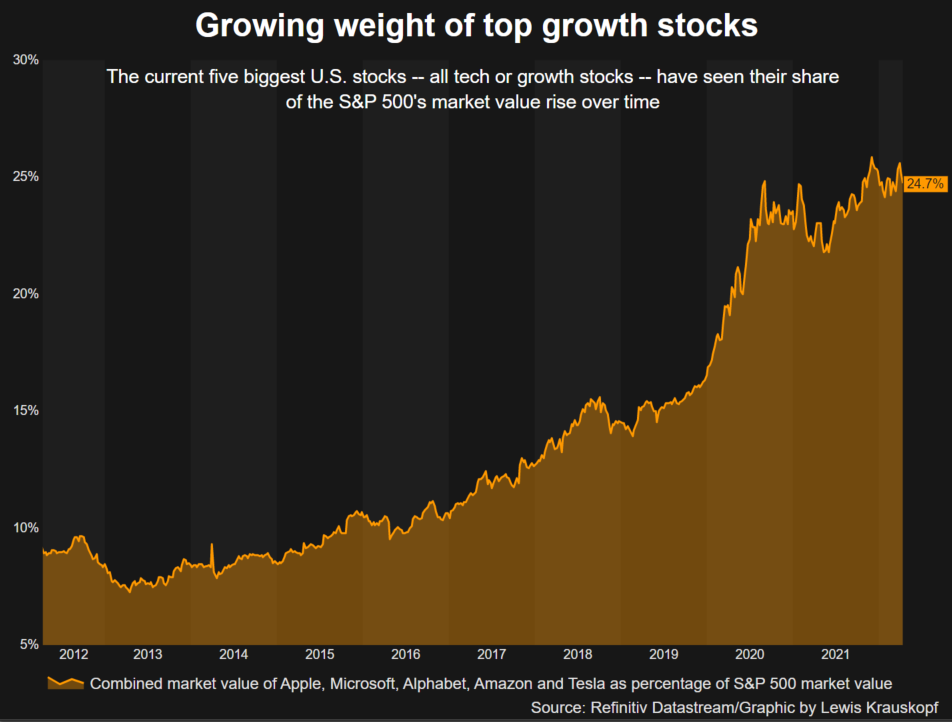

Reuters GraphicsOn Tuesday, stocks shrugged off the rise in yields, with the S&P 500 ending up 1.6% on the day. Still, the S&P 500 is down 6.4% this year, while the yield on the 10-year TIPS has climbed more than 100 basis points.”Real 10-year yields are the risk-free alternative to owning stocks,” said Barry Bannister, chief equity strategist at Stifel. “As real yield rises, at the margin it makes stocks less attractive.”One key factor influenced by yields is the equity risk premium, which measures how much investors expect to be compensated for owning stocks over government bonds.Rising yields have helped result in the measure standing at its lowest level since 2010, Truist Advisory Services said in a note last week. Reuters GraphicsHEADWIND TO GROWTH SHARESHigher yields in particular dull the allure of companies in technology and other high-growth sectors, with those companies’ cash flows often more weighted in the future and diminished when discounted at higher rates.That may be bad news for the broader market. The heavy presence of tech and other growth stocks in the S&P 500 means the index’s overall expected dividends are weighted in the future at close to their highest level ever, according to BofA Global Research. Five massive, high-growth stocks, for example, now make up 22% of the weight of the S&P 500.At the same time, growth shares in recent years have been highly linked to the movement of real yields.Since 2018, a ratio comparing the performance of the Russell 1000 growth index (.RLG) to its counterpart for value stocks (.RLV) – whose cash flows are more near-term – has had a negative 96% correlation with 10-year real rates, meaning they tend to move in opposite directions from growth stocks, according to Ohsung Kwon, a U.S. equity strategist at BofA Global Research.Rising yields are “a bigger headwind to equities than (they have) been in history,” he said.

Reuters GraphicsHEADWIND TO GROWTH SHARESHigher yields in particular dull the allure of companies in technology and other high-growth sectors, with those companies’ cash flows often more weighted in the future and diminished when discounted at higher rates.That may be bad news for the broader market. The heavy presence of tech and other growth stocks in the S&P 500 means the index’s overall expected dividends are weighted in the future at close to their highest level ever, according to BofA Global Research. Five massive, high-growth stocks, for example, now make up 22% of the weight of the S&P 500.At the same time, growth shares in recent years have been highly linked to the movement of real yields.Since 2018, a ratio comparing the performance of the Russell 1000 growth index (.RLG) to its counterpart for value stocks (.RLV) – whose cash flows are more near-term – has had a negative 96% correlation with 10-year real rates, meaning they tend to move in opposite directions from growth stocks, according to Ohsung Kwon, a U.S. equity strategist at BofA Global Research.Rising yields are “a bigger headwind to equities than (they have) been in history,” he said. Top five stocks market cap as percentage of S&P 500Bannister estimates the S&P 500 could retest its lows of the year, which included a drop in March of 13% from the index’s record high, should the yield on the 10-year TIPS rise to 0.75% and the earnings outlook – a key component of the risk premium – remain unchanged.Lofty valuations also make stocks vulnerable if yields continue rising. Though the tumble in stocks has moderated valuations this year, the S&P 500 still trades at about 19 times forward earnings estimates, compared with a long-term average of 15.5, according to Refinitiv Datastream.“Valuations aren’t great on stocks right now. That means that capital may look at other alternatives to stocks as they become more competitive,” said Matthew Miskin, co-chief investment strategist at John Hancock Investment Management.Still, some investors believe stocks can survive just fine with rising real yields, for now. Real yields were mostly in positive territory over the past decade and ranged as high as 1.17% while the S&P 500 has climbed over 200%.JPMorgan strategists earlier this month estimated that equities could cope with 200 basis points of real yield increases. They advised clients maintain a large equity versus bond overweight.”If bond yield rises continue, they could eventually become a problem for equities,” the bank’s strategists said. “But we believe current real bond yields at around zero are not high enough to materially challenge equities.”Register now for FREE unlimited access to Reuters.comReporting by Lewis Krauskopf in New York

Top five stocks market cap as percentage of S&P 500Bannister estimates the S&P 500 could retest its lows of the year, which included a drop in March of 13% from the index’s record high, should the yield on the 10-year TIPS rise to 0.75% and the earnings outlook – a key component of the risk premium – remain unchanged.Lofty valuations also make stocks vulnerable if yields continue rising. Though the tumble in stocks has moderated valuations this year, the S&P 500 still trades at about 19 times forward earnings estimates, compared with a long-term average of 15.5, according to Refinitiv Datastream.“Valuations aren’t great on stocks right now. That means that capital may look at other alternatives to stocks as they become more competitive,” said Matthew Miskin, co-chief investment strategist at John Hancock Investment Management.Still, some investors believe stocks can survive just fine with rising real yields, for now. Real yields were mostly in positive territory over the past decade and ranged as high as 1.17% while the S&P 500 has climbed over 200%.JPMorgan strategists earlier this month estimated that equities could cope with 200 basis points of real yield increases. They advised clients maintain a large equity versus bond overweight.”If bond yield rises continue, they could eventually become a problem for equities,” the bank’s strategists said. “But we believe current real bond yields at around zero are not high enough to materially challenge equities.”Register now for FREE unlimited access to Reuters.comReporting by Lewis Krauskopf in New York

Editing by Ira Iosebashvili and Matthew LewisOur Standards: The Thomson Reuters Trust Principles. .

Column: Saudi’s record crude oil price for Asia shows Russia war impact: Russell

A view shows branded oil tanks at Saudi Aramco oil facility in Abqaiq, Saudi Arabia October 12, 2019. REUTERS/Maxim Shemetov/Register now for FREE unlimited access to Reuters.comLAUNCESTON, Australia, April 5 (Reuters) – The jump in Saudi Arabia’s crude oil prices for its Asian customers is a real world example of how the Russian invasion of Ukraine is starting to force a realignment of global oil markets.Saudi Aramco (2222.SE), the state-controlled producer, raised its official selling price (OSP) for its flagship Arab Light crude for Asian refiners to a record premium of $9.35 a barrel above the Oman/Dubai regional benchmark. read more An increase in the OSP had been anticipated, with a Reuters survey of seven refiners estimating the price would rise to a premium of between $10.70 and $11.90. read more Register now for FREE unlimited access to Reuters.comThis means the actual increase from April’s premium of $5.90 to May’s $9.35 was somewhat below market expectations, but still highlights that refiners in Asia are going to be paying considerably more for Middle East crudes.There are several factors at work driving the increase in Saudi OSPs, which tend to set the trend for price movements by other major Middle East exporters.Spot premiums for Middle East grades hit all-time highs in March, a sign that usually points to higher OSPs as it signals strong demand from refiners.However, these have slumped in recent trading sessions as physical traders mulled the impact of more crude being released from the strategic reserves of major importing nations, led by the U.S. commitment to supply 180 million barrels over a six-month period. read more Another factor driving the increase in the OSPs for May cargoes is the strong margins being enjoyed by Asian refiners, especially for middle distillates, such as diesel.Robust refinery profits are also usually a trigger for producers to raise crude prices, and currently a Singapore refinery processing Dubai crude is making a margin of about $18.45 a barrel, which is more than three times the 365-day moving average of $5.03.But behind all these factors is the dislocation of global crude markets caused by Russia’s Feb. 24 invasion of neighbouring Ukraine.While Russia’s crude oil and refined product exports have not been targeted by Western sanctions, buyers are starting to shun Russian cargoes and seek alternatives.Russia exported up to 5 million barrels per day (bpd) of crude and around 2 million bpd of products, mainly to Europe and Asia, prior to the conflict.IMPACT IMMINENT?Russia’s crude and product exports are yet to show any meaningful decline, with commodity analysts Kpler putting March crude exports at 4.56 million bpd, down only a touch from 4.60 million bpd in February.But the self-sanctioning of Russian crude is likely only to start being felt in April and May, as cargoes loaded in March would have been secured before the Feb. 24 invasion, which Moscow refers to as a special military operation.Asian importers such as Japan and South Korea may start to pull back from buying Russian crude, meaning they will be keen to source similar grades from the Middle East, thereby likely boosting demand for cargoes from Saudi Arabia and other exporters such as the United Arab Emirates and Kuwait.Conversely, China, the world’s biggest crude importer, and India, Asia’s second-biggest, may well try to buy more Russian cargoes, given both countries have refused to condemn Moscow’s attack on Ukraine.India in particular will be keen to secure heavily discounted Russian cargoes, with some reports of Urals crude being offered at discounts of $35 a barrel or more to global benchmark Brent.There are several key questions that remain to be answered, including how much more Russian crude can China and India actually buy, and arrange to transport, especially from the eastern ports that used to mainly ship to European refiners.The United States will not set any “red line” for India on its energy imports from Russia but does not want to see a “rapid acceleration” in purchases, a top U.S. official said last week during a visit to New Delhi. read more It is also still unclear just how much self-sanctioning will cut Europe’s and Asia’s imports of Russian crude.What is likely to happen is that Europe and the democracies in Asia, such as Japan and South Korea, effectively swap with China and India their Russian cargoes for Middle Eastern grades.Even so, this is unlikely to soak up all the Russian crude that will be available, meaning the market will still have to find additional barrels, and Middle East exporters will be likely to continue to keep OSPs at elevated levels.GRAPHIC-Saudi oil prices to Asia: https://tmsnrt.rs/36XkgP8Register now for FREE unlimited access to Reuters.comEditing by Himani SarkarOur Standards: The Thomson Reuters Trust Principles.Opinions expressed are those of the author. They do not reflect the views of Reuters News, which, under the Trust Principles, is committed to integrity, independence, and freedom from bias. .

Column: Elusive bond risk premium misses its curtain call: Mike Dolan

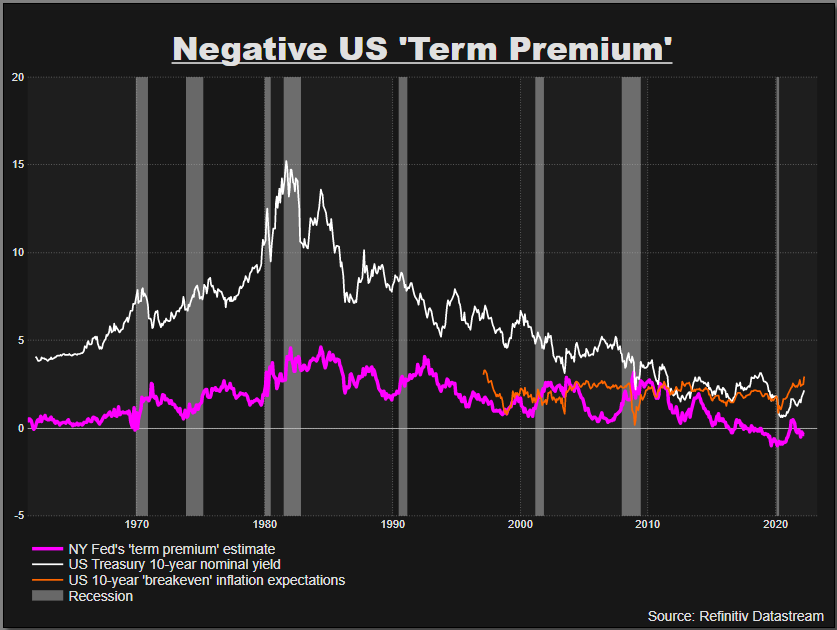

LONDON, March 30 (Reuters) – If not now, when? Investors typically demand some added compensation for holding a security over many years to cover all the unknowables over long horizons – making the absence of such a premium in bond markets right now seem slightly bizarre.Disappearance of the so-called “term premium” in 10-year U.S. Treasury bonds over the past 5 years has puzzled analysts and policymakers and been blamed variously on subdued inflation expectations or distortions related to central bank bond buying.And yet it’s rarely, if ever, been more difficult to fathom the decade ahead – at least in terms of inflation, interest rates or indeed quantitative easing or tightening.Register now for FREE unlimited access to Reuters.comInflation is running at a 40-year high after the pandemic forced wild swings in economic activity and supply bottlenecks and was then compounded by an energy price spike due to war in Ukraine that may redraw the geopolitical map.The U.S. Federal Reserve and other central banks are scrambling to normalise super easy monetary policies to cope – not really knowing whether to focus on reining in runaway prices or tackle what Bank of England chief Andrew Bailey this week described as a “historic shock” to real household incomes.Bond yields have surged, much like they did in the first quarter of last year. But this time bond funds have suffered one of their worst quarters in more than 20 years and some measures of Treasury price volatility are at their highest since banking crash of 2008. (.MOVE3M)But the most-followed estimates of term premia embedded in bond markets remain deeply negative. And this matters a lot to a whole host of critical bond market signals, not least the unfolding inversion of the U.S. Treasury curve between short and long-term yields that has presaged recessions in the past.”The 10-year term premium has barely budged even as inflation spiked to 8%, suggesting that long-dated yields are probably still capped by the Fed’s record-high balance sheet,” said Franklin Templeton’s fixed income chief Sonal Desai. “Or maybe investors think the Fed will blink and ease policy again once asset prices start a meaningful correction.””In either case, I think markets are still underestimating the magnitude of the monetary policy tightening ahead,” said Desai, adding that expectations of another more than 2 percentage points of Fed hikes this year still likely leaves real policy rates deeply negative by December even if inflation eases to 5%. US ‘term premium’ stays negative

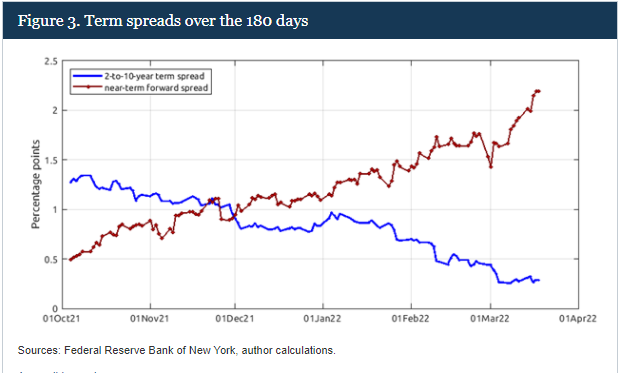

US ‘term premium’ stays negative Fed contrast between Yield Curve and Near Term Forward SpreadBUMP IN THE NIGHTSo what’s the beef with the term premium?In effect, the Treasury term premium is meant to measure the additional yield demanded by investors for buying and holding a 10-year bond to maturity as opposed to buying a one year bond and rolling it over for 10 years with a new coupon.In theory it covers all the things that might go bump in the night over a decade hence – including the outside chance of credit or even political risk – but it mostly reflects uncertainty about future Fed rates and inflation expectations.At zero, you’d assume investors are indifferent to holding the 10-year today as opposed to rolling 10 one-year notes.But the New York Fed’s measure of the 10-year term premium remains deeply negative to the tune of -32 basis points – ostensibly suggesting investors actually prefer holding the longer-duration asset.Although the premium popped back positive in the first half of last year, it’s been stuck around zero or below since 2017 – oddly in the face of the Fed’s last attempt to unwind its balance sheet.And the persistent and puzzling erosion of the term premium to zero and below brings it back to the 1960s, not the much-vaunted inflation-ravaged 1970s that everyone seems to think we’re back in.It matters a lot now as the debate about the inversion of the 2-10 yield curve heats up and many argue that the signal sent by that inversion is less clear about a coming recession as it’s distorted by the disappearance of the term premium.In the absence of a term premium, the long-term yield curve is just a reflection of long-run policy rate expectations that will inevitably see some retreat if the Fed is successful in taming inflation over the next two years.Fed Board economists Eric Engstrom and Steven Sharpe late last week also dismissed the market’s obsession with a 2-10 year yield inversion signalling recession.In a blog called ‘(Don’t Fear) The Yield Curve’ they said near term forward rate spreads out to 18 months were much more informative about the chance of a looming recession, just as accurate over time and – significantly – heading in the opposite direction right now.The main reason they pushed back on the 2-10s was it contained a whole host of information about the world beyond two years that’s simply less reliable as an economic signal and “buffeted by other significant factors such as risk premiums on long-term bonds.”But what could see the term premium return?Presumably the Fed’s planned balance sheet rundown, or quantitative tightening (QT), would be a prime candidate if indeed its long-term bond buying has distorted term premia.But the last Fed attempt at QT in 2017-19 didn’t do that and Morgan Stanley thinks it will be some time yet before just allowing short-term bonds on its balance sheet to roll off and mature gets replaced by outright sales of longer-term bonds.”QT is not the opposite of QE; asset sales are.”Of course, maybe the world just hasn’t changed that much – in terms of ageing demographics, excess savings and pension fund demand, falling potential growth and negative real interest rates. Once this current storm has passed, investors seem to think that will dominate once more. read more

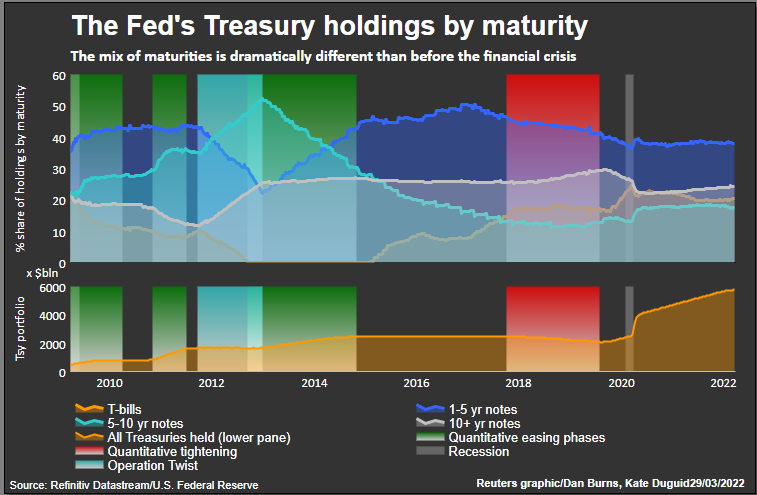

Fed contrast between Yield Curve and Near Term Forward SpreadBUMP IN THE NIGHTSo what’s the beef with the term premium?In effect, the Treasury term premium is meant to measure the additional yield demanded by investors for buying and holding a 10-year bond to maturity as opposed to buying a one year bond and rolling it over for 10 years with a new coupon.In theory it covers all the things that might go bump in the night over a decade hence – including the outside chance of credit or even political risk – but it mostly reflects uncertainty about future Fed rates and inflation expectations.At zero, you’d assume investors are indifferent to holding the 10-year today as opposed to rolling 10 one-year notes.But the New York Fed’s measure of the 10-year term premium remains deeply negative to the tune of -32 basis points – ostensibly suggesting investors actually prefer holding the longer-duration asset.Although the premium popped back positive in the first half of last year, it’s been stuck around zero or below since 2017 – oddly in the face of the Fed’s last attempt to unwind its balance sheet.And the persistent and puzzling erosion of the term premium to zero and below brings it back to the 1960s, not the much-vaunted inflation-ravaged 1970s that everyone seems to think we’re back in.It matters a lot now as the debate about the inversion of the 2-10 yield curve heats up and many argue that the signal sent by that inversion is less clear about a coming recession as it’s distorted by the disappearance of the term premium.In the absence of a term premium, the long-term yield curve is just a reflection of long-run policy rate expectations that will inevitably see some retreat if the Fed is successful in taming inflation over the next two years.Fed Board economists Eric Engstrom and Steven Sharpe late last week also dismissed the market’s obsession with a 2-10 year yield inversion signalling recession.In a blog called ‘(Don’t Fear) The Yield Curve’ they said near term forward rate spreads out to 18 months were much more informative about the chance of a looming recession, just as accurate over time and – significantly – heading in the opposite direction right now.The main reason they pushed back on the 2-10s was it contained a whole host of information about the world beyond two years that’s simply less reliable as an economic signal and “buffeted by other significant factors such as risk premiums on long-term bonds.”But what could see the term premium return?Presumably the Fed’s planned balance sheet rundown, or quantitative tightening (QT), would be a prime candidate if indeed its long-term bond buying has distorted term premia.But the last Fed attempt at QT in 2017-19 didn’t do that and Morgan Stanley thinks it will be some time yet before just allowing short-term bonds on its balance sheet to roll off and mature gets replaced by outright sales of longer-term bonds.”QT is not the opposite of QE; asset sales are.”Of course, maybe the world just hasn’t changed that much – in terms of ageing demographics, excess savings and pension fund demand, falling potential growth and negative real interest rates. Once this current storm has passed, investors seem to think that will dominate once more. read more  Fed balance sheet and maturitiesThe author is editor-at-large for finance and markets at Reuters News. Any views expressed here are his ownRegister now for FREE unlimited access to Reuters.comby Mike Dolan, Twitter: @reutersMikeD. Editing by Jane MerrimanOur Standards: The Thomson Reuters Trust Principles.Opinions expressed are those of the author. They do not reflect the views of Reuters News, which, under the Trust Principles, is committed to integrity, independence, and freedom from bias. .

Fed balance sheet and maturitiesThe author is editor-at-large for finance and markets at Reuters News. Any views expressed here are his ownRegister now for FREE unlimited access to Reuters.comby Mike Dolan, Twitter: @reutersMikeD. Editing by Jane MerrimanOur Standards: The Thomson Reuters Trust Principles.Opinions expressed are those of the author. They do not reflect the views of Reuters News, which, under the Trust Principles, is committed to integrity, independence, and freedom from bias. .