BEIJING, March 11 (Reuters) – Middle East crude benchmarks Oman, Dubai and Murban shaded weaker on Friday as major oil producers strive to bring more supply to the market to offset the embargos on Russian cargos, while policymakers around the globe mull tapering inflation.Qatar Energy has sold four May-loading crude cargoes via tenders at record premiums after buyers avoided Russian oil amid fears of Western sanctions following Moscow’s invasion of Ukraine. Spot premiums for al-Shaheen crude nearly tripled from the previous month after the producer sold two al-Shaheen crude cargoes to Unipec and PetroChina at about $12 a barrel above Dubai quotes, they said. The cargoes will load on May 2-3 and 29-30.Register now for FREE unlimited access to Reuters.comExports of Malaysia’s flagship Kimanis crude oil are set to fall to six cargoes in May, down two from April, due to maintenance at oilfields offshore Sabah, a preliminary loading schedule showed on Friday. read more Sinopec’s (600028.SS) 250,000 barrels-per-day Yangzi refinery will shut down its whole plant for a 61-day planned maintenance, starting from March 15, according to a company statement. OSPKuwait raised the official selling prices (OSPs) for two crude grades it sells to Asia in April from the previous month, a price document reviewed by Reuters showed on Friday. read more The producer has set April Kuwait Export Crude (KEC) price at $4.80 a barrel above the average of Oman/Dubai quotes, up $2.25 from the previous month.It also raised the April Kuwait Super Light Crude (KSLC) OSP to $5.95 a barrel above Oman/Dubai quotes, up $2.60.The price hike for KEC was 10 cents more than that for Saudi’s Arab Medium crude in the same month.WINDOWCash Dubai’s premium to swaps fell 61 cents to $11.48 a barrel.PRICES ($/BBL)India’s ONGC Videsh failed to get bids in its tender to sell 700,000 barrels of Russian Sokol crude in a growing backlash against Moscow for its invasion of Ukraine, sources familiar with the matter said. read more This was the first tender by ONGC Videsh, since the war in Ukraine began on Feb. 24.NEWSNorwegian state oil company Equinor (EQNR.OL) has stopped trading Russian oil as it winds down operations there in the wake of Moscow’s invasion of Ukraine. read more Canada is studying ways to increase pipeline utilization to boost crude exports as Europe seeks to reduce its dependence on Russian oil. read more European Union leaders are set to agree on Thursday to cut their reliance on Russian fossil fuels, although they are divided over whether to cap gas prices and to sanction oil imports as Moscow wages war in Ukraine. read more The European Central Bank will stop pumping money into financial markets this summer, it said on Thursday, paving the way for an increase in interest rates as soaring inflation outweighs concerns about the fallout from Russia’s invasion of Ukraine. read more For crude prices, oil product cracks and refining margins, please click on the RICs below.Register now for FREE unlimited access to Reuters.comReporting by Muyu Xu and Florence Tan; Editing by Krishna Chandra EluriOur Standards: The Thomson Reuters Trust Principles. .

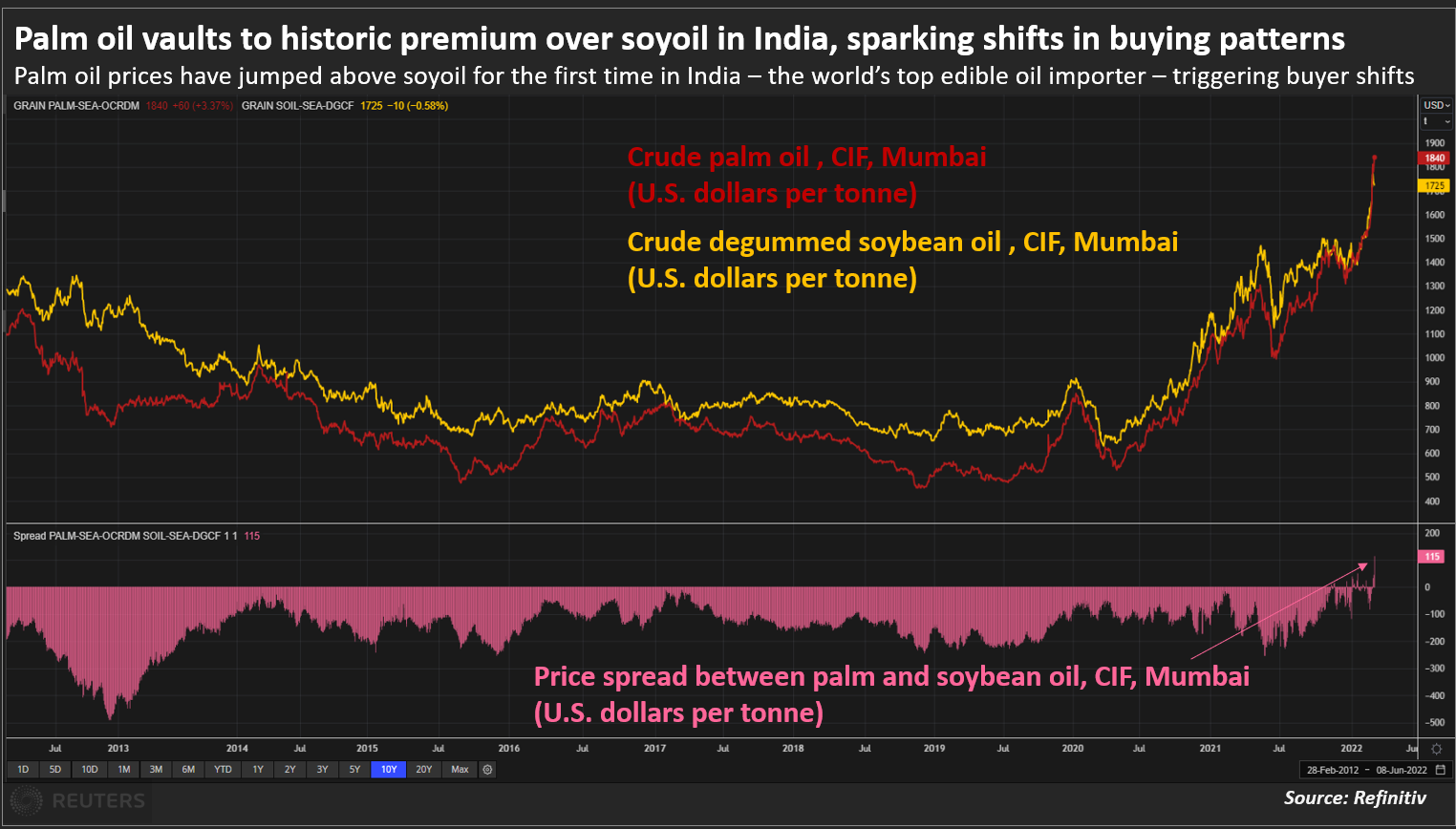

Palm oil becomes costliest vegoil as Ukraine war halts sunoil supply

- Buyers struggle to replace sunoil quickly

- Huge demand lifts palm oil prices to a record high

- Soyoil supply limited as drought hits South America

- Palm’s premium could fade as buyers shift to soyoil

MUMBAI, March 1 (Reuters) – Palm oil has become the costliest among the four major edible oils for the first time as buyers rush to secure replacements for sunflower oil shipments from the top exporting Black Sea region that were disrupted by Russia’s invasion of Ukraine.Palm oil’s record premium over rival oils could squeeze price-sensitive Asian and African consumers already reeling from spiralling fuel and food costs, and force them to curtail consumption and shift to rival soyoil , dealers said.Crude palm oil (CPO) is being offered at about $1,925 a tonne, including cost, insurance and freight (CIF), in India for March shipments, compared with $1,865 for crude soybean oil.Register now for FREE unlimited access to Reuters.comRegisterCrude rapeseed oil was offered at around $1,900, while traders were not offering crude sunflower oil as ports are closed due to the Ukraine crisis. Palm oil vaults to historic premium over soyoil in India, sparking shifts in buying patternsThe Black Sea accounts for 60% of world sunflower oil output and 76% of exports. Ports in Ukraine will remain closed until the invasion ends. read more “Asian and European refiners have raised palm oil purchases for near-month shipments to replace sunoil. This buying has lifted palm oil to irrational price level,” said a Mumbai-based dealer with a global trading firm.”They have the option of buying soyoil as well. But prompt soyoil shipments are limited and they take much longer to land in Asia compared to palm oil,” he said.Soybean production in Argentina, Brazil and Paraguay is expected to fall because of dry weather. Price-sensitive Asian buyers traditionally relied on palm oil because of low costs and quick shipping times, but now they are paying more than $50 per tonne premium over soyoil and sunoil, said a Kuala Lumpur-based edible oil dealer.Palm oil’s price premium is temporary, however, and could fade in the next few weeks as buyers shift to soyoil for April shipments, the dealer said.Most of the incremental demand for palm oil is fulfilled by Malaysia, as Indonesia has put restriction on the exports, said an Indian refiner. “Malaysian stocks are depleting fast because of the surge in demand. It is the biggest beneficiary of the current geopolitical situation,” he said.Register now for FREE unlimited access to Reuters.comRegisterReporting by Rajendra Jadhav

Palm oil vaults to historic premium over soyoil in India, sparking shifts in buying patternsThe Black Sea accounts for 60% of world sunflower oil output and 76% of exports. Ports in Ukraine will remain closed until the invasion ends. read more “Asian and European refiners have raised palm oil purchases for near-month shipments to replace sunoil. This buying has lifted palm oil to irrational price level,” said a Mumbai-based dealer with a global trading firm.”They have the option of buying soyoil as well. But prompt soyoil shipments are limited and they take much longer to land in Asia compared to palm oil,” he said.Soybean production in Argentina, Brazil and Paraguay is expected to fall because of dry weather. Price-sensitive Asian buyers traditionally relied on palm oil because of low costs and quick shipping times, but now they are paying more than $50 per tonne premium over soyoil and sunoil, said a Kuala Lumpur-based edible oil dealer.Palm oil’s price premium is temporary, however, and could fade in the next few weeks as buyers shift to soyoil for April shipments, the dealer said.Most of the incremental demand for palm oil is fulfilled by Malaysia, as Indonesia has put restriction on the exports, said an Indian refiner. “Malaysian stocks are depleting fast because of the surge in demand. It is the biggest beneficiary of the current geopolitical situation,” he said.Register now for FREE unlimited access to Reuters.comRegisterReporting by Rajendra Jadhav

Editing by Shri NavaratnamOur Standards: The Thomson Reuters Trust Principles. .

Treasury Wine shares surge as ex-China growth begins to pay off

Bottles of Penfolds Grange wine and other varieties, made by Australian wine maker Penfolds and owned by Australia’s Treasury Wine Estates, sit on shelves for sale at a winery located in the Hunter Valley, north of Sydney, Australia, February 14, 2018. REUTERS/David GrayRegister now for FREE unlimited access to Reuters.comRegisterFeb 16 (Reuters) – Treasury Wine Estates (TWE.AX) said on Wednesday its operating earnings outside mainland China jumped 28%, underpinned by growth in its luxury and premium brands, sending shares of the world’s largest standalone winemaker nearly 12% higher.Treasury has had to re-direct supply to the United States, Europe and domestically after a diplomatic row between Canberra and Beijing effectively closed the lucrative Chinese market to Australian wine.The company said it recorded strong growth in its Americas and premium brands businesses, both of which reported a 19% rise in their earnings before interest, tax, SGARA and material items (EBITS).Register now for FREE unlimited access to Reuters.comRegister“Penfolds growth was particularly strong in Asian markets outside of Mainland China … increasing distribution in Asia, domestic markets, Europe and the United States was a key execution highlight,” the company said in a statement.Reported EBITS, excluding Australian COO wine sold in mainland China, rose to A$262.4 million ($187.7 million), narrowly missing market expectations of A$265 million while its total net profit slid 7.5% to A$109.1 million.The company said trading conditions for the remainder of fiscal 2022 were expected to remain broadly in line with the first half across its key markets and channels.”Despite FY22 potentially shaping up to be slightly softer than expectations, we see Treasury doing a commendable job building demand for its products in new markets,” Citi analysts said in a note.Treasury shares jumped as much as 11.8% to A$11.78 in early trading, while the broader market (.AXJO) rose 0.4%.The company said it plans to increase prices across select portfolio brands to partly mitigate the impact of elevated supply chain costs and logistics. The Melbourne-based firm retained its interim dividend of 15 Australian cents per share.($1 = 1.3986 Australian dollars)Register now for FREE unlimited access to Reuters.comRegisterReporting by Tejaswi Marthi and Savyata Mishra in Bengaluru; Editing by Aditya Soni and Sherry Jacob-PhillipsOur Standards: The Thomson Reuters Trust Principles. .

کنیاک های گران قیمت در Remy Cointreau روحیه می بخشند

آرم Remy Cointreau SA در دفتر مرکزی آنها در پاریس، فرانسه، 21 ژانویه 2019 به تصویر کشیده شده است. رویترز/Benoit Tessier هم اکنون برای دسترسی نامحدود رایگان به رویترز.com ثبت نام کنیدثبت نام کنید[196539001]4% فروش. مشابه برای شبیه در مقابل تخمین 14.9%

پاریس، 25 ژانویه (رویترز) – Remy Cointreau (RCOP.PA) مطمئن است که تقاضا برای کنیاک ممتاز خود در چین، ایالات متحده و اروپا باعث رشد سود در سال جاری خواهد شد، زیرا گروه مشروبات الکلی فرانسوی پیش بینی های فروش سه ماهه سوم را شکست داد. سازنده کنیاک رمی مارتین و مشروب Cointreau اندکی کاهش یافت. با این حال، در مورد چشم اندازهای جشنهای سال نوی چینی در ماه آینده به دلیل محدودیتهای کووید، محتاطتر است و سهام آن با افزایش 1.6 درصدی تا ظهر روز به روز رسید. ماه پیش خواهد بود لوکا ماروتا، رئیس امور مالی، به تحلیلگران گفت: یک سال جدید چینی 2022 جامد، اگرچه بهترین سال برای صنعت نیست. اکنون برای دسترسی نامحدود رایگان به رویترز.com ثبت نام کنید. او اضافه کرد که سهم بازار چین را به دست بیاورد. این بیماری همه گیر به حرکت رمی به سمت مشروبات الکلی با قیمت بالاتر کمک کرده است تا حاشیه سود را در درازمدت افزایش دهد و به سمت نوشیدنی های ممتاز، مصرف در خانه، کوکتل ها و تجارت الکترونیک سرعت بخشد. فروش گروهی برای این سه مورد ماههای منتهی به 31 دسامبر به 440.5 میلیون یورو (498.1 میلیون دلار) رسید که رشدی ارگانیک 21 درصدی را نشان میدهد که بر اجماع 18 تحلیلگر شرکت برای افزایش 15.1 درصدی پیشی گرفته است. فروش در بخش کنیاک رمی مارتین که 90 درصد است. سود گروه، 19.4 درصد افزایش یافت و به 332.7 میلیون یورو رسید، همچنین بالاتر از برآوردهای 14.9 درصدی تحلیلگران. این شرکت گفت که عملکرد سه ماهه سوم منعکس کننده رشد فروش دو رقمی در چین است که توسط کنیاک کلوب و فروش تجارت الکترونیک قوی در طول سال. خرید آنلاین روز مجردها nza. تقاضای کنیاک در ایالات متحده نیز قوی باقی مانده است، با مارک های گران قیمت مانند کنیاک لوئیس سیزدهم که بیش از 2000 دلار در هر بطری به فروش می رسد، Remy Martin XO و 1738 Accor Royal عملکرد بهتری داشتند. برای تمام سال 2021/2022، رمی حفظ کرد. پیشبینی رشد ارگانیک «بسیار قوی» در سود عملیاتی جاری و رشد فروش ارگانیک قوی، و مجدداً تأکید کرد که به توانایی خود در عملکرد بهتر از بازار مشروبات الکلی ممتاز اطمینان دارد. 38٪ و رشد فروش 26.5٪ "در سطح مناسب" بود. گروه تکرار کرد که به دلیل هزینه های بازاریابی و ارتباطات بیشتر و مقایسه سخت تر در نیمه دوم، سود کل سال صرفاً توسط رشد نیمه اول خواهد بود. سال مالی شرکت فرانسوی از 1 آوریل شروع می شود و در 31 مارس به پایان می رسد. (1 دلار = 0.8843 یورو) اکنون برای دسترسی نامحدود رایگان به رویترز.com ثبت نام کنید ثبت نام گزارش توسط Dominique Vidalon

ویرایش توسط جین مریمن و مارک پاتر استانداردهای ما: اصول اعتماد تامسون رویترز. .