The introduction of the Consumer Duty is the biggest regulatory shift in financial services in recent years, with a very tight timescale for implementation set out in the FCA’s policy statement of 28 July 2022 (PS 22/9).

We have scrutinised each of the FCA’s consultations leading up to its final rules and engaged with clients on the key issues, advising them on their implementation plans and how to put plans in place. Drawing on this experience, we have set out in this article guidance on implementing the Consumer Duty for insurance companies.

Insurers should note that the FCA has been clear that there is no ‘one size fits all’ approach and that implementation plans should be tailored to each firm. Therefore, we recommend firms receive advice on their specific implementation plans and needs.

What is the Consumer Duty?

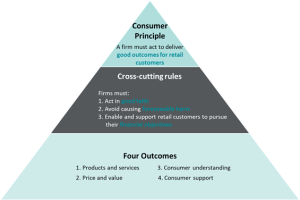

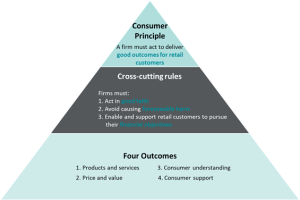

Understanding the structure of the Consumer Duty is crucial to then being able to implement it properly. The Consumer Duty has the following structure:

The principle

The Consumer Duty amends the FCA’s existing Principles for Business (PRIN) introducing a new Principle 12, the Consumer Principle, which is intended to set higher standards for firms than the existing Principles. This is shown at the top of the triangle. In particular, when Principle 12 applies, the existing Principle 6 (treating customers fairly) and Principle 7 (clear, fair and not misleading communications) are disapplied. Principle 12 is outcome-focused – so your implementation plan should be as well. The new Consumer Duty requires a more proactive approach.

The FCA has provided some comfort that the Consumer Duty is not a duty of care, is not a fiduciary duty, and does not require firms to provide advice where they would not otherwise do so.

The cross-cutting rules

Underpinning the new principle are three cross-cutting rules.

The FCA has provided examples where a firm would not be acting in good faith. Insurers will particularly want to consider:

-

- Taking into account retail customers’ interests and ensuring the product (i.e. a policy of insurance) is suitable for the target customer. This would include ensuring that a policy provides the level of cover which the policyholder requires and does not exclude types of claims for which the policyholder is intending to insure against.

- Not exploiting retail customers’ behavioural biases. In an insurance context, this could include not seeking to rely on or exploit a customer’s inherent bias towards allowing their policy to automatically renew annually without reviewing the details of any revised terms and endorsements, as well as any changes to their excesses or premiums

- Not taking advantage of a retail customer or their circumstances, such as a policyholder in financial difficulty and/or one who is also likely to be deemed a vulnerable customer.

- Not carrying out the same activity to a higher standard or more quickly when it benefits the firm than when it benefits the retail customer. This may be particularly pertinent when providing claims support and issuing decisions as to whether a claim falls for cover.

0

- Avoid causing foreseeable harm

A firm must avoid causing foreseeable harm to retail customers, whether by act or omission, and whether in a firm’s direct relationship with the retail customer or through its role in the distribution chain even where another firm in that chain also contributes to the harm.

This cross-cutting rule was amended from “avoiding foreseeable harm” to “avoid causing foreseeable harm” to underline that firms are not required prevent harm where a properly informed retail customer has made the decision to proceed. In the context of insurance, such a situation may be where a customer decides to proceed with purchasing a policy which contains a number of endorsements which limit cover, or where amendments are made to an existing policy at the point of renewal (such as setting a higher policy excess), provided that these endorsements and changes were raised with the customer in advance. One of the FCA’s regulatory principles is that customers are responsible for their own decisions.

Whether harm is foreseeable will depend on whether a prudent firm acting reasonably would be able to predict or expect the ultimately harmful result of the firm’s act or omission. The Consumer Duty is “underpinned by the concept of reasonableness” so firms are only responsible for addressing the risk of harm that is reasonably foreseeable at the time. Where harm was not foreseeable at the outset of an arrangement but becomes apparent later, firms must take steps to take appropriate action at that stage to mitigate the risk of harm, whether actual or foreseeable.

- Enable and support retail customers to achieve their financial objectives

The implementation of this cross-cutting rule will depend on the nature of the policy and insurance being offered and the target customer base identified by the insurer. A common objective of customers in purchasing insurance is to provide protection in the event of a claim arising and to reduce the financial risk to themselves. In motor insurance, for example, this would mean having cover to pay the costs of repair to a vehicle following a collision, and thus saving the customer from having to pay this directly.

The four outcomes

The Consumer Duty is described as an outcomes-based approach to regulation. The four outcomes should therefore be central to firms’ practices at every stage. We have set out further analysis on the impact of these outcomes for insurers below.

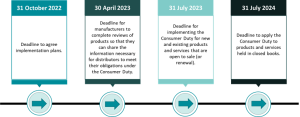

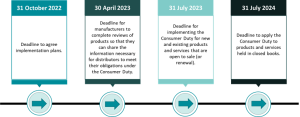

Implementation timeline

Firms should focus on the implementation timeline to ensure implementation is feasible within the regulatory timescales.

Implementation for Insurers

The Consumer Duty extends not only to the insurers that provide the insurance products and policies, but to “all firms in the distribution chain that can influence material aspects of the design, target market or performance of a retail financial services product or service, even where they did not have a direct relationship with the retail customer.”

The Duty will, therefore, also extend to insurance intermediaries such as brokers. Subsequent guidance will also follow separately which focuses on the Consumer Duty’s impact on insurance intermediaries.

For insurers themselves, implementation should focus on the four outcomes identified above:

As manufacturers of insurance policies, insurers and underwriters will need to work with brokers and other insurance intermediaries to obtain information about customers they already distribute to and obtain other relevant information that assists insurers with identifying their target customers and their characteristics. Insurers should also map the customer journey from start to finish, i.e. from the initial underwriting discussions through to the sale of the policy and the lifespan of the policy itself, taking into account any claims which may arise, along with any mid-term adjustments to the policy itself. Firms should also be thinking about what outcomes there could be for customers and when these may occur during the customer journey. When mapping the customer journey, insurers should identify all other parties in its distribution chain, so that all of the parties likely to fall within the remit of the Consumer Duty are known.

Insurers will need to consider the cost of insurance premiums for the policies they sell and whether these reflect fair value for customers. The terms of a policy itself may be of particular assistance in determining this point. A policy which has a high premium but also contains numerous exclusions or endorsements, as well as any prescriptive terms about requirements that must be met in order for a claim to be covered may prove to be of less value to a customer than a similarly priced policy which contains fewer exclusions or limitations on cover.

Insurers will also need to consider the question of policy excesses, as these may factor into a customer’s assessment of the overall price of the policy, since the excess will fall payable by them in the event of a claim. A policy with a high annual premium along with a high excess for each individual claim may prove to be of lesser value to a customer than a policy with a high premium but lower excess (or conversely, a low annual premium but higher excess).

Finally, insurers will also need to consider the issue of any commission or fees paid to intermediaries such as insurance brokers. Such fees are often paid as a percentage of the annual premium paid by the policyholder to the insurer, and so this may have an impact on the overall price and value of the policy.

Insurers will need to give particular thought as to the ability of customers to fully understand the nature of the policies they are purchasing and what cover their policy provides, along with details of any exclusions or endorsements which may limit or remove cover. Such information should be made clear to customers before the purchase of any policy, but should also be made available during the lifespan of the policy as well as during the course of any renewal discussions. Any proposed changes to cover at the point of renewal should be particularly made clear so as to ensure that customers are aware of any changes to their policy and scope of cover from one year to the next.

Insurers should also consider how they presently engage with intermediaries such as brokers, and what steps are taken to ensure that these intermediaries are sufficiently familiar with the terms of insurers’ policy wordings and that they are able to communicate such information to the end customers.

Insurers should identify all channels of communication and support that customers might access and consider how each of these channels will meet the new standards. For instance, it may be proportionate for some insurers, whose policies are sold mostly or entirely online, to offer only online and telephone support to consumers. However, if the sales process does or can take place face-to-face, then it may be inappropriate to exclude face-to-face communication as an option for future communications.

Presently, many insurers’ annual renewal invitations are sent to policyholders via electronic means but also via physical mail. In such cases, it may be appropriate for insurers to enable customers to correspond with them via mail or telephone as well as via electronic means, as to ensure a consistent level of communication and support.

Insurers should also identify any ‘friction points’ that could benefit the firm to the detriment of the customers. This may include circumstances such as long telephone hold times, or a requirement for a policy proposal which was submitted online to be reviewed by an underwriter before a decision can be issued. Claims processes should also be carefully scrutinised, such as the length of time taken to acknowledge claim notifications, along with the timescales for dealing with these and what service standards claims handlers are expected to operate to, particularly in terms of communicating a final decision as to whether a claim is covered.

Insurers should particularly consider vulnerable customers, including those in financial difficulty, during the course of any sale and/or renewal discussions so as to support and assist the customer in making good decisions in respect of their policies (e.g. when they are assessing the affordability of the proposed premiums or of any proposed policy excesses) without facing undue pressure.

The Scope of Consumer Duty for Insurers

The Duty is wide-reaching and will apply to firms across the whole financial services industry. Insurers will be particularly affected by the new rules and will need to consider how these changes will impact their business practices going forwards, both in terms of how their policies and supporting literature are presented to customers, as well as how the policies themselves are prepared at the underwriting stage.

At this point, it is important to remember that the Duty only applies to ‘retail customers’. For the purposes of the insurance industry, the supporting guidance document issued by the FCA clarifies the scope as follows:

“For insurance, the scope follows the position in the Insurance Conduct of Business Sourcebook (ICOBS). The Duty does not apply to reinsurance, contracts of large risk sold to commercial customers or other contracts of large risk where the risk is located outside the UK. Nor does it apply to activities connected to the distribution of group insurance policies or the extension of these policies to new members.”

The ICOBS broadly splits customers into two categories – consumers and commercial customers. A ‘consumer’ for these purposes is defined as any natural person acting for purposes outside his trade, business or profession.

The rules will therefore apply mainly to individual customers such as those acquiring home and car insurance, as well as more specialised cover such as for art collections, jewellery, and other such types of personal insurance. The Duty can also extent to individuals who are acting in certain other capacities such as the trustee of a family trust and who may in such circumstances wish to acquire trustee and individual liability insurance, as such individuals are deemed ‘consumers’ for the purposes of ICOBS.

Specific Issues for Insurers

The Duty brings with it a number of challenges and issues for the insurance industry to address. Given the length of time before implementation is due, it is expected that further guidance and clarification will provided by the Financial Conduct Authority in due course. The Policy Statement of 28 July 2022 (PS 22/9), however, provides plenty for insurers to consider in the meantime. We have set out below some of the immediate issues which the Duty and the supporting rules may present to insurers.

How are policies to be worded?

One of the most commonly cited criticisms of insurance policies relates to their detailed and, in many cases, very technical wordings. Key details of insurance cover and the relevant insuring clauses are often spread across different sections and even different documents, for instance:

- A policy schedule – i.e. the document setting out the key details of the policy such as the limit of indemnity, period of coverage, premium details, and policy excesses – is commonly issued as a stand-alone document; and

o

- Policy wordings – which set out the specific insuring clauses detailing what is covered, what is excluded, and what conditions and obligations rest on the policyholder – are then issued as separate documents. The different wordings for the different types of cover purchased (such as professional indemnity, public liability, employment practices liability) often being ‘grouped’ together into a single document. These documents can, on occasion, contain wordings for different types of cover including those which the policyholder may not have purchased. Often, there are also ‘general’ terms and conditions that apply to all of the different types of cover. This means that it is necessary to cross-reference within the policy wording itself as well as cross-referencing the policy wording against the separate policy schedule for confirmation about what cover has actually been purchased and which policy wordings in the separate document will apply. In addition to this, whilst the policy wordings will set out the fundamental details of the cover, many policies also contain separate endorsements (amendments or extensions to the standard cover and policy wording), which are instead located in the policy schedule document.

The practical upshot of this is that many policyholders, particularly those acting alone and without any support from a third party such as a broker, are often left not fully understanding the terms of their insurance policies or the extent of cover available to them. A home insurance policy, for example, may include specific provisions and endorsements regarding minimum security requirements which are expected to be in place in order for the policy to respond to any claim. This may involve requirements such as having security alarms and safes in place, and if a policyholder fails to do this and is subsequently burgled, the resulting claim may not be covered. These specific requirements will often be case-dependent and so may form part of bespoke endorsements within the schedule rather than the core policy wording, and so not be readily identified by a customer.

Many would argue that insurance is, rightly, a very technical and detailed area and so the need for thorough documentation is an unavoidable necessity. The Consumer Duty, however, raises questions about how insurers approach their policy wordings and the presentation of these to policyholders.

One such question is: does a detailed insurance policy set out in the manner described above, particularly one which is presented to a retail customer with no broker involvement, risk contravening the Duty and, in particular, the outcome relating to consumer understanding? If so, this raises significant questions about how policies for retail customers need to be drafted, presented and issued.

The rules helpfully provide some clarity on this point, with the guidance suggesting that insurers can demonstrate acting in good faith to support their customers’ understanding by “presenting information in an even-handed way that properly explains the benefits and risks.”

The rules also offer comfort to insurers in that they suggest a firm may not be considered to be in breach where the firm “reasonably believed” that the retail customer understood and accepted the potential risks involved.

The onus for insurers, therefore, will be to ensure that they present policies and draft terms in such a way that they can assure themselves that the customer is aware of the provisions in the policy and the limits of cover. Insurers may wish to focus on how their policies are laid out, what supporting documentation is provided beyond the core policy documents (such as any separate ’summary of cover’ sheets and checklists), and what direct conversations were had with the customer before and after the point of sale.

Online and Immediate Insurance Purchases

Thanks to the internet, policyholders are often able now to search for, review and purchase policies online with minimal external assistance or human input. Policies can be bought through comparison sites and from insurers’ own websites directly. Marketing taglines such as “Online quote in 5 minutes” and “Immediate cover for your business” are commonly seen on such websites, and, in many cases, it is easy for a customer to obtain a quote within minutes and to secure the cover immediately thereafter if they wish to proceed. This does, however, rely almost entirely on electronic systems and algorithms being employed to assess the risk based typically on the responses given to ‘stock’ questions.

Whilst on the face of it this approach is efficient and convenient for both insurers and policyholders, the lack of any specific human involvement from the insurers’ end of the process may mean that certain customers are limited in how they can go about securing the cover they need, and instead select options which appear a ‘best fit’ for their needs. The questions which algorithms use to provide quotes can often be confusing and potentially interpreted in several ways. For example, many systems will ask customers to confirm if they have ever had any prior insurance refused or cancelled. A customer who may have previously had a ‘declined to quote’ decision from a prospective insurer (which may be for entirely innocent reasons such as the value of the risk being outside an insurers’ risk appetite) may be unsure whether this constitutes a ‘refusal’ of insurance for the purpose of the question, and so needs to take an educated guess as to how the question applies, and this may present difficulties should insurers review the point further in the event of a future claim. Whilst the customer may choose to take a cautious approach and answer ‘yes’ to such a question, this may result in the insurance premiums being higher than would otherwise have been offered if the insurer had clarified that a ‘declined to quote’ decision from a past insurer did not constitute a ‘refusal’. If the customer had been speaking with the insurer directly and/or with an insurance intermediary, clarification on this point may have been easily obtained. With online purchasing however, these potentially uncertainties become more problematic.

The Duty places emphasis on the need to ensure consistency of service standards, and so whilst insurers will not be precluded from selling policies online and without direct discussion with the customer (where appropriate to do so), they will still need to focus on the customer journey and what support is made available to the policyholder. One solution to this may be a standard procedure of ensuring a telephone call is made to every customer who purchased a policy online within 24 hours of them doing so, in which the insurer can offer to discuss the policy and check its suitability for the customer’s needs.

Perhaps the best question for insurers to ask themselves when assessing the suitability of their systems for the purposes of the Duty is: “does a customer who buys a policy online at 1:00 AM have the same opportunity to discuss and understand their policy as a customer who purchased one in a face-to-face meeting with us that same afternoon?”

Exclusions, Endorsements and Limitations on Cover

The requirement that firms must avoid causing foreseeable harm to retail customers raises questions about how insurers approach the question of limiting the extent of cover available within a policy whilst meeting their obligations under the Duty.

On the face of it, a policy which contains wide-ranging exclusions or which has particular endorsements which serve to significantly limit cover, as well as any terms such as special excesses or sub-limits of indemnity, could be seen as potentially risking causing harm to policyholders, since such clauses serve to limit the applicability of the cover in question and may risk leaving policyholders exposed to financial liabilities and claims which they may had reasonably expected would be covered.

Furthermore, any decision by an insurer to void a policy or to fail to provide renewal terms (whether because of a change in the insurer’s risk appetite, because of a high number or value of claims, or because of any other factors) could be seen as potentially putting the customer at risk of foreseeable harm. A decision not to renew cover may cause a policyholder to have to urgently source new insurance cover elsewhere, and in a ‘hard market’ situation where insurers are taking firmer underwriting decisions, this may leave the policyholder either facing onerous new policy terms or potentially even unable to secure new cover, particularly where they have a negative claims history. The potential resulting harm is that they are put at a significant financial disadvantage (due to higher premiums) or at risk of future incidents occurring for which they are not insured, or which could cause detriment in other areas of their lives, such as being unable to legally drive owing to an inability to obtain insurance.

This all raises questions about how far insurers can realistically serve to limit or exclude cover in their policies, given that this can inherently put customers at potential risk of financial and legal harm.

Helpfully however, the new rules do set out specifically that the duty to avoid causing foreseeable harm does not mean a firm has a responsibility to prevent all harm. The rules allow for the fact that a product may have inherent risks which retail customers accept by selecting that product. Where a firm reasonably believes a retail customer understands and accepts such risks, it will not breach the rule if it fails to prevent them. The rules go on to state that whether any such belief is “reasonable” will depend on the nature of the product offered, along with the adequacy of the firm’s product design, communications and customer services.

The key for insurers, therefore, will be to ensure that retail customers are made fully aware of the nature of the policy and the limits and exclusions of cover, so that they can identify any potential “gaps” and identify where their policy may be limited. This will help reduce the risk of any unexpected claim declinatures being received, and so lessen the risk of harm to the customer.

How Can We Help?

We at Freeths LLP are experienced in advising firms, including those within the insurance industry, on complying with their regulatory obligations and how to adapt to incoming changes. Our expert team is able to assist you with considering how the Consumer Duty regime will impact your firm and what changes and reviews will be needed so as to ensure that you can be confident in your ability to evidence compliance once the new rules take effect.

For further information, do not hesitate to contact Adam Edwards, Daniel Seely or Daniel Meyer for a confidential, no-obligation discussion to review what support we can give you.

The content of this page is a summary of the law in force at the present time and is not exhaustive, nor does it contain definitive advice. Specialist legal advice should be sought in relation to any queries that may arise.