Find the right option for you.April 6, 2022Updated: April 6, 2022 8:17 a.m.

H&R Block Free OnlineJoe Raedle/Getty Images

H&R Block Free OnlineJoe Raedle/Getty Images

With so many tax filing options out there, it may be hard to figure out what tax preparation software is best to use. H&R Block offers multiple products depending on your tax situation, and here’s what you need to know about each one.

H&R Block Free Online

- Price: $0 for federal and state returns

- Who it’s for: Anyone who has a simple tax return

- What’s included: W-2 income, standard deductions, earned income tax credit, child credit, unemployment income, interest and dividend income, and student loan interest/payments/tuition.

H&R Block Deluxe Online

- Price: $43.99+, $44.99 per state filed

- Who it’s for: Anyone who wants to itemize their deductions

- What’s included: Everything in H&R Free Online, plus Health Savings Account (HSA), real estate taxes, mortgage interest. It also lets you digitally organize all your tax documents for up to six years.

H&R Premium Online

- Price: $59.99+, $44.99 per state filed

- Who it’s for: Anyone who investment or rental property income

- What’s included: Everything in H&R Deluxe Online, plus stock sales capital gains, investment income, cryptocurrency sales, and rental income and deductions.

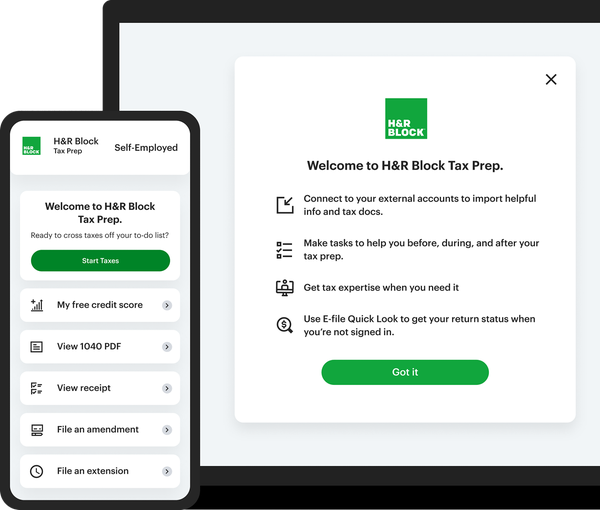

H&R Block Self-Employed Online

Self-Employed Online

$114.99

- Price: $91.99+, $44.99 per state file

- Who it’s for: Anyone who has their own small business or works for themself

- What’s included: Everything in H&R Premium Online, plus personal/business income and expenses, guidance for industry-specific expenses, business deductions, and asset depreciation.

Lesley Chen is a San Francisco-based freelance writer who covers shopping, tech, health/fitness, travel, and general lifestyle topics. She’s written for BuzzFeed, Byrdie, PureWow, and Well + Good, among others. When not writing, she’s out looking for the flattest walking route around the city.