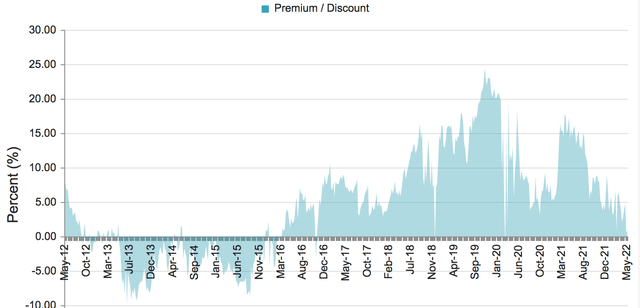

KanawatTH/iStock via Getty ImagesLooking for exposure to corporate bonds? Many would say that now isn’t the time to increase that exposure, but maybe it might pay in the long run to take advantage of lower-priced bond-related income vehicles. For example, the PIMCO Dynamic Income Fund (NYSE:PDI) has a long history of being priced at a premium to its NAV/share. Unlike ETFs, closed-end funds can trade at wide premiums and/or discounts – buying them at cheaper valuations than their historic ones can be a useful strategy. Since ~2016, PDI has mainly traded at high premiums to its NAV/share, but, with the current rising rate environment, it’s trading at its smallest premium since the COVID Crash of 2020:

KanawatTH/iStock via Getty ImagesLooking for exposure to corporate bonds? Many would say that now isn’t the time to increase that exposure, but maybe it might pay in the long run to take advantage of lower-priced bond-related income vehicles. For example, the PIMCO Dynamic Income Fund (NYSE:PDI) has a long history of being priced at a premium to its NAV/share. Unlike ETFs, closed-end funds can trade at wide premiums and/or discounts – buying them at cheaper valuations than their historic ones can be a useful strategy. Since ~2016, PDI has mainly traded at high premiums to its NAV/share, but, with the current rising rate environment, it’s trading at its smallest premium since the COVID Crash of 2020:  cfcnctAs of the 5/25/22 close, PDI was selling at a small 0.90% Premium to NAV/Share, way lower than its one-year 8.17%, three-year 11.31%, and five-year 10.24% average premiums:

cfcnctAs of the 5/25/22 close, PDI was selling at a small 0.90% Premium to NAV/Share, way lower than its one-year 8.17%, three-year 11.31%, and five-year 10.24% average premiums:  Hidden Dividend Stocks PlusProfile: “Offering access to PIMCO’s income-generating ideas across multiple global fixed income sectors, the multi-sector fund seeks current income as a primary objective and capital appreciation as a secondary objective. The fund normally invests worldwide in a portfolio of debt obligations and other income-producing securities of any type and credit quality, with varying maturities and related derivative instruments. The fund’s investment universe includes mortgage-backed securities, investment grade and high yield corporates, developed and emerging markets corporate and sovereign bonds, other income-producing securities and related derivative instruments. The fund will normally invest at least 25% of its total assets in privately issued (commonly known as “non-agency”) mortgage-related securities. The Fund may normally invest up to 40% of its total assets in securities of issuers economically tied to emerging market countries. The fund will normally maintain an average portfolio duration of between zero and eight years.” (PDI site) PDI is a big fish in the debt CEF sub-industry, with a market cap of $1.5B, vs. the debt CEF average cap of $422M. Its net asset base is $4.96B, and it has 1581 holdings, with average daily volume of 939K. Since management uses leverage, at 46.14%, there are interest expenses of 0.74%, in addition to the 2.04% in annual expenses. Note: If you’re new to CEFs, please note that those expenses don’t get subtracted from your dividends/distributions, which are issued on a net basis.

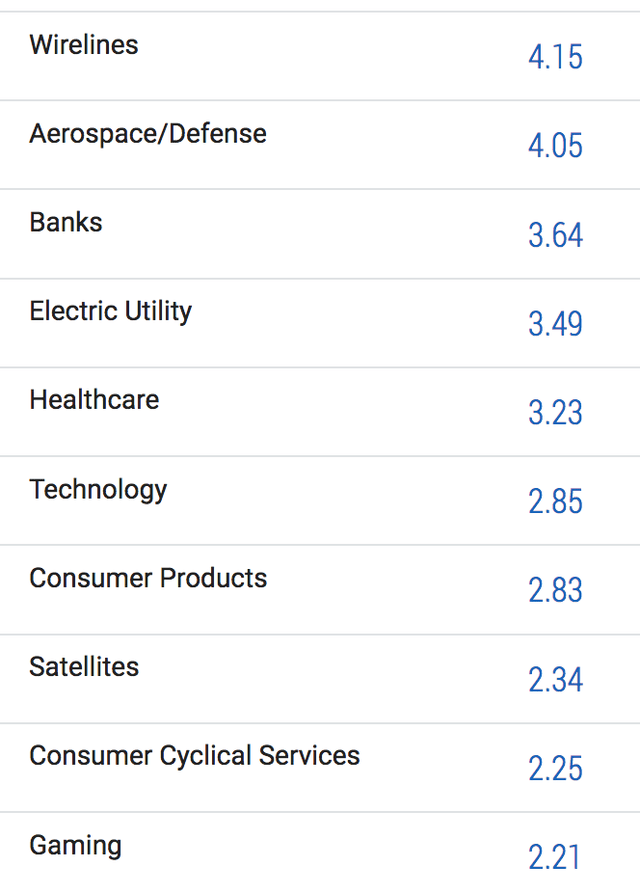

Hidden Dividend Stocks PlusProfile: “Offering access to PIMCO’s income-generating ideas across multiple global fixed income sectors, the multi-sector fund seeks current income as a primary objective and capital appreciation as a secondary objective. The fund normally invests worldwide in a portfolio of debt obligations and other income-producing securities of any type and credit quality, with varying maturities and related derivative instruments. The fund’s investment universe includes mortgage-backed securities, investment grade and high yield corporates, developed and emerging markets corporate and sovereign bonds, other income-producing securities and related derivative instruments. The fund will normally invest at least 25% of its total assets in privately issued (commonly known as “non-agency”) mortgage-related securities. The Fund may normally invest up to 40% of its total assets in securities of issuers economically tied to emerging market countries. The fund will normally maintain an average portfolio duration of between zero and eight years.” (PDI site) PDI is a big fish in the debt CEF sub-industry, with a market cap of $1.5B, vs. the debt CEF average cap of $422M. Its net asset base is $4.96B, and it has 1581 holdings, with average daily volume of 939K. Since management uses leverage, at 46.14%, there are interest expenses of 0.74%, in addition to the 2.04% in annual expenses. Note: If you’re new to CEFs, please note that those expenses don’t get subtracted from your dividends/distributions, which are issued on a net basis.  Hidden Dividend Stocks PlusHoldings: PDI’s top sectors run from Wirelines and Aerospace/Defense, both at ~4%, with Banks, Electric Utilities, and Healthcare in the next tier of 3%-plus. The 2%-plus tier includes Tech, Consumer Products and Services, Gaming, and even Satellites, an industry we haven’t come across too often in the high dividend stocks world.

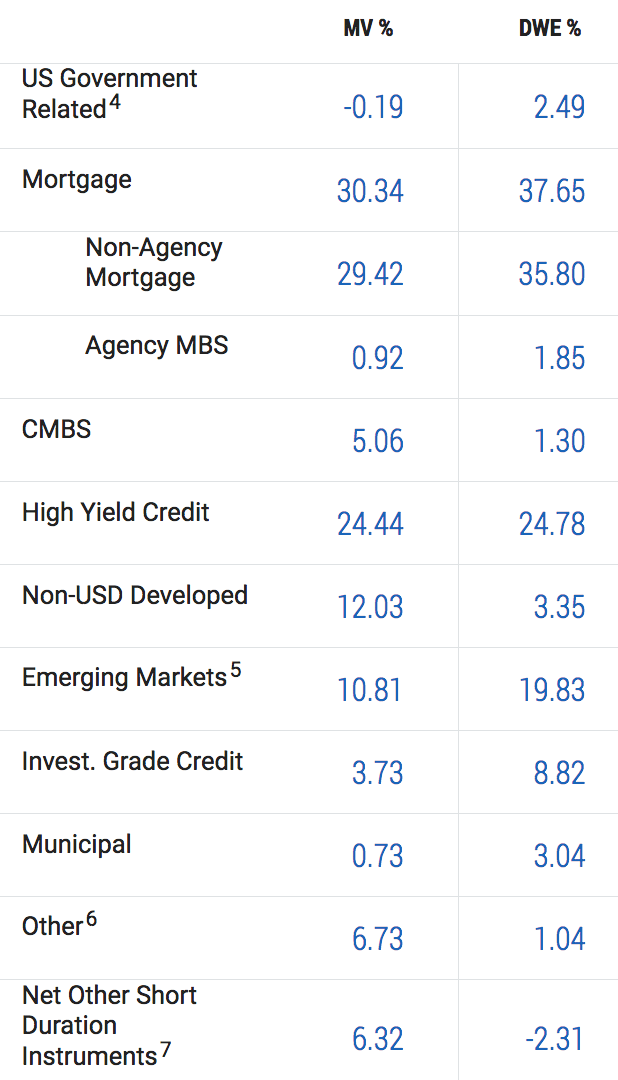

Hidden Dividend Stocks PlusHoldings: PDI’s top sectors run from Wirelines and Aerospace/Defense, both at ~4%, with Banks, Electric Utilities, and Healthcare in the next tier of 3%-plus. The 2%-plus tier includes Tech, Consumer Products and Services, Gaming, and even Satellites, an industry we haven’t come across too often in the high dividend stocks world.  PDI siteThe assets are rated on a market value and a DWE – Duration Weighted Exposure basis. There’s limited exposure to Government debt. Mortgage-related assets are mainly non-government agency issues, at 29.4%, in addition to ~5% in Commercial Mortgage-Backed Securities. High Yield Credit is the largest asset category of PDI’s holdings, at ~24%, with Developed Non-US holdings at 12%, Emerging Markets at ~11%, with other short duration instruments, Municipals, Investment Grade Credits, and a ~7% mix of other assets completing the mix:

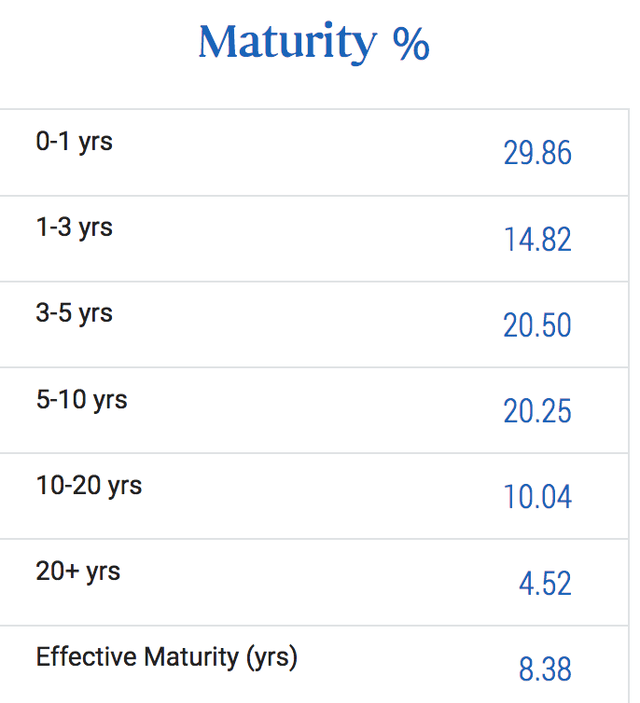

PDI siteThe assets are rated on a market value and a DWE – Duration Weighted Exposure basis. There’s limited exposure to Government debt. Mortgage-related assets are mainly non-government agency issues, at 29.4%, in addition to ~5% in Commercial Mortgage-Backed Securities. High Yield Credit is the largest asset category of PDI’s holdings, at ~24%, with Developed Non-US holdings at 12%, Emerging Markets at ~11%, with other short duration instruments, Municipals, Investment Grade Credits, and a ~7% mix of other assets completing the mix:  PDLI site30% of PDI’s maturities are short term, one year or less, with 14.8% mature in 1-3 years. 3-5 and 5-10-year maturities are both the largest group, each at ~20%, with 10-20 years at 10%, and 20+ years at 4.5%. The effective maturity is 8.38 years, while the total Leveraged-Adjusted Effective Duration is 4.36.

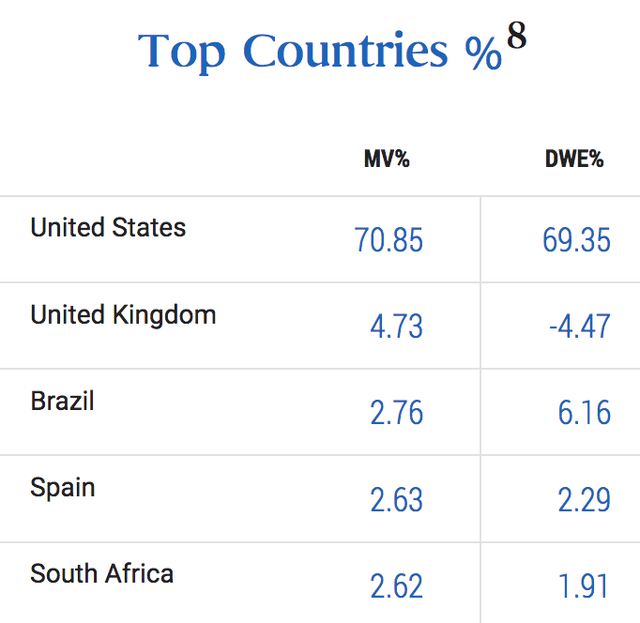

PDLI site30% of PDI’s maturities are short term, one year or less, with 14.8% mature in 1-3 years. 3-5 and 5-10-year maturities are both the largest group, each at ~20%, with 10-20 years at 10%, and 20+ years at 4.5%. The effective maturity is 8.38 years, while the total Leveraged-Adjusted Effective Duration is 4.36.  PDI siteThe US is PDI’s top regional exposure by far, at ~71%, followed by UK, at 4.7%, with Brazil, Spain, and South Africa each at ~2.6% to 2.8%, on a market value basis:

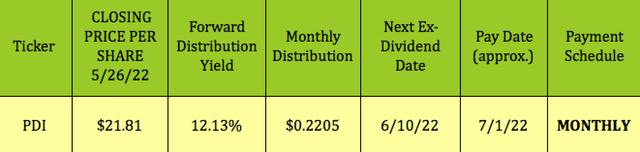

PDI siteThe US is PDI’s top regional exposure by far, at ~71%, followed by UK, at 4.7%, with Brazil, Spain, and South Africa each at ~2.6% to 2.8%, on a market value basis:  PDI siteDividends: At its 5/26/22 closing price of $21.81, PDI yields 12.13%. It pays monthly and has held its dividend at $0.2205 steady since Q3 ’15. It also has paid out $2.37 via 3 special distributions since 2016, and ~$5.00 prior to 2016. It should go ex-dividend next on ~6/10/22.

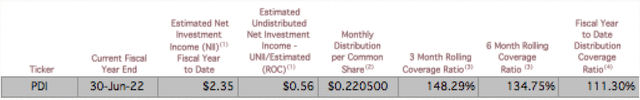

PDI siteDividends: At its 5/26/22 closing price of $21.81, PDI yields 12.13%. It pays monthly and has held its dividend at $0.2205 steady since Q3 ’15. It also has paid out $2.37 via 3 special distributions since 2016, and ~$5.00 prior to 2016. It should go ex-dividend next on ~6/10/22.  Hidden Dividend Stocks PlusAs of 4/30/22, PDI had $0.56/share in Undistributed Net Investment Income, UNII, with a fiscal year coverage ratio of 111.3X:

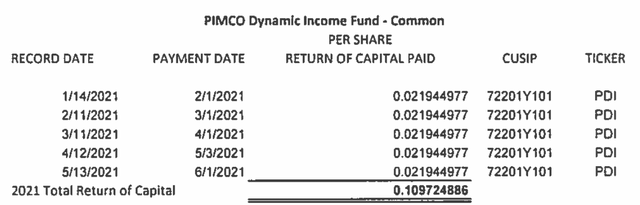

Hidden Dividend Stocks PlusAs of 4/30/22, PDI had $0.56/share in Undistributed Net Investment Income, UNII, with a fiscal year coverage ratio of 111.3X:  PDI siteTaxes: This is the most recent tax breakdown for PDI’s distributions. There was $0.1097 in Return of Capital for the first five distributions in 2021, totaling ~10%.

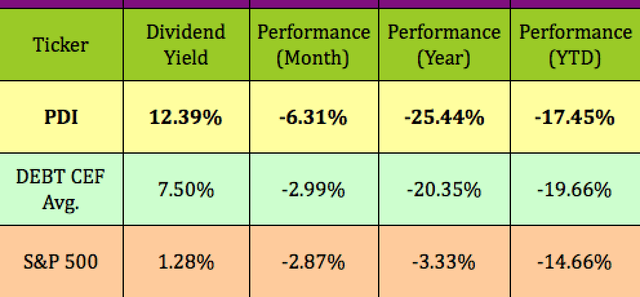

PDI siteTaxes: This is the most recent tax breakdown for PDI’s distributions. There was $0.1097 in Return of Capital for the first five distributions in 2021, totaling ~10%.  PDI sitePerformance: As you may have suspected, PDI has lagged the market over the past month, year, and so far in 2022, due to the new rising rate environment. Somewhat surprisingly though, it also has lagged the debt CEF industry over the past year and month, while outperforming it in 2022. PDI is 4.5% above its 52-week low.

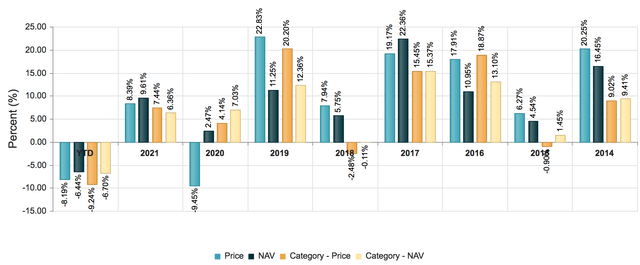

PDI sitePerformance: As you may have suspected, PDI has lagged the market over the past month, year, and so far in 2022, due to the new rising rate environment. Somewhat surprisingly though, it also has lagged the debt CEF industry over the past year and month, while outperforming it in 2022. PDI is 4.5% above its 52-week low.  Hidden Dividend Stocks PlusLooking back further shows PDI outperforming the Morningstar US CEF Multi-Sector category in 2014-2015, 2017 – 2019, and 2021, while lagging it in 2020 and 2016:

Hidden Dividend Stocks PlusLooking back further shows PDI outperforming the Morningstar US CEF Multi-Sector category in 2014-2015, 2017 – 2019, and 2021, while lagging it in 2020 and 2016:  cfcntParting Thoughts: It may be premature to buy PDI now with the Fed on a path to raising its rate by another 100 basis points before its late summer Jackson Hole meeting. However, if you’re willing to hold it long term, you’ll probably be rewarded when the Fed stops raising rates, and PDI starts getting higher premiums over NAV. In the meantime, you’ll collect a very attractive monthly payout. All tables by Hidden Dividend Stocks Plus, except where otherwise noted.

cfcntParting Thoughts: It may be premature to buy PDI now with the Fed on a path to raising its rate by another 100 basis points before its late summer Jackson Hole meeting. However, if you’re willing to hold it long term, you’ll probably be rewarded when the Fed stops raising rates, and PDI starts getting higher premiums over NAV. In the meantime, you’ll collect a very attractive monthly payout. All tables by Hidden Dividend Stocks Plus, except where otherwise noted.

✅ خرید وی پی ان ❇ ip ثایت vPn آی پی اختصاصی ◐

✅ خرید VPN آی پی ثابت ترید بایننس وی پی ان ◐ ip اختصاصی اکانت آی پی ثابت