Why do annuity payments belong in a plan for retirement income?There is a very simple answer: Retirees who have annuity payments feel more confident about their long-term finances in retirement.It seems obvious to someone like me, who is an actuary by training and spent most of my later career in the retirement business. That confidence comes because an annuity payment is similar to Social Security or a pension in one important respect: They all provide a lifetime of guaranteed income. Since annuity payments are guaranteed under contracts issued typically by highly rated insurance companies, in my view retirees or near-retirees with a reasonable life expectancy should at least consider them as an important source of retirement income. However, according to one survey, a relatively low percentage of retirees — fewer than 15% — make annuity payments part of their retirement income plans.So, let’s discuss the objections and questions that consumers often have about annuity payments, the contracts that guarantee those payments, and the reasons annuity payments belong in a plan.Where the confusion comes in with annuities Today, the annuity landscape is quite competitive and often confusing to average investors. There are many types of annuities. They can be grouped in various ways:

- Accumulation or income.

- Fixed, variable or indexed.

- With or without downside protection.

- Current or future annuitized income.

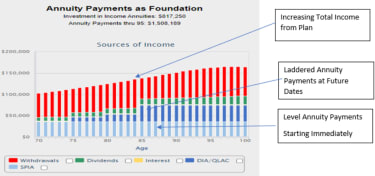

I take some responsibility for changing the annuity landscape, having invented the first annuity that could be categorized as accumulation/variable/downside protection/future annuitized income.Unfortunately, contracts providing guaranteed annuity payments often get lumped together with other annuities, and that’s where the confusion creeps in. It’s just like with insurance: Car insurance is not the same as life insurance, health insurance or dental insurance. So, you should look at each annuity based on its stated purpose and not whether it shares a name with another product. One type of annuity might be just right for you, while others might not be a good fit.The rest of this article is about annuity contracts whose sole purpose is to provide lifetime annuity payments — starting now or at a date in the future you select. Let’s start with a few questions I’ve gotten from readers like you.Q: Do annuity payments increase with inflation?A: In some contracts, annuity payments increase over time, but most do not. Those contracts that do provide payments that grow with inflation tend to have a starting annuity payment that is 20% to 30% lower than a contract with fixed, level payments. Inflation protection is not cheap.Of course, the question about purchasing power and inflation is timely with what’s going on in the U.S. and elsewhere. The Labor Department announced in early February that inflation hit a 40-year high, with consumer prices jumping 7.5% compared with last year. If you relied on annuity payments for all your income, the value lost to inflation would be a major problem. But your retirement income plan shouldn’t look like that.First, you have Social Security and possibly a pension, which grow with inflation. Second, when the income from these sources is not sufficient to cover inflation, you will want income from your savings to increase over time, and you should plan accordingly. In creating that plan, you should consider annuity payments that start immediately, and a second set of annuity payments that start when you reach a certain age (or ages) in the future. The first can provide a foundation of lifetime income, and the second can be deployed in a laddered purchase of annuity payments to achieve growing income. Here’s an illustration of a plan that provides increasing income over the years and that shows how annuity payments are deployed:

Q: Can I cash in my future annuity payments if I need liquid funds? A: The answer is no for most contracts — due to the actuarial approach annuities are founded upon.The reason for no liquidity is that when you receive annuity payments, a portion of the higher payment is enabled by a survivor credit, which represents the benefit of pooling your longevity risk. Unlike life insurance, where the benefit is paid at your passing, under these annuity contracts the benefit is paid at your surviving. If you could cash in annuity payments during your lifetime, you’d undermine the pooling concept — and the lifetime income advantage.Our typical female retiree aged 70 who wants to increase the cash flow from her $500,000 in low-yielding savings could purchase annuity payments at an annual rate of around 6.75% today, or $33,750 per year. That’s the survivor credit benefit. If she wanted to ensure her beneficiary a return of the balance of the annuity premium at her passing, the annuity payout rate would be around 6.00%, or $30,000 per year. How do you overcome the liquidity issue? Here are a few short answers:

Q: Can I cash in my future annuity payments if I need liquid funds? A: The answer is no for most contracts — due to the actuarial approach annuities are founded upon.The reason for no liquidity is that when you receive annuity payments, a portion of the higher payment is enabled by a survivor credit, which represents the benefit of pooling your longevity risk. Unlike life insurance, where the benefit is paid at your passing, under these annuity contracts the benefit is paid at your surviving. If you could cash in annuity payments during your lifetime, you’d undermine the pooling concept — and the lifetime income advantage.Our typical female retiree aged 70 who wants to increase the cash flow from her $500,000 in low-yielding savings could purchase annuity payments at an annual rate of around 6.75% today, or $33,750 per year. That’s the survivor credit benefit. If she wanted to ensure her beneficiary a return of the balance of the annuity premium at her passing, the annuity payout rate would be around 6.00%, or $30,000 per year. How do you overcome the liquidity issue? Here are a few short answers:

- Understand that in drawing down from liquid savings early in retirement, you may be reducing your future income.

- Invest only a portion of your savings in these annuity contracts, leaving the balance of your retirement savings in liquid, marketable securities.

- For late-in-retirement liquidity needs, say, for medical or long-term care, use the higher annuity payments to purchase long-term care insurance, or let them accumulate in more liquid, marketable securities.

Q: What are the advantages of including annuity payments in a plan?A: These annuity contracts are similar to the pension your parents had. Just like a pension, they provide a lifetime of guaranteed income. When incorporated into a plan for retirement income, annuity payments address the most common fear of retirees: Will I outlive my savings?Recognizing the benefits of annuity payments, recent revisions to federal law governing qualified retirement plans, like 401(k)s and 403(b)s, made it easier for participants to convert part of their savings to these annuity contracts.Set out below are some of the other benefits of annuity payments.Annuity payments enable retirees to stay the course with their investmentsAnnuity payments allow you to adjust parts of your retirement income plan without giving up on your goal to live comfortably for the rest of your life. In fact, they can be one of several steps you can take to build a safer income plan.You should not put all of your savings into purchasing annuity payments. A good portion should remain in your portfolio of stocks and bonds, with a concentration in income- and dividend-producing ETFs. In fact, retirees who are not receiving annuity payments will be very unlikely to invest a higher percentage of their equity portfolios in stocks that might generate more robust returns.I write frequently about the value of staying the course during volatile economic times, which cause some people to abandon sound plans. In fact, statistics show that individual investors underperform the market by 1% to 3% per year on average because they jump out of the market during alarming plunges. This is even more likely for retirees who have no annuity payments. The protection of annuity payments increases your ability to work the market to your best advantage.Recognizing that your plan is built on several pillars of guaranteed lifetime income allows you to “stay the course” during a turbulent market.Annuity payments receive favorable tax treatmentTax legislation and regulation encourage the use of these annuity contracts by offering favorable tax treatment. I believe this treatment granted by the IRS over the years is to encourage retirees to be more self-reliant in their retirement plans.As I have explained before, the IRS makes you pay taxes only once on money you earn. Here is how that translates into favorable tax treatment for annuity payments.

- A Single Premium Immediate Annuity (SPIA) delivers a portion of its payments tax-free when you purchase the annuity payments from savings that have already been taxed. Going back to our typical 70-year-old female retiree mentioned above, if she purchased an immediate annuity, she would see less than 4% of her annuity payments being taxable for the first 15 years.

- A Deferred Income Annuity called a QLAC, when purchased with money from a rollover IRA or 401(k), reduces taxable required minimum distributions until QLAC annuity payments begin, usually at 80 or 85 years old. A retiree with $500,000 in a rollover IRA could defer distributions on $125,000. (For 2022, QLACs are capped at 25% of the IRA balance or $135,000, whichever is less.)

- Under IRS Section 1035 rules, you can make a tax-free exchange of an accumulation annuity with a gain to an annuity contract with annuity payments starting immediately or in the future. That means you could spread the tax on that gain over the lifetime of the annuity payments.